The SECURE 2.0 Act of 2022 (SECURE 2.0) established or revised several reporting and disclosure requirements for 401(k) plans. Section 340 of SECURE 2.0 requires the Department of Labor (DOL) to recommend improvements to the fee disclosure rules for participant-directed 401(k) plans to “enhance participants' understanding of defined contribution plan fees and expenses, including the cumulative effect of such fees on retirement savings over time.” The DOL requested public feedback about the fee disclosure rules on August 11. We responded this week.

In our comment letter, we suggested improvements to the annual fee disclosure that participants in participant-directed 401(k) plans must receive before their enrollment date and at least annually thereafter. Our suggestions have three basic objectives – increase the transparency of “hidden” fees, make total fees easier to calculate and compare, and better warn participants about the cumulative effect of fees.

How Annual Fee Disclosures Fall Short Today

In a 2021 study, the GAO found that “almost 40 percent of 401(k) plan participants do not fully understand and have difficulty using the fee information that the Department of Labor (DOL) requires plans to provide to participants in fee disclosures.” In our view, three annual fee disclosure shortcomings contribute to this confusion.

No Standard for Plan-Related Information

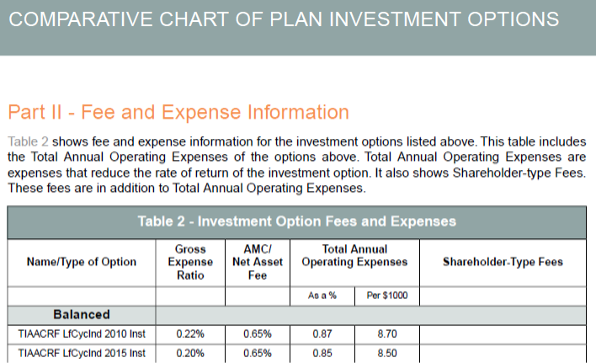

The DOL developed a model comparative chart for investment-related information but didn’t for plan-related information - which includes administrative and individual expenses. Without a disclosure model, providers are free to describe the fees they receive using confusing and non-transparent language. This variability can also make it impossible for 401(k) participants to benchmark their fees – basically, compare them apples-to-apples to the fees charged by other plans.

“Hidden” Fees Can Be Buried in Fund Expenses

All 401(k) providers charge administration fees for delivering plan services such as asset custody, participant recordkeeping, Third-Party Administration (TPA), and professional investment advice. When these 401(k) administration fees are paid from plan assets, they can be “direct” or “indirect” in nature. The difference between the types is how they are paid. Direct fees are deducted from participant account balances, while indirect fees are deducted from investment fund returns.

Indirect fees are often called "hidden" 401(k) fees because they lack the transparency of direct fees. Revenue sharing and wrap fees are the two most common forms.

-

- Revenue sharing – is paid to a 401(k) provider by some mutual funds. The two most common forms are 12b-1 and sub-Transfer Agency (sub-TA) fees.

- Wrap fees – are paid to a 401(k) provider by some variable annuities. Variable annuities are basically mutual funds that have been wrapped with additional fees and redemption restrictions by an insurance company. The wrap can increase the expense ratio of the underlying mutual fund by 1% or more.

Direct fees must be disclosed as a dollar amount or formula in the plan-related information section of annual fee disclosures today. However, indirect fees can be buried in the expense ratio of funds listed in the investment-related information section, leaving it up to the participant to know whether the operating expenses of a fund have been inflated by indirect fees.

The Cumulative Effect of Fees is an Afterthought

Both direct and indirect administration fees reduce participant returns dollar-for-dollar. Disclosures typically focus on the amount of annual fees paid out by participants, which is only a small portion of their cumulative effect. Participants will also miss out on the compound interest the fees would have earned had their amount remained invested. This cumulative effect can cost a 401(k) participant hundreds of thousands of dollars in retirement.

Despite the stakes, annual fee disclosures tend to inadequately warn 401(k) participants about the cumulative effect of fees. Most bury the warning in the comparative chart. Below is the anodyne statement included in the DOL's model comparative chart:

“The cumulative effect of fees and expenses can substantially reduce the growth of your retirement savings. Visit the Department of Labor's Web site for an example showing the long-term effect of fees and expenses at https://www.dol.gov/sites/default/files/ebsa/about-ebsa/our-activities/resource-center/publications/a-look-at-401k-plan-fees.pdf. Fees and expenses are only one of many factors to consider when you decide to invest in an option. You may also want to think about whether an investment in a particular option, along with your other investments, will help you achieve your financial goals.”

Proposals to Address the Shortcomings

Given the cumulative effect of 401(k) fees, we think their dollar amount should be as transparent as possible. We also think that the cumulative effect of fees explanation must be more prominent and compelling.

To achieve these goals, we recommend three changes to the design and content requirements of annual fee disclosures.

Standardize Plan-Related Information

The mix of 401(k) administrative and individual expenses charged by plan providers today can vary dramatically. However, the types of expenses they charge are few. Administrative expenses tend to be flat (based on the number of plan participants) or asset-based (based on a percentage of plan assets), while individual expenses usually relate to distributions and loans. Given the small number of expense types, we recommend the DOL develop a model for plan-related information to help participants total and benchmark their fees.

Below is a model chart for administrative and individual expenses. In the next proposal, we recommend the breakout of indirect fees from fund operating expenses in comparative charts. If a plan pays indirect fees, we recommend the chart refer participants to the comparative chart.

|

Administrative Expenses |

|||

|

Description |

Amount |

When Charged: |

Paid to: |

|

Flat Fee |

$50 Annually |

Quarterly |

[Company Name] |

|

Asset- Based Fee (Direct) |

0.50% of balance ($5.00 per $1,000) |

Quarterly |

[Company Name] |

|

Asset- Based Fee (Indirect) |

Varies by Fund. See Comparative Chart. |

Quarterly |

[Company Name] |

|

Individual Expenses |

|||

|

Description |

Amount |

When Charged: |

Paid to: |

|

Distribution Fee |

$75 |

Per request |

[Company Name] |

|

Loan Establishment Fee |

$50 |

Per request |

[Company Name] |

|

Loan Maintenance Fee |

$50 |

Annually |

[Company Name] |

|

Qualified Domestic Relations Order (QDRO) Fee |

$500 |

Per request |

[Company Name] |

|

Check Reissue Fee |

$25 |

Per event |

[Company Name] |

|

Stale Check Fee |

$25 |

Per event |

[Company Name] |

Breakout “Hidden” Fees in the Comparative Chart

Without a doubt, “hidden” fees are the top reason why Americans are confused about their 401(k) fees today. To mitigate their confusion, we recommend the DOL require the breakout of indirect administration fees from fund operating expenses in the comparative chart. Below is an example from an actual 401(k) plan administered by Nationwide. In the chart, Nationwide breaks out the wrap fee which adds to the expense ratio of mutual funds. We would like to see a similar disclosure for ALL indirect fees.

Show the Cumulative Effect of Fees in Dollars

In our experience, most 401(k) participants have no idea how dramatically the cumulative effect of fees can impact their retirement savings over time. We think two changes to the annual fee disclosure can help. First, move the cumulative effect of fees explanation from the comparative chart to the opening. Second, add a graphic illustration to the cumulative effect of fees.

The following illustration demonstrates the cumulative effect of fees over 10, 20, 30, and 40 years, assuming $20,000 in annual contributions and a 7% rate of return (compounded daily). We think the dollars would shock a lot of participants.

|

|

10 Years |

20 Years |

30 Years |

40 Years |

|

No Annual Fees |

||||

|

Account Balance |

$289,660.56 |

$872,926.14 |

$2,047,399.97 |

$4,412,341.08 |

|

Losses from fees |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

0.25% Annual Fee |

||||

|

Account Balance |

$285,655.90 |

$846,658.50 |

$1,948,417.35 |

$4,112,173.01 |

|

Losses from fees |

($4,004.66) |

($26,267.64) |

($98,982.62) |

($300,168.07) |

|

0.50% Annual Fee |

||||

|

Account Balance |

$281,720.92 |

$821,337.63 |

$1,854,935.64 |

$3,834,720.26 |

|

Losses from fees |

($7,939.64) |

($51,588.51) |

($192,464.33) |

($577,620.82) |

|

1% Annual Fee |

||||

|

Account Balance |

$274,054.69 |

$773,390.28 |

$1,683,194.18 |

$3,340,883.23 |

|

Losses from fees |

($15,605.87) |

($99,535.86) |

($364,205.79) |

($1,071,457.85) |

Foxes Guard the Hen House Today!

The annual fee disclosures distributed to 401(k) participants are usually – if not always – prepared by the plan provider today. In other words, the party receiving the fees. This arrangement can be problematic when the plan provider charges hidden fees given the current design and content requirements for annual fee disclosures. These rules are too lenient, allowing broad discretion regarding the disclosure of hidden fees. A provider can abuse this discretion by describing their hidden fees using confusing and non-transparent language.

To mitigate this conflict, we’d like to see the DOL mandate a model for disclosing all fees – including the hidden ones. We hope the DOL agrees.