Steps to Get Started

If you want to have a 401(k) plan ready for the start of 2024, there are a few things you’ll need to do:

Larger contribution limits and more possibilities, get started with a 401(k) plan now.

If you want to have a 401(k) plan ready for the start of 2024, there are a few things you’ll need to do:

Fill out this form and one of our 401(k) experts will reach out to you within 1 business day.

“Employee Fiduciary offers an outstanding product in its plan design and retirement plan administrative services, and manages to do so while providing top-level service and responsiveness at industry-leading low costs.”

The secret to a faster retirement is a cost-efficient 401(k) plan that makes appropriate investing simple for participants.

No 401(k) provider makes it easier for small and medium-sized businesses to offer such plans than Employee Fiduciary.

Read our help articles below to learn everything you need to know about replacing a SIMPLE IRA with a 401(k) for 2024.

Replacing a small business SIMPLE IRA with a 401(k) is not a complicated process, but it does require planning. Our FAQ can help the process go smoothly.

Read More

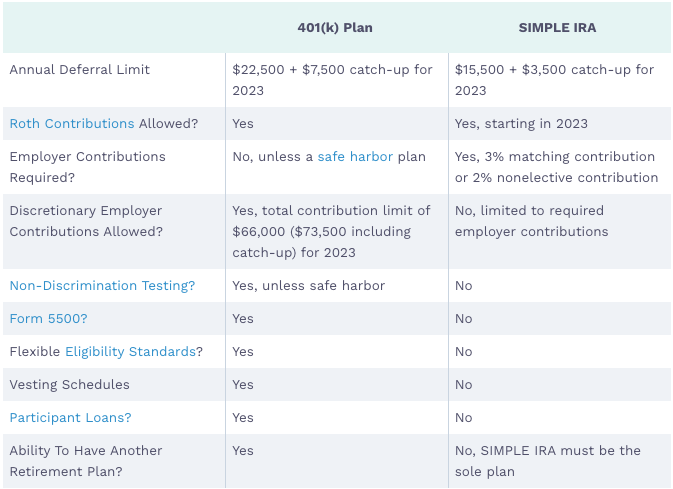

401(k) or SIMPLE IRA? The kind of plan you pick could have an enormous impact on the finances of everyone involved in your business. Choose wisely.

Read More

Meeting 401(k) fiduciary responsibilities does not need to be scary or time-consuming for small business plan sponsors. Following some simple guidance is the key.

Read More