A Guide to Safe Harbor 401(k) Plans for Small Businesses - Including SECURE 2.0 Changes

Key Takeaways

- Safe harbor 401(k) plans can automatically satisfy the ADP/ACP and top heavy nondiscrimination tests that small business plans often fail.

- There are several contribution options to fulfill safe harbor requirements, offering flexibility in meeting plan goals for both employers and employees.

- Understanding and implementing the appropriate safe harbor options can help a small business meet its 401(k) plan goals in a cost-efficient manner.

Safe harbor 401(k) plans are the most popular type of 401(k) plan sponsored by small businesses today. They are exempt from the nondiscrimination tests that small business 401(k) plans often fail. A 401(k) plan must meet certain employer contribution and participant disclosure requirements to achieve safe harbor status. This trade-off can be a win-win for business owners and their employees.

We receive many questions about safe harbor 401(k) plans from small businesses. In this guide, we’ll answer the most common. It incorporates the law changes made by the SECURE Act of 2019 (SECURE 1.0) and SECURE Act of 2022 (SECURE 2.0).

Understanding Safe Harbor 401(k) Plans

Safe harbor 401(k) plans are not subject to the ADP/ACP and top heavy nondiscrimination tests that traditional (non-safe harbor) plans must pass to prove annual contributions do not disproportionately favor Highly Compensated Employees (HCEs) over Non-Highly Compensated Employees (NHCEs). To achieve safe harbor status, a 401(k) plan must comply with employer contribution rules and participant disclosure requirements.

Safe harbor plans come in two basic forms:

-

- Classic safe harbor – the original form.

- Qualified Automatic Contribution Arrangement (QACA) - includes an automatic enrollment feature and different contribution requirements than the original form.

Safe harbor 401(k) plans are most popular with businesses who would fail the ADP/ACP or top heavy tests with a traditional plan and/or who want to offer a generous employer contribution. Safe harbor plans are particularly popular with small businesses, who are more likely than large businesses to fail the ADP/ACP and top heavy tests.

The Benefits of a Safe Harbor 401(k) Plan

A safe harbor 401(k) plan can be a win-win for business owners and their employees.

Benefits for Business Owners:

-

- Guaranteed contributions – No ADP/ACP testing means no risk of contribution refunds to correct a failed test – which guarantees owners can defer up to the 402(g) limit annually ($24,500 for 2026 / $32,500 for catchup-eligible owners).

- Simplified administration – The ADP/ACP and top heavy tests can require a large amount of data and technical calculations to prepare properly. A safe harbor plan can make this effort unnecessary.

- Enhanced recruitment and retention – the generous employer contribution requirements of a safe harbor plan can help a business attract and retain talent.

Benefits for Employees:

-

- Guaranteed contributions – safe harbor contributions ensure employees receive additional funds towards their retirement savings, above and beyond what they might save on their own.

- Accelerated vesting – Classic safe harbor contributions must be 100% vested when made, while QACA contributions can require no more than two years of service to fully vest.

- Faster savings – guaranteed employer contributions with accelerated vesting mean more savings to compound until retirement.

Contribution Requirements for Safe Harbor Plans

A 401(k) plan must make a qualifying matching or nonelective contribution to participants to achieve safe harbor status. The contribution requirement depends upon the safe harbor plan’s classic or QACA status.

Classic Safe Harbor Options

- Basic match - 100% of the first 3% of compensation and an additional 50% on the next 2% of compensation (4% of compensation total).

If a participant elects to defer 4% of her $50,000 compensation, then she would be entitled to $1,750 (3.5% x $50,000) of match. If the same participant deferred 8% of her compensation, then she would receive the max match of $2,000 (4% x $50,000).

- Enhanced match – must equal or exceed the basic match at each tier. A common enhanced match is 100% match on the first 4% of compensation.

If a participant elects to defer 4% of her $50,000 compensation, then she would be entitled to $2,000 (4% x $50,000) of match. If the same participant deferred 8% of her compensation, then she would receive $2,000 (4% x $50,000) of match.

- Nonelective contribution - 3% (or more) of compensation, regardless of how much the employee defers.

If a participant earns $50,000, their nonelective contribution would be $1,500 (3% x $50,000, even if they defer $0 during the year.

QACA Safe Harbor Options

- Basic match - 100% of the first 1% of compensation, plus 50% on the next 5% of compensation (3.5% of compensation total).

If a participant elects to defer 4% of her $50,000 compensation, then she would be entitled to $1,250 (2.5% x 50,000) of match. If the same participant deferred 8% of her compensation, then she would receive the max match of $1,750 (3.5% x 50,000).

- Enhanced match – must equal or exceed the basic match at each tier. A common enhanced match is 100% match on the first 3.5% of compensation.

If a participant elects to defer 4% of her $50,000 compensation, then she would be entitled to $1,750 (3.5% x 50,000) of match. If the same participant deferred 8% of her compensation, then she would still receive $1,750 (3.5% x 50,000) of match.

- Nonelective contribution – same formula requirement as classic plans. 3% (or more) of compensation, regardless of how much the employee defers.

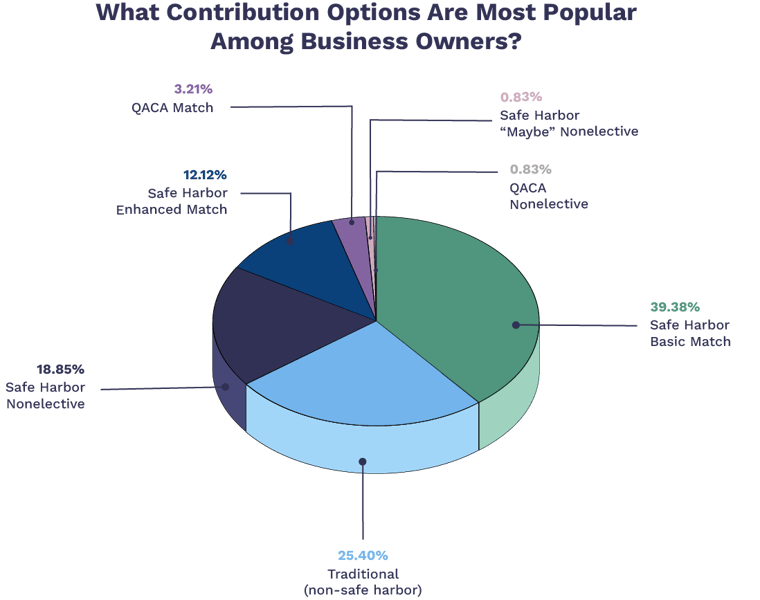

The Most Popular Safe Harbor Contributions

In 2022, we studied the plan designs of 4,330 small business 401(k) plans. Below are the safe harbor contributions selected by these plans, if any.

Additional Contribution Requirements

- Eligibility – A safe harbor plan becomes subject to top heavy testing if two conditions apply:

-

- Stricter eligibility requirements apply to safe harbor contributions than elective deferrals and

- An employee meets the eligibility requirements for elective deferrals, but not safe harbor contributions.

- Excludable employees – A plan can exclude HCEs from safe harbor contributions.

- Allocation period - Safe harbor matching contributions may be allocated on a payroll period or an annual basis. If the allocation period is annual, a "true up" may be necessary to annualize the matching contributions funded by payroll throughout the year.

- Allocation conditions – A plan cannot apply allocation conditions to safe harbor contributions. For example, safe harbor contributions cannot be limited to eligible employees who work 1,000 hours and/or those employed on the last day of the year.

- Vesting – Classic safe harbor contributions must be 100% immediately vested when made, while QACA safe harbor contributions can be subject to a 2-year cliff vesting schedule. Other contributions can be subject to a 3-year cliff or 6-year graded schedule.

- Discretionary match – A discretionary match can be added to a match- or nonelective-based safe harbor plan and not subject the plan to ACP or top heavy testing if the discretionary match meets the following conditions:

- The match cannot be based on more than 6% of compensation.

- The match amount cannot exceed 4% of compensation.

- The match rate cannot increase as elective deferral rate increases.

- The match cannot be subject to allocation conditions.

- Profit sharing – A safe harbor plan becomes subject to top heavy testing for years in which a profit-sharing contribution is allocated to eligible employees (including a forfeiture reallocation).

Participant Disclosure Requirements for Safe Harbor Plans

A participant disclosure requirement applies to some safe harbor 401(k) plans. These plans must distribute a safe harbor notice to eligible employees annually.

Requirement for Match-Based Plans

All match-based plans must distribute a safe harbor notice to participants.

Requirement for Nonelective-Based Plans

Nonelective-based plans generally have no notice requirement. An exception applies for safe harbor plans with a contingent (or "maybe") nonelective contribution.

When a safe harbor plan includes a “maybe” nonelective contribution, employers can decide whether or not to make the contribution later in the year. These plans will be subject to ADP/ACP and top heavy testing for years in which a nonelective contribution is not made.

The safe harbor notice for a "maybe" nonelective plan must explain the contingent nature of the contribution. A follow-up notice must be distributed if a nonelective contribution will be made for the year.

Timing Requirement for Safe Harbor Notices

When applicable, a safe harbor notice must be distributed to plan participants within a reasonable period before the start of each plan year. In general, “reasonable” means:

-

- 30-90 days before the start of each plan year.

- For new participants, generally no earlier than 90 days before their plan entry date and no later than that date.

Content Requirement for Safe Harbor Notices

The notice must contain the following information:

-

- The formula for the safe harbor matching or nonelective contribution.

- Information about other plan contributions, including the potential for discretionary contributions.

- A description of the wages that employees can contribute.

- Instructions for making deferral elections, including any requirements that apply to the elections.

- The frequency that deferral elections can be changed.

- Vesting and distribution provisions applicable to contributions.

- How to obtain additional information about the plan.

Consequences for Failing the ADP/ACP and Top Heavy Tests

Safe harbor 401(k) plans are popular with small businesses because owners tend to bear the brunt of the consequences when the ADP/ACP and top heavy tests fail. A safe harbor plan guarantees no contribution refunds for owners, while costing a business about the same as a top heavy traditional plan.

Consequences for Failing the ADP/ACP Test

The Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests measure the elective deferrals and matching contributions of Highly-Compensated Employees (HCEs) for nondiscrimination.

For 2026, an HCE is defined as an individual that meets one of the following criteria:

-

- They own more than 5% of the employer (either directly or by family attribution) at any time during 2026 or 2025, or

- They received more than $160,000 in compensation from the employer during 2025. Alternatively, a plan may also limit this group to the top 20% of employees, ranked by compensation.

When the ADP/ACP test fails, the most common correction method is refunding the contributions made to HCEs in the amount necessary to pass the applicable test.

Consequences for Failing the Top Heavy Test

A 401(k) plan is considered top heavy for a plan year when the account balances of “key employees” exceed 60% of total plan assets as of the last day of the prior plan year.

For 2026, a “key employee” is defined as any employee (including former or deceased employees), who at any time during the plan year was:

-

- An officer making over $235,000, or

- A 5% owner of the business (a 5% owner is someone who owns more than 5% of the business), or

- An employee owning more than 1% of the business and making over $150,000 for the plan year.

When a 401(k) plan is top heavy, all non-key employees employed on the last day of the plan year must receive a top heavy minimum contribution. The required amount must equal the lesser of:

-

- 3% of compensation,

- The highest contribution rate for any key employee – including elective deferrals.

The required amount for a non-key employee is offset by any employer contributions received during the year.

Percentage of Plans that Fail Testing

In 2020, we studied 3,217 small business 401(k) plans to learn the percentage that failed the ADP/ACP and top heavy tests. We found 26.47% of traditional plans failed the ADP test, while 45.41% of all plans were top heavy. I think it’s safe to assume the percentage of safe harbor plans that would have failed ADP test had they NOT been safe harbor would be higher than 26.47%.

|

|

|

Failure Rate |

||||

|

Plan Type |

Plans Studied |

ADP |

ACP |

Top Heavy |

402(g) |

415(c) |

|

Traditional 401(k) - no automatic enrollment |

598 |

25.59% |

4.68% |

12.04% |

3.18% |

0.50% |

|

Traditional 401(k) - automatic enrollment |

101 |

31.68% |

2.97% |

2.97% |

0.99% |

0.00% |

|

Safe Harbor 401(k) - no automatic enrollment |

2,252 |

N/A |

N/A |

56.88% |

2.58% |

0.49% |

|

Safe Harbor 401(k) - automatic enrollment |

266 |

N/A |

N/A |

39.47% |

3.38% |

0.38% |

|

All Plans |

3,217 |

26.47%* |

3.74%* |

45.41% |

2.70% |

0.47% |

*Excluding safe harbor plans

How to Choose Between a Safe Harbor and Traditional 401(k) Plan?

Reasons to choose a safe harbor 401(k) plan:

-

- The plan will be top heavy. Because a top heavy 401(k) plan must generally make a 3% minimum contribution to non-key employees, the 3% nonelective contribution will cost about the same. The 4% match might even cost less than the top heavy minimum contribution if participants defer at low rates.

- The plan will fail the ADP and/or ACP test. A safe harbor plan allows HCEs to maximize their annual contributions without fear of refund due to failed testing.

- Business owners want to offer a generous employer contribution.

Reasons to choose a traditional 401(k) plan:

-

- The plan will have no trouble passing the ADP/ACP and top heavy tests.

- Business owners want to discourage employee turnover by adding allocation conditions (e.g., 1,000 hours, employment on last day of plan year) and/or vesting schedule to matching contributions.

- Business owners want to use a “stretch” match formula (e.g., 25% of elective deferrals up to 10% of compensation) to incentivize employees to make bigger elective deferrals.

Deadline for Adopting a New Safe Harbor 401(k) Plan

In general, the first year of a new safe harbor 401(k) plan must be at least 3 months long – to give all plan participants the opportunity to make elective deferrals. That means the deadline for employers to adopt a new calendar-based plan is October 1.

Deadline for Converting a 401(k) Plan to Safe Harbor

A 401(k) plan must be formally amended to convert from a traditional to a safe harbor plan. The deadline for adopting this amendment will depend upon the type of safe harbor contribution to be made.

-

- Safe harbor match – amendment deadline is the last day of year preceding the plan year in which the plan will be safe harbor.

-

- However, match-based safe harbor plans must distribute a safe harbor notice to participants sooner - 30-90 days before the start of the plan year. The SECURE Act eliminated the safe harbor notice requirement for nonelective-based plans.

-

- Safe harbor nonelective – The SECURE Act made the amendment deadline much more flexible for these plans. It’s based on the nonelective contribution formula:

-

- Less than 4% - up to 30 days before the close of the plan year in which the plan will be safe harbor.

- 4% or greater - The last day of the plan year following the plan year in which the plan will be safe harbor (i.e., the deadline for distributing ADP/ACP corrective refunds).

-

- Safe harbor match – amendment deadline is the last day of year preceding the plan year in which the plan will be safe harbor.

Replacing a SIMPLE IRA with a Safe Harbor 401(k) Plan

All SIMPLE IRAs operate on a calendar basis. Further, a SIMPLE IRA must be the sole retirement plan maintained by an employer. Before January 1, 2024, employers had to maintain a SIMPLE IRA for the entire calendar year. SECURE 2.0 now allows employers to terminate a SIMPLE IRA at any time during the year by replacing the terminated plan with a safe harbor plan.

However, this replacement process is subject to special timing and contribution limit requirements. Some coordination is necessary to meet these requirements. We recommend a five-step process:

-

- Establish the safe harbor plan’s start date.

- Terminate the SIMPLE IRA effective the day before the start date.

- Notify employees about the replacement.

- Properly limit elective deferrals.

- Confirm deferral limits were not exceeded.

Amending a Safe Harbor Plan Mid-Year

To amend a safe harbor 401(k) plan mid-year, an employer must meet the following requirements if the amendment will affect the content of the safe harbor notice provided before the start of the plan year:

-

- Distribute a new notice to eligible employees 30-90 days before the effective date of the amendment.

- Give eligible employees a reasonable opportunity to change their deferral election before the amendment’s effective date. A 30-day election period is deemed reasonable.

The mid-year amendment cannot include a change prohibited in Notice 2016-16. Prohibited amendments include:

-

- Increasing the number of years required for full vesting of QACA safe harbor contributions.

- Narrowing the group of employees eligible to receive safe harbor contributions if the employees have already met the existing eligibility conditions.

- Changing the type of safe harbor plan (e.g., traditional safe harbor to QACA safe harbor).

- Modifying a match formula that increases contributions or adding a discretionary match within three months of year-end. This change is permitted if made prior to three months before year-end and the change is retroactive to the beginning of the plan year.

Reducing or Suspending Safe Harbor Contributions Mid-Year

A safe harbor match or nonelective contributions (as applicable) can be reduced or suspended mid-year when all of the following conditions are met:

-

- Either of the following conditions apply:

-

- The plan sponsor is operating at an economic loss.

- The safe harbor notice provided before the start of the plan year states that contributions can be suspended mid-year.

-

- A supplemental notice is distributed to eligible employees at least 30 days before the effective date of the reduction or suspension.

- Eligible employees have a reasonable opportunity to change their deferral election before the reduction or suspension occurs.

- The plan is ADP/ACP tested for the full plan using the current year testing method.

- The plan meets the safe harbor requirements for compensation paid through the effective date of the reduction or suspension.

- The reduction or suspension is effective no earlier than the later of:

-

- 30 days after the supplemental notice if provided to employees; or

- The date the amendment is signed.

-

- Either of the following conditions apply:

The Tax Credits for New Safe Harbor 401(k) Plans

The SECURE 1.0 and 2.0 provide significant 401(k) tax credits for eligible small businesses. These credits include:

-

- Startup tax credit – for small businesses who adopt a new plan. Up to $5,000 per year for three years.

- Employer contribution tax credit – for small businesses who allocate employer contributions to plan participants. Initially up to $1,000 per qualifying employee, subject to a sliding scale for five years.

- Automatic enrollment tax credit – for small businesses who add an automatic enrollment feature to a new or existing plan. Up to $500 per year for three years.

To qualify for the tax credits, a small business must meet three requirements:

-

- Employ 100 or fewer employees with at least $5,000 in compensation during the preceding year;

- Employ at least one non-HCE; and

- Did not cover substantially the same employees with a 401(k), SEP, or SIMPLE IRA during the preceding 3 years.

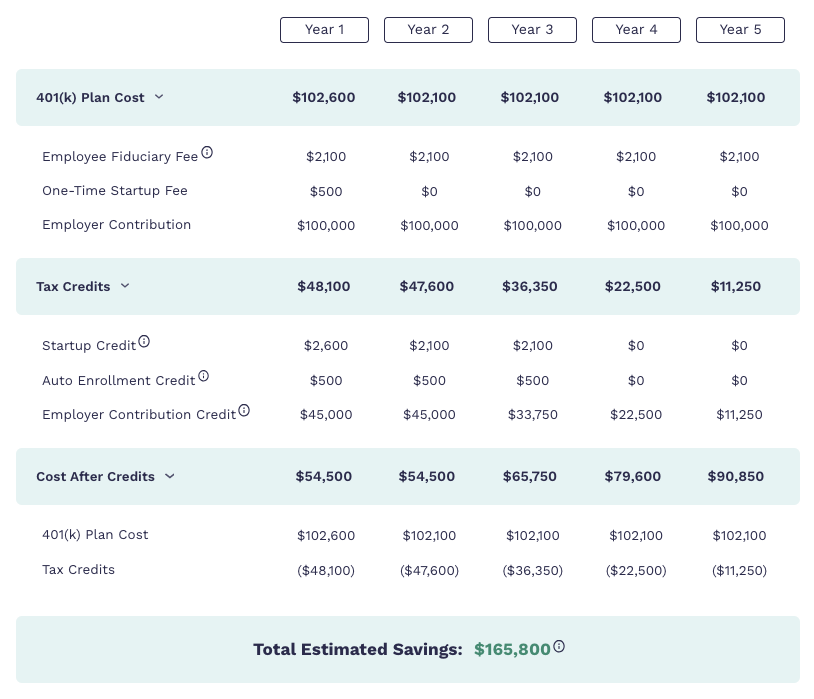

These credits can dramatically lower the out-of-pocket cost of a new safe harbor plan. Below is an illustration of the tax credits available to a hypothetical small business with 50 employees based on the following assumptions:

-

- HCEs = 5

- Automatic enrollment = Yes

- Employees that earn > $100,000 annually = 5

- Annual employer contribution = $100,000

The tax credits for the hypothetical small business would total $165,800 over five years. The calculator used for this illustration can be found here.

Know Your Options!

Safe harbor and traditional 401(k) plans have trade-offs. For small business owners to make the best choice, they must know how to weigh the pros and cons of these plans. Our guide can help.

Frequently Asked Questions

In general, the first year of a new safe harbor 401(k) plan must be at least 3 months long – to give all plan participants the opportunity to make wage deferrals. Establishing a new calendar-based plan is October 1st.

Small businesses can save up to $16,500 on their taxes by starting a Safe Harbor 401(k) plan. All small business tax credits available to conventional 401(k) plans are offered to Safe Harbor 401(k) plans.

It depends on the provider you choose. Employee Fiduciary's price is $1,500 (for up to 30 employees) for a full-service 401(k) plan and includes all Recordkeeping and TPA services.

There are four contribution options: traditional match, traditional non-elective, QACA match, and QACA non-elective.

Additional Resources

SECURE Act 2.0 – A Summary of the Major 401(k) Provisions

SECURE Act 2.0 makes sweeping changes to 401(k) plans. Employers should understand the most significant provisions to prepare their 401(k) plan for them.

Read More

401(k) Fee Study: 75% of Small Business Plans Pay Hidden Fees

“Are my 401(k) fees too high?” is a common question asked by both plan sponsors and participants. Our small business fee study can give some perspective.

Read More

Small Business 401(k) Tax Credits – SECURE 2.0 Updates

Discover three small business 401(k) tax credits that can help lower the out-of-pocket cost of starting a small business retirement plan. Plus, read the latest changes due to SECURE 2.0.

Read More