Mutual fund companies tend to make their funds available to 401(k) plans in multiple share classes. While all classes hold the same underlying securities, they can charge dramatically different fees. The most expensive often pay “hidden” fees to 401(k) providers. I recommend employers avoid these classes in favor of ones that pay no hidden fees. More often than not, doing so will lead to higher fund returns for plan participants and lower fiduciary liability for employers.

A simple truth about 401(k) plans is that all providers charge fees for plan administration. When these fees are paid from plan assets, they reduce the returns of plan participants dollar-for-dollar. Employers have a fiduciary responsibility to pay no more than “reasonable” fees from plan assets for this reason. When plan fiduciaries fail to meet this responsibility by paying excessive fees, they can be held personally liable for restoring the excess amount.

Given the stakes, I recommend employers avoid hidden 401(k) fees. This is easy to do with some basic education about mutual fund fees. Here’s what employers need to know.

Mutual Fund Fees 101

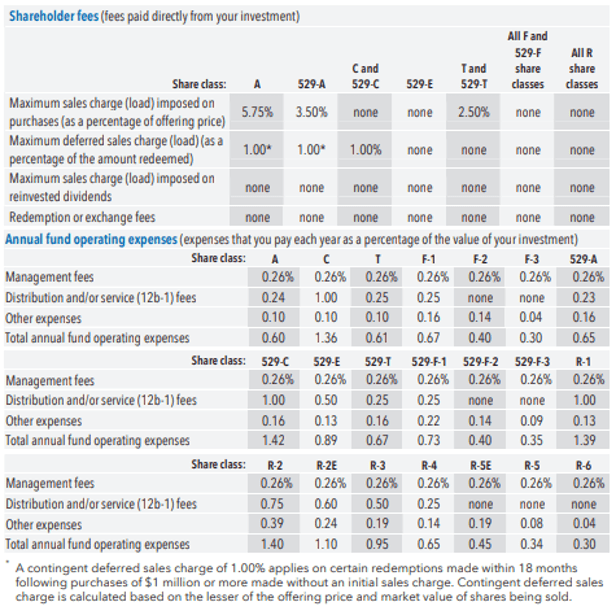

Mutual fund fees increase the cost of investing for 401(k) participants – lowering their returns. They fall into one of two general categories – operating expenses and shareholder fees. Operating expenses cover regular and recurring fund expenses, while shareholder fees apply to individual investor transactions and account maintenance.

Mutual funds are obligated by law to disclose these fees in their prospectus. Most mutual funds disclose this information for all share classes in a single prospectus.

Operating expenses can include:

- Management fees – are paid out of fund assets to the fund’s investment adviser for portfolio management.

- Distribution and/or service 12b-1 fees – are paid out of fund assets for marketing and selling fund shares, such as compensating brokers and others who sell fund shares. "12b-1 fees" get their name from the SEC rule that authorizes a fund to pay them.

- Other Expenses - are expenses not included in the other two categories. Examples include custodial expenses, legal expenses, accounting expenses, transfer agent expenses, and other administrative expenses.

Shareholder expenses can include:

- Sales loads – are a form of sales commission. A “front-end” sales load is deducted from the amount available to purchase fund shares, while a “back-end “(or “deferred”) sales load is deducted from the proceeds of a sale (called a redemption).

- Redemption fees – are deducted from sale proceeds like a deferred sales load, but they are paid to the fund company instead of the salesperson. The fee is intended to defray fund expenses related to share redemptions.

- Purchase fees – reduce the amount available to purchase fund shares like a front-end sales load, but they are paid to the fund company instead of the salesperson. The fee is intended to defray fund expenses related to share purchases.

- Exchange fees – are imposed by some funds when its shares are exchanged for the shares of another fund.

- Account fees – are imposed by some funds when an account falls below a minimum balance.

The Hidden 401(k) Fees Paid by Some Mutual Funds

When 401(k) administration fees are paid from plan assets, they can be direct or indirect in nature. The primary difference is who pays them. Direct fees are deducted from participant balances, while indirect fees are deducted from the returns of plan investments.

Direct fees are the most transparent. Their dollar amount must be explicitly disclosed in fee disclosures, Form 5500s, and participant statements. In contrast, indirect fees can be buried in the fund expenses of fee disclosures and not appear at all in Form 5500s or participant statements. Indirect fees are often called “hidden” fees due to their lack of transparency.

Revenue sharing is the most common form of hidden 401(k) fees paid by mutual funds today. These payments increase a mutual fund’s operating expenses. There are two types:

- 12b-1 fees are paid to a 401(k) financial advisor. They increase “Distribution and/or service 12b-1 fees.” If these hidden fees apply, 401(k) providers must disclose them to employers in their 408b-2 fee disclosure.

- Sub-Transfer Agency (sub-TA) fees are paid to a 401(k) recordkeeper. They increase “Other Expenses.” If these hidden fees apply, 401(k) providers must disclose them to employers in their 408b-2 fee disclosure.

401(k) provider fees are unavoidable – all providers charge them. As such, employers should make their amount as transparent as possible to avoid excess fees most easily. Only direct fees fit that bill.

To replace hidden 401(k) fees with direct ones, employers must replace the share class of their funds. The hard part is getting a 401(k) provider to give them up.

How Share Class Affects 401(k) Participant Returns

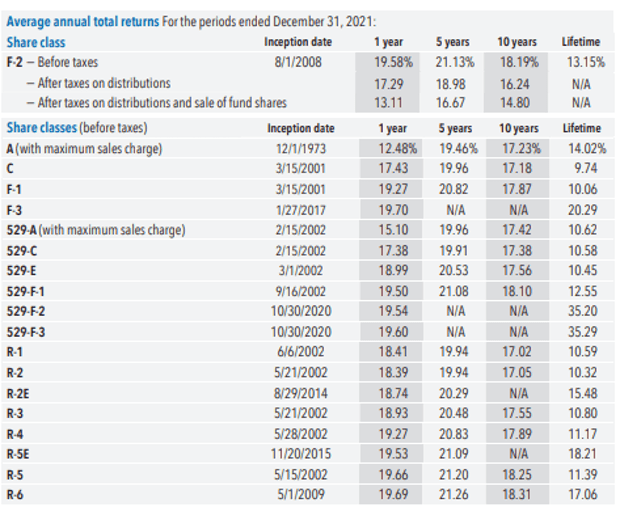

To see how share class affects participant returns, check out the following two tables from the latest American Funds Growth Fund of America prospectus. The highlighted section in the first table discloses the different fees charged by the fund’s share classes, while the highlighted section in the second one discloses their investment returns over specific periods of time.

401(k) plans most commonly use one of the “R” share classes. The R-2 shares pay the most revenue sharing, while R-6 shares pay none at all. Free from the drag of revenue sharing, the R-6 shares returned 1.26% more in average annual returns over the past 10 years! These additional earnings can snowball dramatically over time thanks to the power of compound interest.

Lower your 401(k) fees by Switching Share Class!

In our most recent 401(k) fee study, we found six of the top ten highest-priced 401(k) providers in terms of per capita administration fees also ranked in the top ten based on their percentage of hidden fees. The takeaway for employers – plans that pay hidden fees cost more. That means lower investment returns for participants and higher liability for plan fiduciaries.

In my view, it’s always a bad idea for a 401(k) plan to pay hidden fees. All 401(k) providers charge fees for plan administration. For employers to keep their amount in check for participants, they must be transparent. Only direct fees fit that bill.

The easiest way to avoid hidden fees is by replacing the mutual fund share classes that pay them. If a 401(k) provider won’t allow it, it’s time to replace them.