When an employer is looking to hire a financial advisor for their 401(k) plan, my advice to them is always the same – only consider financial advisors subject to a fiduciary standard of care. My reason is simple - only fiduciary-grade advisors are obligated by law to give impartial advice. In contrast, non-fiduciary advisors can give conflicted advice that favors investments with high commissions – making it harder for employers to keep their 401(k) fees in check. Generally, investment advisers are subject to a fiduciary standard of care, while brokers and insurance agents are not.

The irony? Even though fiduciary-grade 401(k) financial advisors are bound by a higher standard of care than non-fiduciaries, their advice often costs less. Don’t take my word for it. Check out our latest fee study of fiduciary-grade 401(k) advisors below.

Fee study – fiduciary-grade 401(k) advice

Employee Fiduciary partners with hundreds of financial advisors nationwide. All of these advisors are licensed under the Investment Advisers Act of 1940, making each of them subject to a fiduciary standard of care.

Recently, we studied the advisor fees paid by 753 401(k) plans. The following table summarizes our findings. Please note our study does not account for the depth and breadth of each advisor’s services.

|

Plan Asset Range |

$0-$250k (260 plans) |

$250k-$1M (260 plans) |

$1M-$5M (233 plans) |

|

Average Assets |

$97,434.69 |

$564,639.25 |

$1,976,556.74 |

|

Average Participants |

17 |

22 |

39 |

|

Range |

0.05% - 7.41% |

0.08% - 1.53% |

0.05% - 1.00% |

|

Average |

0.83% |

0.67% |

0.55% |

|

Median |

0.60% |

0.65% |

0.50% |

A plan-level breakdown of our study can be found here.

Studying advisor fees within the context of a “bundled” 401(k) arrangement

All 401(k) plans require three basic administration services – asset custody, participant recordkeeping and Third-Party Administration (TPA). Employee Fiduciary provides all of them. Financial advisors ally with service providers like Employee Fiduciary to offer a “bundled” (complete) 401(k) solution to employers.

When evaluating the fees charged by a 401(k) financial advisor, employers should do so within the context of the total fees charged under the bundled arrangement. By adding financial advisor fees from the prior table to Employee Fiduciary fees, average total plan fees can be determined.

|

Plan Asset Range |

$0-$250k (260 plans) |

$250k-$1M (260 plans) |

$1M-$5M (233 plans) |

|

Employee Fiduciary Fees* |

$1,577.95 |

$1,951.71 |

$3,351.25 |

|

Advisor Fees* |

$808.71 |

$3,783.08 |

$10,871.06 |

|

Total |

$2,386.66 |

$5,734.79 |

$14,222.31 |

|

Percentage of Assets |

2.45% |

1.02% |

0.72% |

*Based on average assets and participants.

These figures do not include investment expense ratios. That said, most of the financial advisors that partner with Employee Fiduciary use low cost investments like index funds and ETFs in their fund menus. The average expense ratio of a menu using these funds can be as low as 0.10% of plan assets.

How do these fees compare with the 401(k) industry?

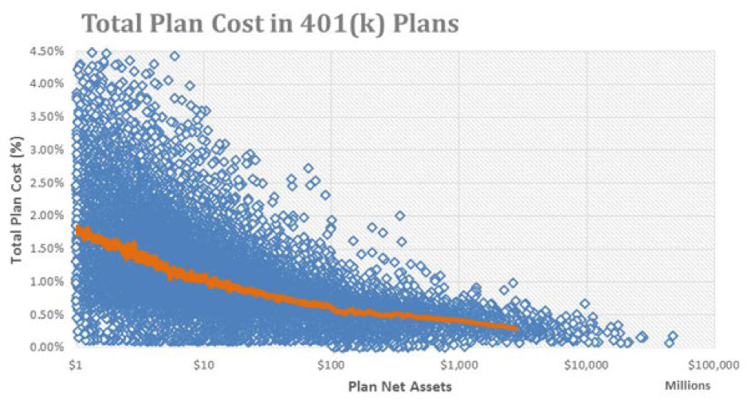

BrightScope is a leading provider of retirement plan ratings and investment analytics to participants, plan sponsors, asset managers, and advisors. In 2015 they released the following chart that summarizes 401(k) fee information from their database:

While plans under $1M are not represented by this chart, you can see the glide path for 401(k) fees and that plans that use a fiduciary-grade financial advisor do not pay more. In fact, most often, they pay less.

Hiring a non-fiduciary 401(k) financial advisor can be a costly mistake!

When employers need assistance in selecting and monitoring investments for their 401(k) plan, they deserve professional advice that puts the interests of their plan participants first. Today, only fiduciary-grade financial advisors are obligated by law to do deliver that. The kicker? Their advice is often less expensive than conflicted advice by brokers and insurance agents. In our view, there is no reason for employers to settle for less.