Advisor Directory

401(k) Financial Advisor Directory

Do you need a financial advisor for your retirement plan? Employee Fiduciary can help. We work with hundreds of advisors nationwide. To find a financial advisor that works with Employee Fiduciary in your area, please select your state from the menu below.

OR

.jpg)

Abound Wealth Management provides consulting services to 401k plans and assists small and mid size businesses with reviewing their current employer sponsored plans. Many times these plans are sold by investment and insurance companies and typically have high fees, limited and poor investment choices, and little to no education for employees.

Some of the services we offer include:

- Overall review of plan design based on the goal and objective you are looking to accomplish.

- Reviewing your current fund line-up, asset classes, and making recommendations for improvements.

- Review of overall plan cost including admin fees, fund fees, and your out of pocket costs.

- Developing an Investment Policy Statement.

- Quarterly fund review to assist you in meeting your fiduciary responsibilities.

- Educational presentations for your employees.

- Access to CFP® professionals to answer your employees’ investment related questions throughout the year, not a 1-800 number.

Fiduciary adviser that provides objective advise to help achieve client goals while maintaining maximum flexibility and control.

Our firm is founded on transparent, low-cost, client-first fiduciary advice. Our five step process for investment selection is intended to provide the prudent, comprehensive tools for plan participants to meet their financial goals.

Our training as a CERTIFIED FINANCIAL PLANNER also leads us towards taking the time to help individual participants to understand how their employer-sponsored retirement plan fits into the context of their lives.

Contact us any time for a consultation.

We are fiduciary fee based advisors who specialize in providing customized solutions to our clients. We install and monitor 401(k), 403(b), 457 and defined benefit plans for our profit and non-profit clients.

The benefits of offering tax-deferred retirement savings plans for your employees are difficult to ignore. At Adviser Investments, we have years of experience providing advisory management to 401(k) plans. Our services for plans and their participants include: An initial evaluation, where we examine your existing plan and suggest improvements to the investment options as necessary; the creation and management of diversified portfolios within your plan suited for a range of investment objectives at varying levels of risk; and ongoing education on saving for retirement as well as opportunities for participants to discuss integrating their personal investments with their retirement assets in a comprehensive wealth-management plan.

AFS Advisors, LLC ("AFS") is a "fee-only" Investment Advisor registered with the Securities and Exchange Commission. With two decades of investment advisory experience, AFS combines sound strategy and intelligent ideas to position you to reach your investment objectives. AFS' advisory business involves two components: comprehensive investment management services for individuals, high net worth individuals, closely-held corporations, business entities, trusts and estates; and corporate consulting services for defined benefit, profit sharing plans and 401(k) plans.

Our firm was founded with a vision of bringing people closer to their goals, values and dreams. We treat our clients like family and follow a non-corporate agenda. We are a wealth advisory practice that provides a wide range of services to a select group of tech entrepreneurs and business leaders.

By having Anderson Financial Strategies as your Retirement Plan Advisers, your stakeholders will enjoy the benefits of boutique-level services. This means that both Plan Administrators along with Participants have a high level of access to your plan’s dedicated Advisory team, instead of only dealing with call centers or other support members.

We embrace serving as a fiduciary and will put our commitment in writing. Our focus is on providing unbiased, objective advice that is customized to fit your retirement plan’s needs.

As a client, you will be plugged into an "ecosystem" of financial advice that is designed to deliver confidence about your retirement plan’s benefits.

Our mission is to provide our clients with expert quality strategies and rapidly responsive service through an open honest relationship.

What would make your organization’s retirement plan successful? We help you design and run a plan that moves you toward those goals, is easy to work with, and is reasonably-priced for both business owners and participants. Services include benchmarking, employee enrollment and education, vendor selection and management, financial wellness, and ongoing plan reviews. We help you manage your fiduciary liability, keep costs competitive, and promote retirement readiness to participants. We also fix issues and mistakes from previous service providers so that plans get back on track. Services are available to one-person employers, startup plans, and larger existing plans.

In addition to plan consulting, we communicate with participants to help them take advantage of the plan and reduce discrimination testing failures. We offer virtual and in-person one-on-one meetings, group presentations, and individualized guidance for employees who want help planning for retirement.

Justin Pritchard, CFP, MBA, PPC is your main point of contact, with a strong network of additional professionals available to assist as needed. We provide fiduciary, fee based-services and can work under a flat fee, assets under management, or an hourly rate.

We offer video enrollment guides, webinars and one-to-one meetings depending upon your needs and price point.

As an independent insurance agency, Bachmann Financial Group, Inc. offers employee benefit packages designed to meet the requirements of your company and its employees. Our broad range of insurance and retirement options, available through a select group of insurance and financial companies, allows us to provide you with the competitive, cost-effective benefits essential in today’s business environment.

Our licensed insurance advisors and service staff strive to deliver outstanding service in the areas of corporate benefits, retirement plans, and business insurance, as well as individual insurance.

Barden Capital offers personalized investment management. Our solutions are tailored to each client's specific situations and goals.

The client's interests come first. Barden Capital is a fee-only firm. We do not accept commissions on any investments we recommend. We are on the client's side 100% of the time.

Barden Capital takes an analytical approach to investment management. We believe financial decisions should be based on objective criteria, not on opinions, guesswork, or the latest media stories.

Bell Wealth Management designs low-cost 401(k) plans to help companies attract and retain the best employees, while providing maximum deferral benefits to owners and senior management. Our goal is to simplify and democratize the 401k landscape by providing best in class retirement plans to small and medium-size businesses in Central Texas.

Consumer Friendly

Biechele Royce is a full service wealth management firm with over 200 million under management and approximately 400 clients. The firm also serves as a plan advisor for approximately 35 retirement plans.

Our model portfolios have, to date, substantially outperformed their Morningstar benchmarks on both an absolute return and net of fees return basis. Our Plans are not "off the shelf;" rather, they are custom built to your needs. We stand behind our Plans, and accept responsibility to serve as the Plan co-fiduciary with the Plan Sponsor. Client rave about access to our personal financial advice. Our fees are fully transparent and modest; and we accept no "soft dollars" or other compensation to offer less than optimal investments. Please see www.bluemapcapital.com and scroll the drop down menus for Testimonials. Thank you.

My goal is to work with plan sponsors and participants in a manner that puts their financial interests ahead of everything else.\n\nThis means using cost-effective methods of allocating plan costs, monitoring the investment menu to ensure the investments are "earning their pay," and doing the leg work to keep plan sponsors in compliance with the regulatory maze that seems to grow more complicated on a daily basis.\n\nI closely watch your plan's investment menu, and, depending upon the breadth of the investment menu, may require that plan investment menus change over time.

invest@bluemoundam.com https://www.bluemoundam.com

Blueprint Financial Strategies ("BFS") is a registered investment adviser offering advisory services in the State(s) of Connecticut and in other jurisdictions where exempted.

Bright Road Wealth Management is an independent, fee-only Registered Investment Advisor.

Since inception, Broad Street Capital Advisors has set the standard for investment and fiduciary counsel throughout the Southeastern United States. We take great pride in two characteristics that differentiate our firm from others: absolute absence of the conflicts of interest in money management selection and the highest possible standard of accountability. At Broad Street, we proudly affirm and formerly attest our fiduciary obligation to our clients in providing the highest level of investment advice and fiduciary counsel. We are headquartered in Athens, Georgia and have additional branch office in Macon, Georgia with clients all over the southeast.

Broad Street Capital Advisors, LLC is a Registered Investment Advisor registered with the SEC under the Investment Advisor Act of 1940. As such, we proudly affirm and formerly attest our fiduciary obligation to our clients in providing the highest level of investment advice and fiduciary counsel. Our advisors are equipped with the systems, research and tools to provide clients with the best possible outcome for their needs. Known for combining high quality service within a culture of fiduciary responsibility, BSCA has become one of the region’s leading investment and fiduciary consulting firms. The founding principals of the firm, originally with Shearson Lehman Brothers consulting service group, bring a combined 56 years of experience in the institutional investment consulting arena. At Broad Street, our clients enjoy a consistent and direct relationship with a dedicated service team of professionals.

Calvary Wealth provides consulting services to 401k plans and assists small and mid size businesses with reviewing their current employer sponsored plans. Many times these plans are sold by investment and insurance companies and typically have high fees, limited and poor investment choices, and little to no education for employees. Some of the services we offer include:\nOverall review of plan design based on the goal and objective you are looking to accomplish\nReviewing your current fund line-up, asset classes, and making recommendations for improvements\nReview of overall plan cost including admin fees, fund fees, and your out of pocket costs\nDeveloping an Investment Policy Statement\nQuarterly fund review to assist you in meeting your fiduciary responsibilities\nEducational presentations for your employees\nAccess to CFP® professionals to answer your employees’ investment related questions throughout the year, not a 1-800 number

Calvary Wealth provides consulting services to 401k plans and assists small and mid size businesses with reviewing their current employer sponsored plans. Many times these plans are sold by investment and insurance companies and typically have high fees, limited and poor investment choices, and little to no education for employees. Some of the services we offer include:\nOverall review of plan design based on the goal and objective you are looking to accomplish\nReviewing your current fund line-up, asset classes, and making recommendations for improvements\nReview of overall plan cost including admin fees, fund fees, and your out of pocket costs\nDeveloping an Investment Policy Statement\nQuarterly fund review to assist you in meeting your fiduciary responsibilities\nEducational presentations for your employees\nAccess to CFP® professionals to answer your employees’ investment related questions throughout the year, not a 1-800 number

We focus on helping the employer find the best value and provide exceptional support.

Utilizing an organized process, we focus on the three main pillars of a retirement plan - helping you achieve a desired result of Fiduciary Excellence. \nThe 3 pillars are:\n1. Fiduciary Risk Management\n2. Plan Investment Opportunities\n3. Employee Education Utilizing an organized process, we focus on the three main pillars of a retirement plan - helping you achieve a desired result of Fiduciary Excellence. \nThe 3 pillars are:\n1. Fiduciary Risk Management\n2. Plan Investment Opportunities\n3. Employee Education

As an independent registered investment advisor, CapSouth 401k Consultants provides plan design guidance, investment advisory services, and employee education. We guide you through plan design issues, establishing a plan that is the right fit for your company and your employees. Our staff will help you make sense of the numerous fees involved, and determine the reasonableness of costs associated with your plan. We help you keep abreast of the constant changes in regulatory oversight, and assist with the governmental requirements of fee disclosure to your plan participants. From creation to administration to participant education and communication, CapSouth 401k can help make your corporate retirement plan a successful asset to your business.

We offer personal service not only to the Sponsors, but also to the Participants. We enjoy educating both the Participants to help them reach their goals. For the Plan Sponsor, we are a partner to lessen their burden and let them do what they do best in their business.

.png)

Centurion Advisory Group serves successful individuals and business owners who choose to live on purpose. We bring our perspective and processes to bear on strategies which help them build wealth, transfer assets and values across generations, give to causes meaningful to them and their families, reduce their tax bill, and allow them to invest in ways which align with their values.

Century Wealth Management offers Retirement Plan Advisory Services to small and medium size businesses wanting to run their plans more efficiently, reduce expenses, manage their fiduciary liability, achieve better investment results, and increase employee participation.

Securities and Advisory Services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Chandeleur is a private, fee-only financial consulting firm focused on individual wealth management and retirement plan consulting.

As retirement plan financial professionals, we focus on more than investments. We also help educate your employees, facilitate the interactions between you and your service providers, and assist you with the plan’s design. We join with you to reach your ultimate goal—the retirement readiness of your employees.

We can assist you with your responsibilities in the following areas:

- Plan goals and objectives — we can help establish clear goals for the plan as well as strategies for reaching these objectives.

- Plan vendors and fees — when you are considering different vendors, we can help you evaluate their services and the reasonableness of their fees.

- Employee education — when employees are engaged in the learning process, they are more likely to make good investment decisions. We can help educate them in a way that encourages action.

- Plan and service support — a plan requires specialized services from multiple providers. We can assist with the coordination of these services, helping the plan run smoothly.

- Plan design consulting — we can consult with you about plan design elements that may help increase participation and savings, thereby helping employees become successful retirees.

Chicago Wealth Management Group is a local team of financial advisors affiliated with Cetera Advisor Networks which is part of Cetera Financial Group with over 8,000+ advisors. We provide advanced investment strategies, retirement plans and additional financial services to individuals, families, companies and non-profits nationwide. Investment Advisor Representative and Registered Representative offering advisory services and securities through Cetera Advisor Networks LLC, a broker/dealer and a Registered Investment Adviser member FINRA/SIPC. Cetera is under separate ownership from any other named entity.

Clarity Capital Advisors charges a flat-fee for our ERISA 3(38) or ERISA 3(21) services. We enjoy working with our plan sponsor clients to ensure their employees have the best opportunity to save for a comfortable retirement. We serve clients nationwide. Let's get started.

We are a wealth-management firm, based in Oregon, with offices in Portland and Bend, serving individuals, families, business owners, executives and institutions. Our team provides the highest level of service for our local and national clients in financial planning and investment management.

With Clear Resource, we guide business owners through the process of retirement-plan design, installation, and ongoing support. It’s our job to understand the complexities of your situation, and your retirement plan is designed with your personalized goals in mind.

services as we participate in annual reviews, plan participant consulting and more all on an as needed (hourly) basis so that you can control your 401k costs.

Fiduciary services offering low cost investments, model portfolios, and transparent pricing.

Colton Groome & Company has been providing trusted financial solutions to business owners, medical professionals, retirees, families and individuals since 1950. Whether you need comprehensive financial guidance, life insurance strategies, corporate retirement plan management or investment advisory services, our team of expert advisors works closely with you to deliver an integrated plan that makes you more confident about your financial future so you can enjoy a better life.

Educating plan sponsors and participants on their 401(k) plan is the cornerstone of our organization.

We are located in Durango, Colorado and have been independent, fee-only advisors for over 14 years. See our website at www.compfinancial.com for more information.

Cross Financial Strategies will help you manage your defined contribution plan and\nmitigate potential fiduciary risk so that you can focus on managing your organization. \n\nOur Retirement Plan Consulting Service can act as a co-fiduciary to your plan. This higher\nlevel of trust, obligation, and responsibility requires us to act in an independent,\nunbiased, and objective manner. We will help you ask the right questions, understand complex fee \nstructures, and implement a formal investment monitoring process.

We believe passionately that a 401(k) plan should provide participants (employees) a chance to retire in dignity and be a benefit in every sense of the word.

We love working with great people, that’s what makes our job fun and exciting! When we partner with you and your organization, we strive to be good stewards and help you and your employees be better prepared for retirement. \n\nCypress Wealth Management is a fee-only firm who serves our clients in a fiduciary capacity. Serving as co-fiduciaries we assume responsibility for many aspects of the plan while helping you stay in compliance with world-class fiduciary standards. \n\nWe are fanatical about controlling and disclosing costs, since you need to know exactly what your retirement plan is costing your company and your employees. \n\nFinally, we a proud to bring the “wealth management experience” to your retirement plan. We build custom plans from an unlimited choice of investment options to help meet your organizations specific needs, just like we do for our private wealth management clients. We provide model portfolios and offer face-to-face, personal guidance to plan participants.

We work with, and encourage plan sponsors to utilize, when appropriate, professional compliance entities such as those who provide services such as: ERISA \n3(16), 3(21) and \n3(38) services. Additionally we believe strongly in obtaining investment options at the lowest possible cost to plan participants.\nFinally, our services are two-fold, to provide overall design and implementation assistance to plan sponsors and to provide meaningful education and enrollment assistance to participants.

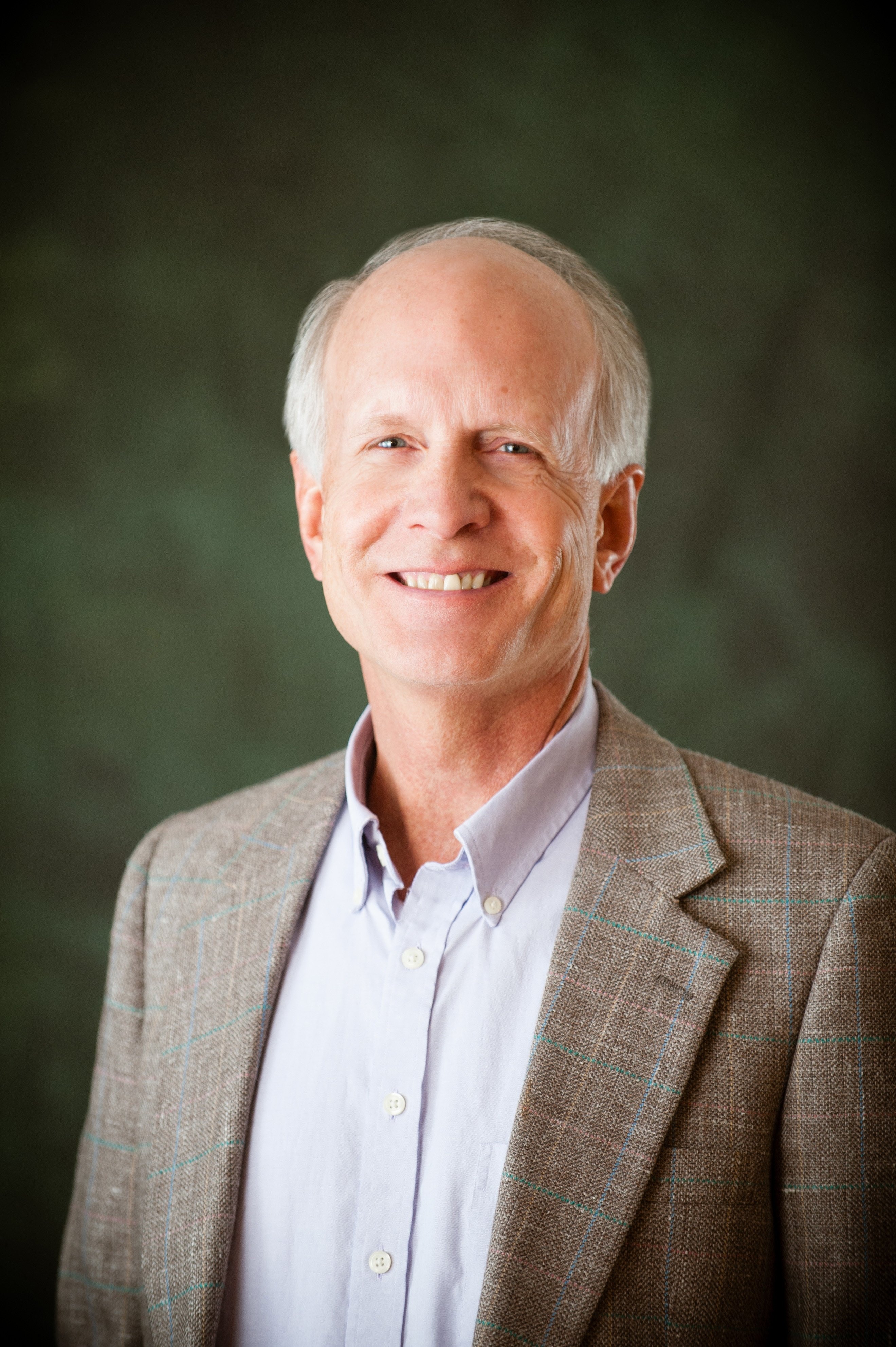

The fact that we operate on a fee-only basis is a major consideration for most clients. This means that at Day & Ennis, you pay no commissions on sales of securities or insurance. Since we have no vested interest in selling you anything, you can count on unbiased financial advice.

Direct Retirement Solutions specializes in retirement plan consulting and advisory services always serving as an ERISA fiduciary. Our fully disclosed and transparent fee model with no conflicts of interest puts us on the same side of the table as our clients. We are experts at plan design & management, vendor & platform selection, fiduciary investment managment, fiduciary governance & stewardship and participant education and advice. Everything coordinated by one team - so you know who to count on.

Specializing in individual participant advice.

.jpg)

Envision Asset Management is a Registered Investment Advisor in Plantation, Florida. We provide high level investment services for corporate executives, professionals, business owners, retirees and others. Our aim is to preserve and build your wealth by managing risk and optimizing returns. Our only loyalty is to you, our client, and we provide full disclosure of any conflicts. We act as a fiduciary.

ESI Financial Services provides comprehensive financial planning, tax and investment advisory services for individuals, families and small businesses.

Everhart Advisors is a corporate retirement plan consulting and investment advisory firm focused on helping employers build, maintain, and enhance 401k plans. As a trusted co-fiduciary, we define success as participants achieving retirement preparedness, while limiting the liability exposure to the plan sponsor. We deliver a comprehensive suite of services including: fiduciary compliance, investment due diligence, participant education and advice, plan design, cost control, and fee transparency. It is our mission to help people achieve financial security.

Everspire helps business owners optimize their company’s retirement plan. We will evaluate your current 401(k) plan, help you understand your duty as a fiduciary, and suggest changes that will reduce your liability and make your plan more ethical and affordable.

High cost plans with poor investment options put employers at risk. It is not unusual to see funds that are 15 - 20 times more expensive than quality alternatives. We are often able to cut overall costs by more than 50% and return that money to you and your employees. In the process we also improve the quality of the investment choices and remove conflicts of interest and risk to your company.

After onboarding, we continue to monitor plan costs, review investment options quarterly, educate employees through presentations and one-on-one meetings, and make ourselves available to answer employees’ investment questions throughout the year.

Contact us and we will help you turn your company’s retirement plan from a distraction into a tool that drives recruitment and retention.

Please refer to our website fairviewfinancial.com

We are a small firm dedicated to providing professional and cost effective advice to our clients.

Your retirement plan and participants should have an objective, un-biased advisor who has had 18 years in the industry working for a mutual fund company, regional bank and retirement consulting firm. Your needs for the plan are reviewed, along with fees, investments and education on the plan sponsor and employee level.

First Bankers Trust Services, Inc has over 50 years of experience as a trustee and advsior in providing employee benefit services to plan sponsors nationwide. We tailor our services to your plan, as every plan is different. Let us guide you through complex issues and rules.

Fleming Capital Partners is an independent investment advisory and retirement plan consulting firm. We are headquartered in Lincoln, Nebraska with offices in Chicago, IL. \n\n"Our mission is to continually increase the wealth of our partners while managing the risks inherent in the pursuit of these interests… We seek these opportunities with determination, passion and discipline."

Single employee business

Special focus on 401k plan design and support for professionals and owners of privately held companies. With the proper planning and customized plan provisions, business owners can maximize the plan benefits provided to them.

Fragasso Retirement Plan Advisors focuses exclusively on employer-sponsored retirement plans. We deliver comprehensive plan objectives. As a fiduciary consultant, the guidance that we provide to plan participants and sponsors takes a complex world and it makes it easy to understand without concern for proprietary products or guidance that does not fit your organization’s goals.

.jpg)

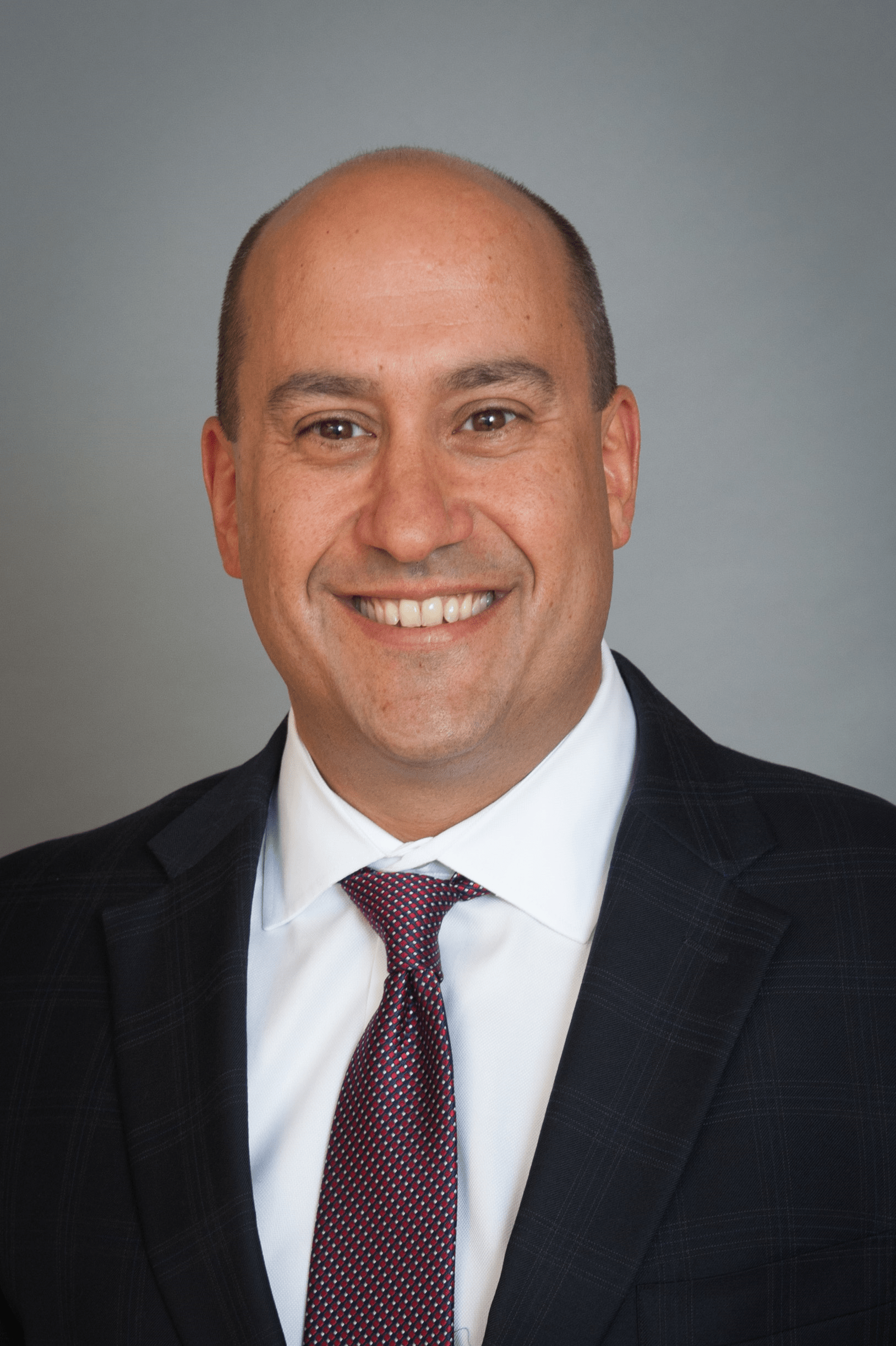

We work with small businesses, professionals, high net worth individuals and corporate employers to develop a comprehensive, custom-built strategy to help them pursue their financial goals.

Gerstemeier Financial Group, LLC offers financial planning, investment management, and income tax preparation services for individuals, small businesses, charities, and corporate retirement plans. The firm was created to provide customized solutions to meet the goals and objectives of our clients. We recognize that in today's fast paced and complex world, there are no easy solutions to the concerns and issues we face in our financial lives.\nUnlike most financial advisory firms, we work on a Fee-Only basis. We receive no commissions or other types of compensation for any investment, insurance, or other financial products we recommend to our clients. We believe financial advisors that are compensated by commissions from product sales have an inherent conflict of interest.

Glasgow Partners, llc is a unique investment advisory firm that specializes in fixed income and self-directed 401k retirement plans, primarily for credit unions and small to mid-sized businesses. Our advisers work closely with clients to build effective portfolios and diversified fund offerings for their plans.

Gold Medal Waters is an independent fee-only financial planner and registered financial advisory firm that has developed a specialty in serving the unique challenges and goals of medical professionals and their families - such as physicians and dentists - as well as clients who have significant assets and complex planning needs.

Greenlight Retirement Plan Consultants is dedicated exclusively to helping retirement plan administrators and plan fiduciaries (our clients). We analyze, create, implement, provide on-going investment due diligence and cost monitoring services, educate, and advise employers on their employees' retirement plan. That is our expertise and it is all we do. As co-fiduciaries, we always act in the best interest of plan participants and strive to save our clients time and money.

We start by doing a thorough and complimentary cost and investment analysis of your organization's current plan. After we present our findings, you can then decide if you would like to hire us as your ongoing consultant.

As the former Director of Investment Strategies of one of the country's largest retirement plan providers, our founder, Ian Green, CFA, has analyzed and created hundreds of investment menus for clients large and small all over the country. Please visit our website for a better understanding of our background and experience.

Companies hire us to build a retirement plan they’re proud of and that their employees love. We do it by providing (k)larity® to help plans make better fiduciary decisions so they’re confident they’re doing the best possible job for employees who depend on them for retirement security. (k)larity® creates confidence that allows you to focus on your business, not your plan, through three disciplines:

1. Fiduciary oversight A comprehensive fiduciary process helps your company avoid potential litigation, going beyond investments to include committee oversight, fiduciary training, fees, plan design, and vendor management. Proprietary tools and methodologies, (k)larity Quotient®, Fiduciary U™ and FeeMetri(k)s™, help you identify and correct shortcomings in your plan. Extensive experience with compliance and ERISA matters helps us advise clients on a broad range of technical issues. We also commit to an annual plan review to ensure you’re on track to meet your goals, that the strategies to achieve them are still working, and that the measures of success we’ve defined together are still relevant.

2. Service by an experienced, credentialed team We have six CFP®, four AIF®, two CRPS® and a CFA on staff. You can be confident your questions will be answered and your issues resolved by knowledgeable people with the facts. You won’t be left uncovered because we assign multiple professionals to your account, all of who know and understand your plan. Our focus on corporate retirement plans gives us huge opportunities to learn; we know what works and what doesn’t. It adds up to satisfied clients. In 2018 we were a PLANADVISER Top 100 Retirement Plan Adviser for the second time and named the 2018 PLANSPONSOR Retirement Plan Adviser of the Year Award in the Small Team category. A client was also one of three finalists for PLANSPONSOR 2018 Plan Sponsor of the Year.

3. Personalized participant advice We act as a fiduciary to your employees, always working in their best interest and giving them unbiased, objective advice. Your employees have access to a CFP® as their dedicated point of contact. S/he gets to know your employees and can respond quickly to questions or issues. We also address individual participants, document interactions to provide fiduciary protection, and help improve participant outcomes with four powerful digital planning tools: an easy-to-use budgeting tool, a debt management tool, a robust retirement analysis and stress testing tool, and a risk analytics platform.

Our primary business is serving our 401k/profit sharing plan clients and participants. Approximately 85% of our business is related to 401k/profit sharing plans. We pride ourselves in bringing the company sponsored retirement plan directly to the participants in a cost-effective way.

We aid the plan sponsor in the establishment of new plans and amendments and help in the ongoing monitoring of plan investments for existing plans. We assist the individual participants in making the proper choices for investment allocation and deferral amounts; and in the one-on-one periodic review of their retirement account, to help them toward their retirement goals. We aim to create a long-term relationship as their trusted advisor.

Securities and Advisory Services offered through Cadaret, Grant & Co., Inc. Member FINRA/SIPC. Guzzetta Financial Associates and Cadaret, Grant are separate entities.

It’s always about the people. That’s what most exciting. We get to partner with great people and organizations who want to be good stewards and help their employees be better prepared for retirement.\nHardy Reed is a CEFEX Certified, independent, fee only, SEC registered fiduciary consultant and retirement plan services firm providing - Objective Fiduciary Guidance. Our team of fiduciary consulting and retirement plan services professionals provides objective guidance to institutions such as retirement plan administrators. \nHardy Reed has earned the Centre for Fiduciary Excellence (CEFEX) Certification. According to CEFEX, "Hardy Reed is among the first Investment Advisors globally to successfully complete the independent certification process. Through CEFEX's independent assessment, the certification provides assurance to investors that Hardy Reed has demonstrated adherence to the industry's best fiduciary practices. This indicates that Hardy Reed's interests are aligned with those of investors." \nThe Retirement Plan Services Division provides consulting services to Retirement Plan Sponsors assisting them with their plan fiduciary governance including plan fee benchmarking, investment, and service provider selection and monitoring. Hardy Reed's Fiduciary Assessment provides evidence of how well an investment steward demonstrates organizational conformity with the Global Standards of Fiduciary Excellence as established by the Center for Fiduciary Studies.

Harvest can serve as the investment advisor for your 401k plan. In this role, we can assist your management team with its fiduciary responsibilities by providing advice on fund options. Because we are completely independent, we have no limitations on finding and recommending what we determine are the best options for your plan. Additionally, because our compensation is not tied to selling any products, you can be assured that our advice will be free of any conflict and be solely based on what we conclude is best for the company and its employees.\n\nHarvest can also provide advice to the plan participants. For many individuals, their 401k balance represents one of their largest assets, yet they are often not provided with specific, actionable advice. Harvest believes everyone should receive the support they need to make the most out of their 401k investment.

Heber Fuger Wendin is an independent, fee-only financial advisor and investment counsel firm founded in 1934 with $4.6 billion in assets currently under management. Heber is one of the oldest, most well-established SEC-registered investment advisory firms in the United States.

HHM Wealth engages business owners, plan sponsors and plan trustees to help design, implement and manage their company’s 401(k) / Profit Sharing retirement plan. The primary goal of this engagement is to ensure the plan design is optimally positioned for the changing workforce while maintaining ERISA compliance. HHM Wealth brings more than 40 years’ of experience in Retirement Plan Consulting to bear for clients including the CFP® and AIF® (Accredited Investment Fiduciary). A general outline of the services HHM Wealth provides can be found on our website.

We help clients utilize their unique resources to live their best financial life

Inspired Financial Planners helps small and medium-sized businesses start and maintain their employer-sponsored retirement plan. We offer customized services tailored to meet your specific needs. Our services are always provided with the experience and expertise of a CFP professional, some of which include:

- We act as a liaison between all moving parts of the plan - Plan Sponsor, TPA, Recordkeeper, custodian, payroll provider, CPA, etc.

- Meet with participants individually at least twice per year on-site or virtually

- Provides general financial & investment education to participants on an as needed basis

- Manages investment options within the plan

- Keeps up with participant eligibility

- Notifies newly-eligible participants and enrolls in the plan

- Sends out required annual notices to participants

- Conducts periodic contribution review

- Provides guidance to Plan Sponsor

- Meets with Plan Sponsor annually to review investments and plan design

- Facilitates participant distributions

- Rebalances participant accounts upon request

- Follows up with TPA/Recordkeeper on outstanding items

- Stays current on new laws and regulations

I have nearly 40 years of experience in the financial services industry

ICM will serve as a fiduciary…we assume responsibility for many\naspects of the plan and bring it into compliance with world-class\nfiduciary standards.\n We control and disclose costs...employers need to know exactly\nwhat their retirement plan benefit costs the company and its\nemployees.\n We give face-to-face, personal guidance to plan participants...\nnot once a year, not quarterly, but ongoing and as needed.\n We custom-build plans...from an unlimited choice of investment\noptions to meet the company’s specific needs.\n We employ a rigorous due diligence process...to select and monitor\nfunds within the plan.\n We provide local support...from enrolling new employees to\nanswering day-to-day questions.

The Investors CHOICE 401(k) Program was designed and developed by Investors Asset Management of Georgia, Inc., a Registered Investment Advisor since 1988. Our program is the Plan Sponsor’s trend-setting solution for simplifying and modernizing existing corporate 401(k) plans.

As a Registered Investment Advisor, we become a either a 3(21) or a 3(38) fiduciary with the Plan Sponsor and thus reduce Plan Sponsor fiduciary liability.

Investors CHOICE 401(k) suggests a unique fund lineup composed primarily or entirely of low-cost index funds and ETF's because we believe their use leads to significantly enhanced participant returns. Fees and expenses are fully disclosed and do not include revenue sharing or 12b-1 fees, thus reducing the occurrence of prohibited transactions or conflicts of interest.

We manage five risk-based portfolios composed of name-brand index funds and ETF's for those participants that wish to have their funds managed for them. These portfolios have a very strong track record over the last eight+ years.

We are a SEC-registered fee-only RIA that offers a true “open architecture” 401(k) platform. Our services include ERISA Fiduciary investment management, plan design, participant support, and Plan Sponsor support. Our fee structure was designed with plan participants in mind. We charge a flat-fee per participant fee and NOT a percentage of assets under management.

Jackson Financial Management is a Financial Planning Company that also provides retirement plan consulting and investment advisory services. Our sponsors' plans range in size from 50 employees to over 200, with plan assets exceeding $20MM. Plans include straight 401(k) plans to more complex, new comparability plans and those that include profit sharing and cash balance options. We are client service focused and provide one-on-one meetings with participants, whether line-workers or executive management.

Jim MacKay Financial Planning was built from the ground up with you in mind.\nWe want to be easy to work with. \nTo do this we:\nMake our services available to anyone, regardless of their net worth or investment portfolio. \nUse the latest technology so we can work with you from just about anywhere. \nUse a simple and straightforward fee structure\nEnjoy teaching as much as you want to learn.\nAlways speak to you in plain English.

We are an asset based - fee only investment adviser.

Tony is President of KerberRose Wealth Management, LLC. Tony specializes in private and public sector retirement plans (401(k), 403(b), 457, etc.). In addition, KerberRose Wealth Management, LLC provide investment management services for individuals, non-profits and corporations.

Ryan Keshemberg, CFP is founder of Keshemberg Advisory. An independent flat fee financial planning company helping dentists and physicians nationwide navigate the financial world. Ryan strives to make the most of his time and can be found traveling the world, lecturing about personal finance, and trying to keep life simple.

Robert is 100% independent and has 24 years of exclusive experience consulting for company-sponsored retirement plans. He serves as an investment fiduciary to your retirement plan with absolutely no proprietary fund requirements. Robert has a unique background with expertise in Plan administration, employee education, and investments.

.jpg)

Financially confident employees are more productive and loyal. We promote financial wellness by providing access to one on one financial planning sessions, goal tracking, educational webinars, annual comprehensive portfolio analysis, and semi-annual personal review meetings.

Our goal is to add more value to your retirement plan benefits. Your success is our success.

Fee-Only Financial Advisory, no third party commissions. Abides by the fiduciary standard.

20+ years of experience specializing in fiduciary prudence for employers and retirement readiness for employees.

Paramount Investment Advisors, Inc. applies comprehensive strategies that help manage your financial needs and goals. We have experience that combines extensive knowledge of tax, estate, retirement, insurance, investment and wealth planning. Paramount Investment Advisors, Inc is a comprehensive Fee Only CERTIFIED FINANCIAL PLANNER™️ Registered Investment Advisory Firm serving business owners and professionals. Acting as a fiduciary we embrace our responsibility to you by accepting accountability for the recommendations we provide to our clients. www.paramountia.com

Perk Planning is a fee-only Wisconsin Registered Investment Advisory firm located in Madison, Wisconsin. We are proud members of the National Association of Personal Financial Advisors (NAPFA) - the country’s leading professional association of Fee-Only financial advisors.\n\nWe provide financial planning advice to individuals and small business on an hourly basis only. We frequently run into 401(k) plans with excessive fees and we urge our clients to consider Employee Fiduciary. Advising on 401K's is not our primary focus, but we are happy to help plan sponsors to review their options and, if appropriate, to act as a 3(21) investment fiduciary for the plan sponsor.

Peterson Wealth Advisory is a fee-only firm that designs low-cost retirement benefit plans to help companies attract and retain the best employees, while providing maximum deferral benefits to owners and senior management. Our goal is to simplify your retirement benefit plan, educate owners and participants and provide best in class service to small and medium-size businesses. With Peterson Wealth Advisory you will have access to a Certified Financial Planner that provides advice in the client’s best interest.

Our goal is to save our clients from Wall Street. Most financial advice is conflicted and high cost. We remove those barriers for our clients. For our retirement plan clients, we serve as a fiduciary and usually cut costs for our clients. We offer a free 401(k) report card so you can benchmark your plan.

https://www.picketfencefinancial.com

Our goal is to save our clients from Wall Street. Most financial advice is conflicted and high cost. We remove those barriers for our clients. For our retirement plan clients, we serve as a fiduciary and usually cut costs for our clients. We offer a free 401(k) report card so you can benchmark your plan.

Pierce Financial is an independent qualified retirement plan consultancy that sees beyond the obvious. As a co-fiduciary, we assist employer plan fiduciaries in the areas of plan design, investment advisory and due diligence, fiduciary compliance and vendor searches. Our mission is to help plan fiduciaries manage risk in terms of potential personal and corporate financial liability while enhancing investment opportunities to help plan participants achieve successful retirement outcomes.\n\nWe are honored to be selected as Financial Times Top 401 Advisors 2015 and 2016. \n\n

Pinehurst Capital specializes in retirement plan consulting and advisory services, serving as an ERISA 3(38) Fiduciary. Our expertise is in plan design & management, fiduciary investment management, participant education and advice, and on-going, cutting-edge retirement plan solutions.

The PIVOTAL Commitment:\n\nTruly independent, unbiased fee-based financial advice that is based on your specific needs and goals.\nTo act as your fiduciary, meaning we must put your interests ahead of ours at all times. We must treat your money with proper prudence and provide you with the best possible advice and investments, just as if it were our own.\nA team of true professionals who are experts in all aspects of financial planning, which consists of Investment , Risk (insurance), Retirement, Tax, Estate and Cash Management planning.\nNo allegiance to any company, product or service. OUR only allegiance is to you, your family and your goals.

Plan Sponsor Consultants www.plansponsorconsultants.com, is a nationally recognized independent retirement plan consulting firm with offices in Alabama, D.C., Maryland, Virginia, Georgia, and Michigan, affiliated with LPL Retirement Partners (formerly National Retirement Partners). We have retirement plan clients throughout the U.S. We demonstrate our Retirement Plan Thought Leadership, daily, through published articles, our regional and national speaking engagements ( 2014 SE Benefit Conference Georgia Tech, 2015 401(k) Summit San Diego) our activities on behalf of plan participants on Capitol Hill, the national Retirement Advisor Council (RAC) and our Financial Literacy efforts.

We use simple low-cost portfolios using primarily index funds from Vanguard. We do not support revenue sharing and only charge flat fees for our service. In addition, we provide personal enrollment and planning assistance to our clients' employees using video conferencing.

PWM of NC aims to provide investment advice to business plans of all sizes by selecting appropriate and cost efficient investment solutions.

Profolio Investments is an independent Registered Investment Advisor dedicated to putting our client's best interests first. We help small businesses by providing fiduciary, investment, and advisory services to their sponsored retirement plans. Additionally, we help retirement plan participants with personalized, one-on-one financial planning. Our offices are located in Jersey City, NJ however, we serve clients throughout the United States.

Please visit our website to learn more.

Purtill Financial is a fast-growing mid sized fee only independent registered investment advisory firm. Our services include active portfolio management, financial plans, and tax planning and preparation. Our specialty is helping executives, educators, small business owners, retirees and young professionals grow and protect their investment assets.

Our Small Business Retirement Plan Consulting Services are available for start-up or take-over plans. Whether you’re considering a plan for the first time, having a plan you’re not satisfied with or just want to enhance the service that you get on your current plan, our Small Business Retirement Plan Consulting Services may be for you.

Rathbone Warwick Investment Management is a money management firm offering institutional management to families, businesses, and non-profit organizations using a highly disciplined investment approach.

We will be happy to provide a complimentary plan analysis of your existing plan.

Reef Wealth Management provides retirement plan consulting and investment advisory services. Our focus is to help maximize savings into a plan for the benefit of all participants. This is accomplished thru in person employee financial education which yields higher participation rates and better prepared participants. Our sponsors’ plans range in size from 30 to over 400 employees.

With Employee Fiduciary as your TPA, and Results Wealth Management as your plan advisor, we guarantee you'll be a Top 15% plan category on next year's Brightscope ratings.

Considered a fiduciary because we render investment advice for a fee. We do not have discretionary authority over participant accounts.

onsultant%2c%20LLC%20-%20logo.jpg)

onsultant%2c%20LLC%20-%20Walter%20Eife.jpg)

RP(k) is an independent product agnostic retirement plan consulting firm. We are a proud member of the Retirement Plan Advisory Group (RPAG) which is an alliance of accomplished retirement focused advisors. Collectively, we serve over 80,000 plans with more than 10M participants and $1T in collective assets under influence. At RP(k), deliver the intellectual capital of a large Wall Street consultant from a small boutique firm in Voorhees, New Jersey.

Tony is a retirement plan consultant with Retirement Plan Advisors LLC, an independent retirement plan consulting firm that specializes in private and public sector retirement plans (401(k), 403(b), 457, ect.). In addition, Retirement Plan Advisors LLC provide investment management services for individuals, non-profits and corporations.\n

We ensure Trustees fulfill their fiduciary obligation to the plan.

Please visit our website at www.rogerswealthplanning.com

Our firm consists of independent financial professionals. We are not employees of an investment or financial services firm, we are independent business owners. Because we are not affiliated with any insurance or investment companies, we are truly objective in the advice we give and the products we recommend. Therefore, we are not pressured or distracted by corporate interests and can focus on what is best for you and your financial goals.\n\nWith an average of 15 years of financial industry experience, our team at Rosemont Financial Group knows what it takes to help individuals, families, and businesses accomplish their financial goals. If you are an individual or family, we will help you create a plan for accumulation of assets, management of assets, and distribution of assets for any goal you have while helping you monitor the plan from start to finish. We can also help you with all of your insurance needs, education planning, and estate planning. If you are a business, we will help you create an employee benefits package that meets both your needs as the employer and those of the employee while working within your company’s budget. We can help you create strategies for business continuation plans, retirement plans, and various insurance plans. Please contact us for a complimentary consultation.

Please contact me for a introductory meeting

Sage Advisors manages a broad variety of retirement plans. Sage specializes in participant education and monitoring.

Salvini Financial Planning is a Registered Investment Advisory firm located in Avila Beach, California. Salvini Financial Planning is proud to offer fee-only, hourly objective advice. We do not sell any products, nor do we require any minimums. We can help to create a customized plan that will be as unique as your company is. We are professional financial planners and financial advisors who are interested in building a relationship with you personally, and not just your money alone.

Sapling Wealth Management crafts financial solutions that work for small businesses, and we deliver our services with honesty & integrity.

Sapling Wealth Management, LLC is an independent investment firm, based in Washington State, that specializes in 401(k) advisory services. Our ideal client values investment advice & service and aims to make their financial world better with thoughtful financial decisions. We believe the best 401(k) service combines face-to-face & remote support, which helps build trust and while supporting ease-of-use.

Unlike many other investment advisers, 401(k) plan management is a significant part of Sapling Wealth Management's business. Will Hicks, Managing Director, is an Accredited Investment Fiduciary (AIF) - a designation indicating his subspecialty focus on 40(k)s.

For more information to quickly understand how we serve small businesses, please go our website for more information and to watch our short video (1:53).

Retirement plans that work for you ™

Installing a retirement plan is fairly straightforward. Understanding how that plan impacts each participant is far more difficult. At Skyline, we are experienced wealth managers ready to assist with the creation or adaptation of retirement plans, yes. However, our primary goal is to ensure both the plan sponsor and every participant understands their plan and how to maximize its value.

We specialize in retirement plan consulting only. We have over 100 plans that we serve and nearly half a billion in assets that we advise on. \nThis is a huge differentiator from the generalist, hobbyist and unfocused "financial advisors" you may come across.\nWe don't sell insurance, annuities, stocks or bonds.\nWe can serve as a 3(21) fiduciary.\nWe can give advice to your employees!\nWe provide all the needed processes to help you fulfill your fiduciary responsibilities and help your employees prepare for retirement with dignity.

At Southport Capital, we understand the unique challenges that come with managing wealth. For more than 20 years, we have served as a trusted partner of individuals, families, and institutions, providing wealth management guidance and solutions based on a thorough understanding of each client’s situation and goals.\n\nWe bring proven expertise to bear on every aspect of a client’s wealth—from accumulation and growth through preservation and distribution.\n\nBy taking an objective and proactive approach that reflects the nuances and complexities of each situation, we continue to build trusted relationships.

http://www.sscapm.com/

Bringing Wall Street to Main Street

http://www.springwaterwealth.com

Springwater Wealth Management offers complimentary consultations to prospective clients.

David’s retirement advisory practice is based on the fiduciary standard, efficient markets, diversification and reducing the impact of fees. He serves retirement plan sponsors in a 3(38) Fiduciary capacity, and assists them in fulfilling their duty to participants through diligent plan design focused on achieving desired outcomes. David is a member of the Global Retirement Partners Advisor Alliance, which is an elite group of retirement plan advisors from across the country.

STM Asset Management is a full service RIA firm located in Fairhope, AL. We handle 401k plans from big to small, from startup to established. We strive to offer you the lowest cost possible while at the same time providing you and your employees with the one on one service you deserve.

We focus on holistic planning and our main goal is to help you achieve financial abundance.

We are specialist in Actively Managed models. Participants appreciate the option of choosing models. The model we offer has a 11 year 3rd party verified historical performance derived from a traded tracking account. Request a pass to view performance at lenfox@scarecrowtrading.com.

We serve small and medium size business and individuals.

We are a CEFEX certified firm. The CEFEX certification is analogous to the ISO certification in the manufacturing world.

At Switchpoint, everything we do is based on a simple fiduciary promise: to do what’s right for you, your company, and your employees, no matter what. It’s the very same obligation you have as the sponsor of your plan – and we’re proud to share it with you.

Serving as lead advisor of an expert team, Switchpoint provides expert advice for plan sponsors and their participants, and access to the same well-diversified, low-cost investment vehicles we incorporate within our clients’ wealth management portfolios.

As an Accredited Investment Fiduciary and Financial Advisor, I am available to help you with your Employer sponsored retirement plans.

Tarragon Capital, LLC also privides individual investment advice and portfolio management with a speciality in absolute return strategies. It is our belief that investors seek a certain risk and return profile over a complete market cycle. Traditional asset allocation models have a higher chance of not meeting such requirements.

TFO Wealth Partners, LLC is a wealth management firm specializing nationally in services for high net worth families, closely held businesses, and endowments. The company headquarters is based in Maumee, Ohio with offices in Houston (TX), St. Louis (MO), Phoenix (AZ), Winchester (VA), Denver (CO), and New York (NY)

Thayer Financial, L.L.C. is a registered investment adviser offering advisory services in the State of North Carolina and in other jurisdictions where exempted.

We help plan sponsors design and administer creative retirement plans designed to help you recruit, retain and reward employees integral to your company's success.

www.chicowealth.com

We aim to serve any and all participants by education.

We serve as a 3(38) Investment Manager, removing all investment liability from our clients. We concentrate on providing the best plan structure to meet the needs of the business owner while focusing on participant education and service.

- Flat advisory fees - never based on assets

- Financial planning included to help each of your employees with their entire financial life

- Includes asset management for outside assets

Additional location at 51 JFK Boulevard, Short Hills NJ, 07078

Verisail Partners is a fee-based financial planning and investment management firm located in Atlanta, GA. Verisail was founded in 2010 and serves over 200 households across the country.

Our firm is structured to serve the self-employed and small- to mid-size firms. Our staff is equipped to relate to employers as well as plan participants. Our plan design skills have been a tremendous benefit to current clients. We work best in a small group or one-on-one setting when assisting plan participants, providing the attention that most other advisors will not or cannot deliver.

Vermillion and White Wealth Management Group is an independent investment management and comprehensive financial planning firm serving the Main Line and beyond. We offer high quality, personalized investment services to individual investors, retirement plans, and businesses. With an experienced and knowledgeable team of specialists, VWW Group develops strategies and solutions designed for each client’s individual needs.

Vesteer Wealth Management, LLC (“Vesteer”) pairs personalized service with Fee-Only affordability in designing your 401(k) plan. Rodney Sullivan CFA, CAIA is 100% owner and has over 25 years of experience.

- We get to know you and your employees and then work with you to design a plan that truly meets your needs.

- We help you to choose the right plan whether your company employs one or many.

- We eliminate the middlemen and the layers of costs.

- We use low-cost index funds and also low-cost recordkeeping, and Third-Party Administrator services.

We are a fee only (no commission) investment advisory firm. We offer 401k consulting for small and medium size businesses. We can analyze your current plan, recommend a new plan with new investments if necessary, and assist with the transition.

Please visit our website to learn more

Wealthview Capital serves as an independent fiduciary consultant to retirement plan sponsors and participants. Our goal is to help plan sponsors fulfill their fiducary mandates while and simultaneously improving their plans from a number of metrics. An important distinction of our firm is our complete independence; serving the exclusive interests of the plan, its participants and beneficiaries. We do not sell retirement plans, nor are we compensated from any investments selected, nor do we accept any compensation from the plan's other service providers. This means we have no conflicts-of-interest and can assist the plan sponsor in executing their duties in compliance with ERISA regulations.

Weyhill’s retirement plan services brings simplicity, transparency, and lower costs to defined contribution plans. As an independent fiduciary advisor, we partner with business owners and plan sponsors of small and mid-sized retirement plans to help reduce their fiduciary liability and administrative burden while improving retirement outcomes for plan participants.

We believe strongly in the golden rule and treat all clients the way we want to be treated with respect, regardless of the amount of money they have, and crystal clear fee structures with no hidden fees. Free initial consultation.