BENCHMARK YOUR FEES

Request a 401(k) Fee Comparison

We'll analyze your plan to uncover hidden fees, show you how much you're actually paying, and provide suggestions to lower your costs.

Step One: Choose Your Provider

Choose your provider from the dropdown for specific instructions on which documents you need and where to get them.

- Choose Your Provider*

Step Two: Locate the Documents Below

408(b)(2) Fee Disclosure

The Department of Labor requires your provider to furnish a document upon request that discloses all the fees your plan is paying. These documents can often be found on your provider’s employer website, but the easiest way to obtain it may be to simply call your customer service rep and ask for it.

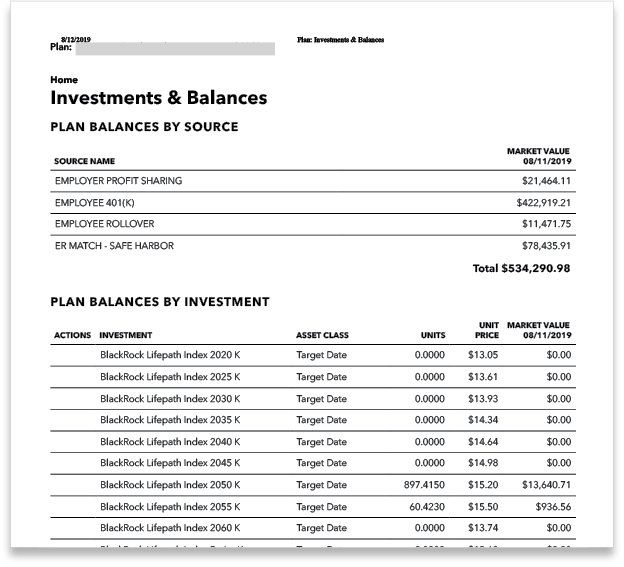

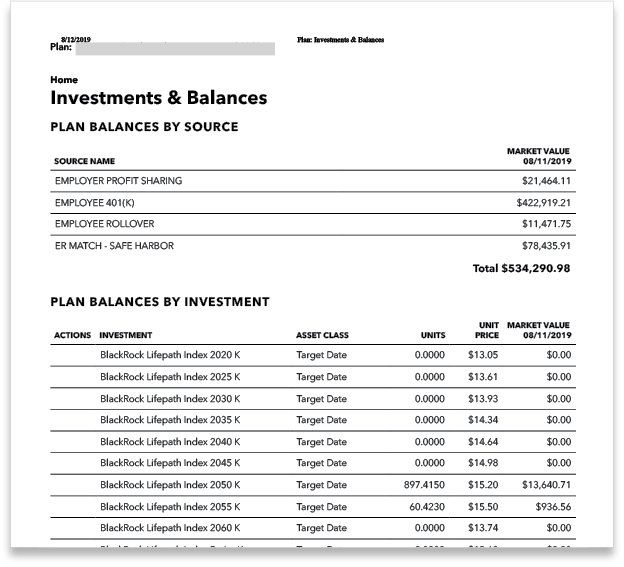

Statement of Assets Report

This is a spreadsheet or document that shows the total amount of money invested in each fund for your company’s entire plan. Since the 408(b)(2) only discloses fees as percentages, we’ll need this to calculate exactly how much you’re paying your provider.

This report can be found on your provider’s employer website.

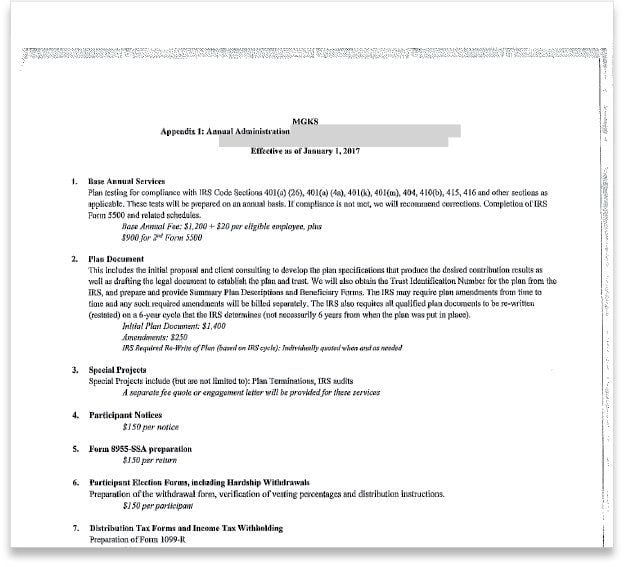

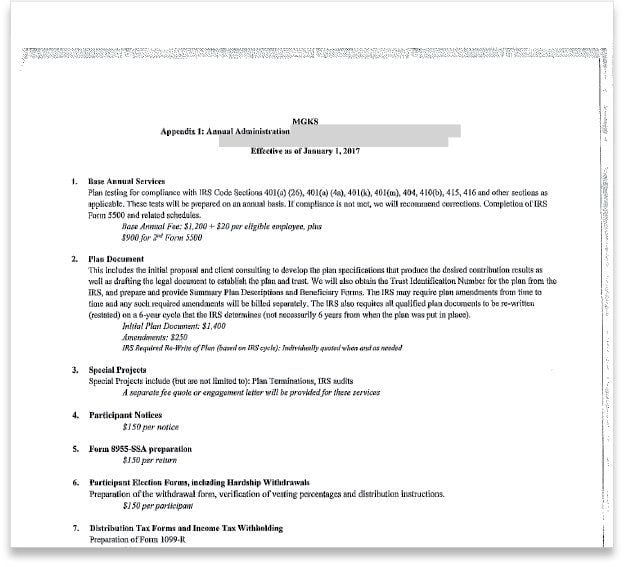

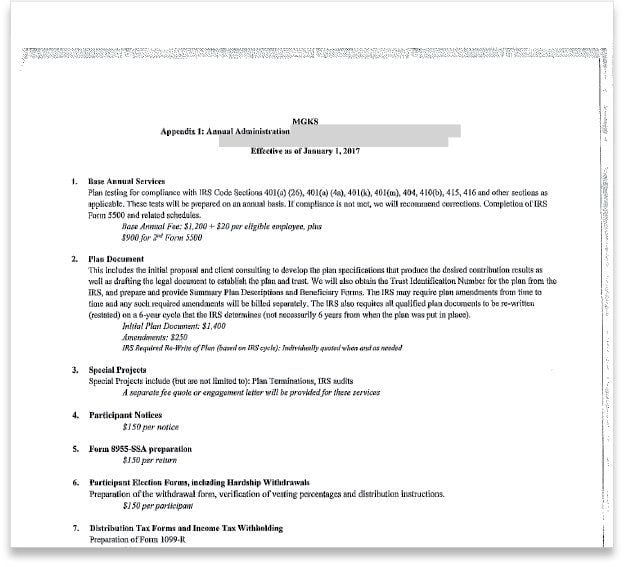

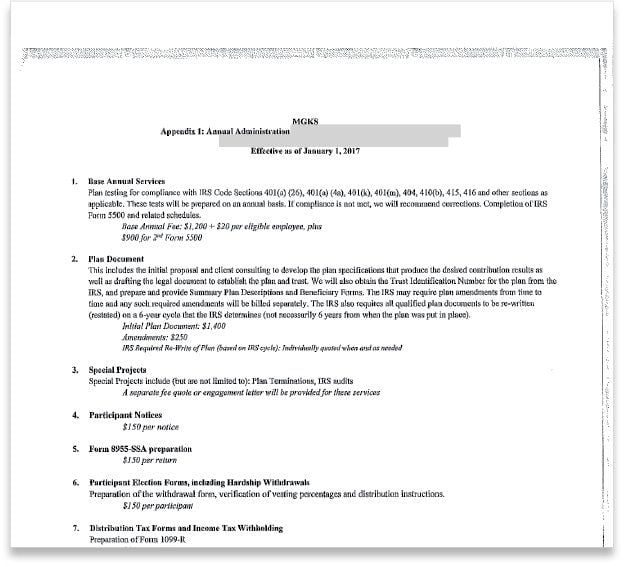

TPA Services Agreement or Invoice

Your provider may not deliver third-party administration (TPA) services – one of the three administration services every 401(k) plan requires – for your plan. In these cases, an unrelated (usually local) TPA delivers these services. If you’re using an outside TPA who is billing you directly, we’ll need to factor their pricing into your fee calculation.

Please provide us with their service agreement or one of their invoices so we can factor in their fees.

Step Three: Submit Your Documents and

Get Your Free Fee Comparison

Step Two: Locate the Documents Below

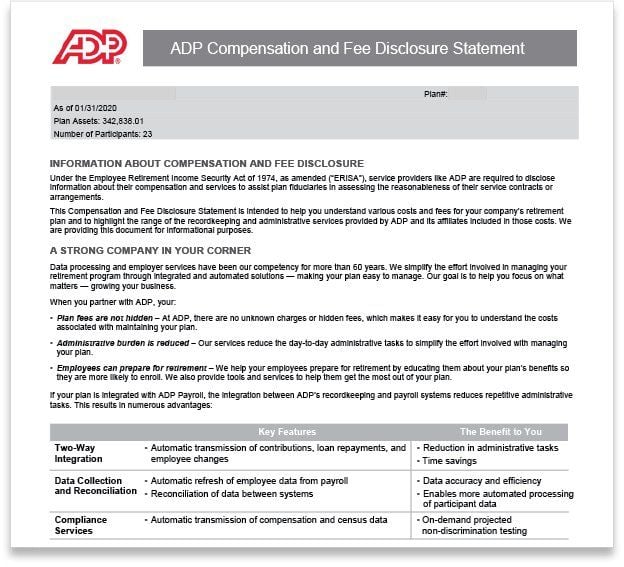

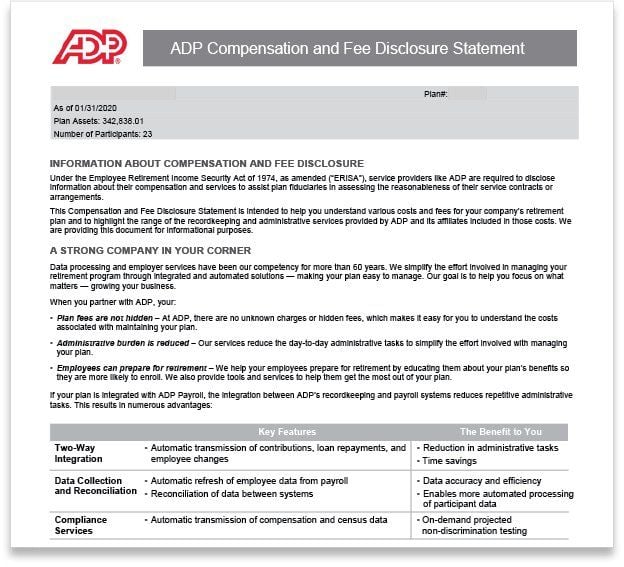

ADP Compensation and Fee Disclosure Statement

Also called your 408(b)(2) fee disclosure, the Department of Labor requires ADP to furnish this document upon request that discloses all the fees your plan is paying. This document can often be found on ADP's employer website, but the easiest way to obtain it may be to simply call your customer service rep and ask for it.

Hidden 401(k) Fees are More Common Than You Think.

In our recent fee study, we found that 75% of small business plans pay hidden fees, costing their participants 0.42% of their account balance every year.

This bar graph shows the worst-offenders at charging hidden fees. If you use one of these providers, chance are you’re paying hidden fees.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

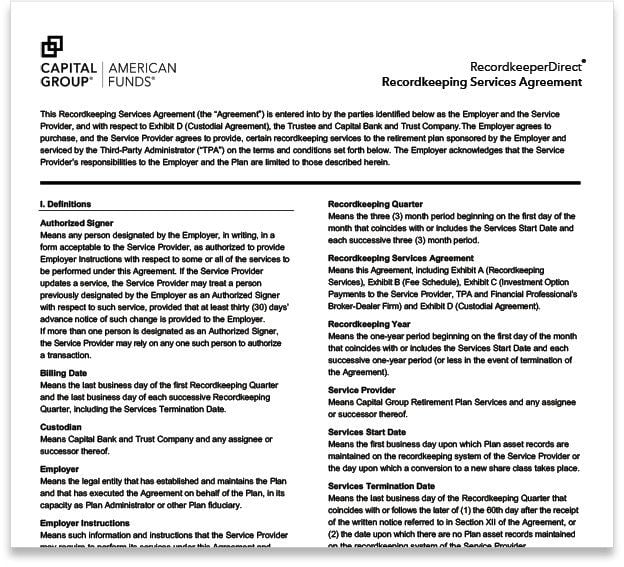

Recordkeeping Services Agreement

Also known as a 408(b)(2) fee disclosure, American Funds is obligated by Department of Labor regulations to provide this to employers. This document contains plan-level information about the administration fees charged by American Funds. This information is intended to help employers evaluate the "reasonableness" of these fees. This document can be found on the American Funds employer website.

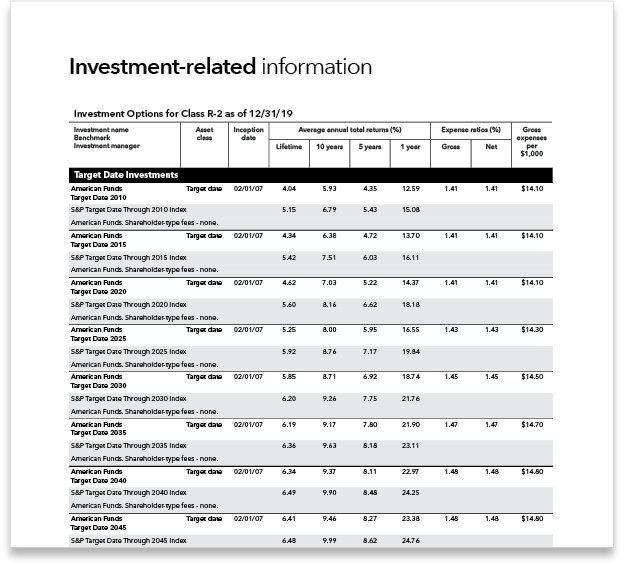

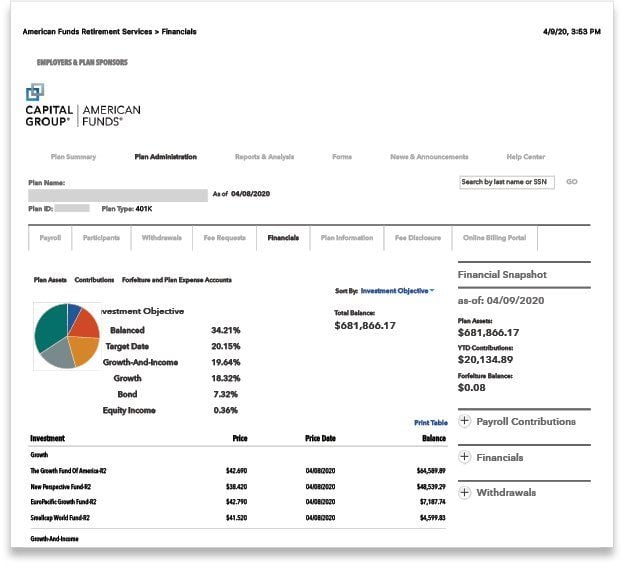

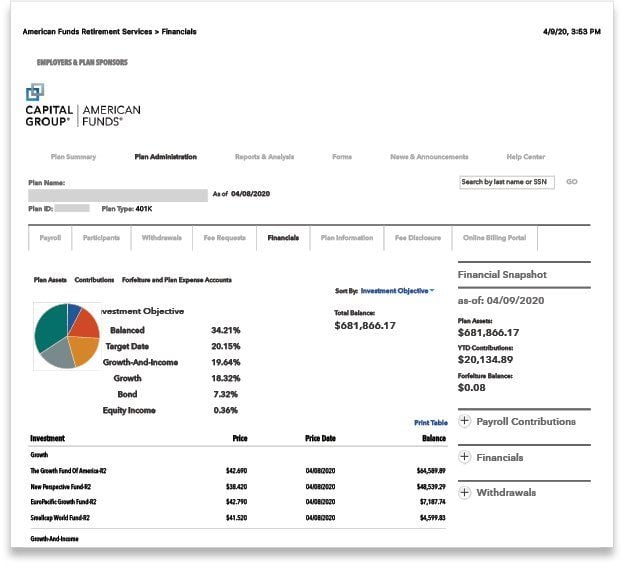

Statement of Assets

This is a spreadsheet or document that shows the total amount of money invested in each fund for your company's entire plan. Since the 408(b)(2) only discloses fees as percentages, we'll need this to calculate exactly how much you're paying your provider.

This report can be found in American Funds' employer website.

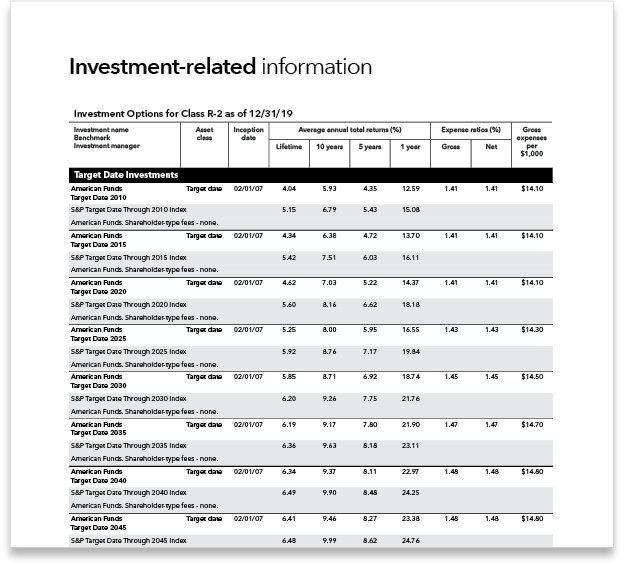

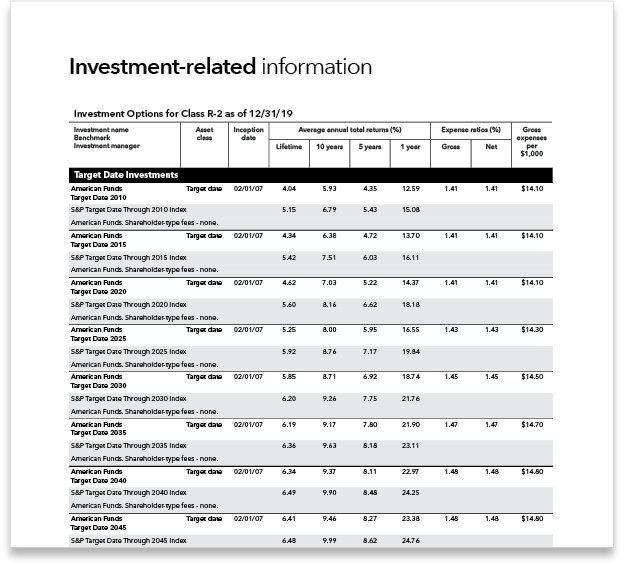

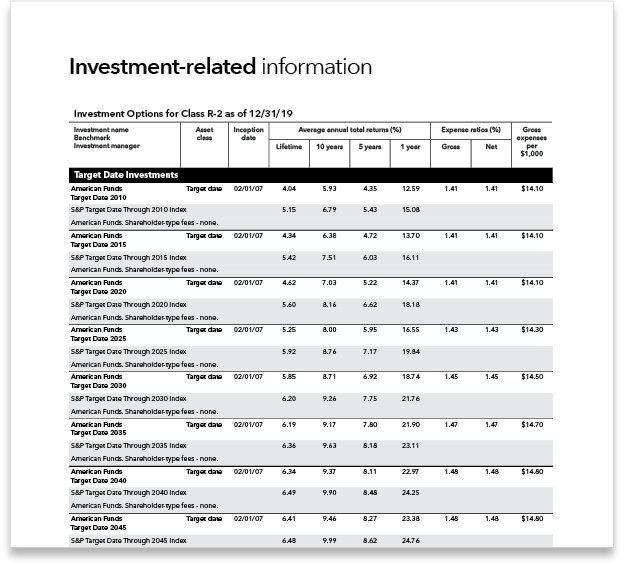

Participant Fee Disclosure

Plan sponsors are obligated by Department of Labor to provide participants with a 404a-5 fee disclosure each year. This document will give us the fund expense ratios, which will allow us to see how much your plan's investments are costing in addition to American Funds' fees.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

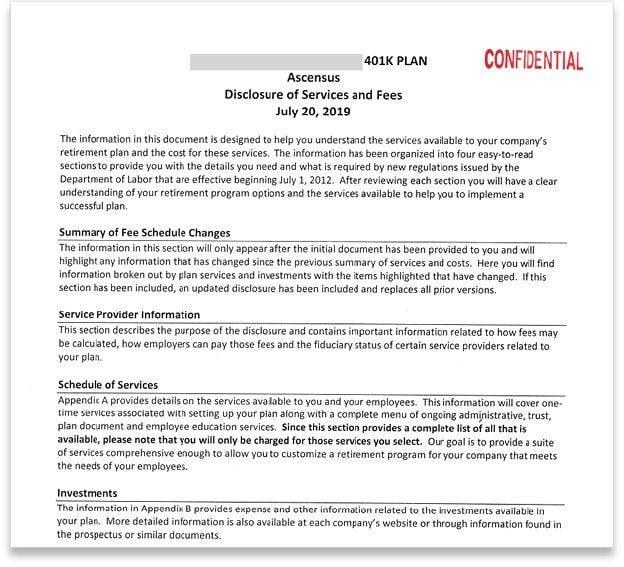

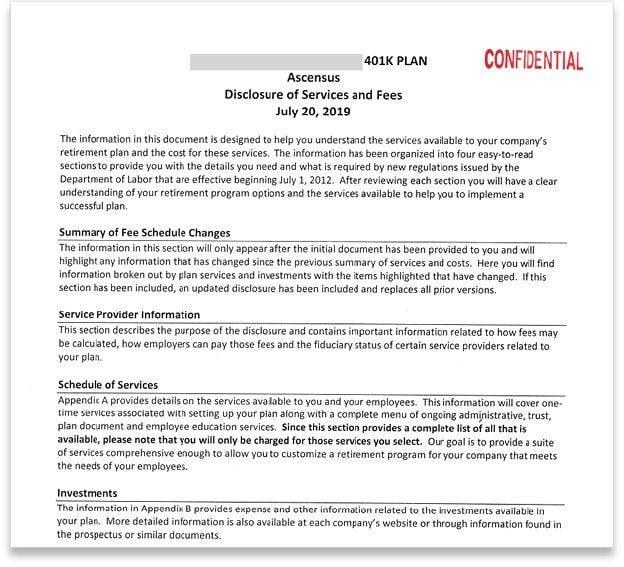

Disclosure of Services and Fees

IAlso called your 408(b)(2) fee disclosure, Ascensus is obligated by Department of Labor regulations to provide this to employers. This document contains plan-level information on the direct fees they’re charging, as well as any revenue sharing payments they receive from the funds. This information is intended to help employers evaluate the “reasonableness” of their 401(k) fees. This document can be found on the Ascensus employer website.

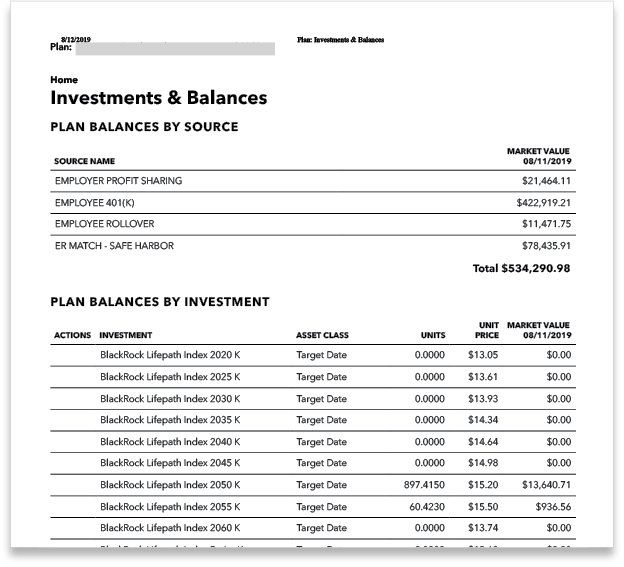

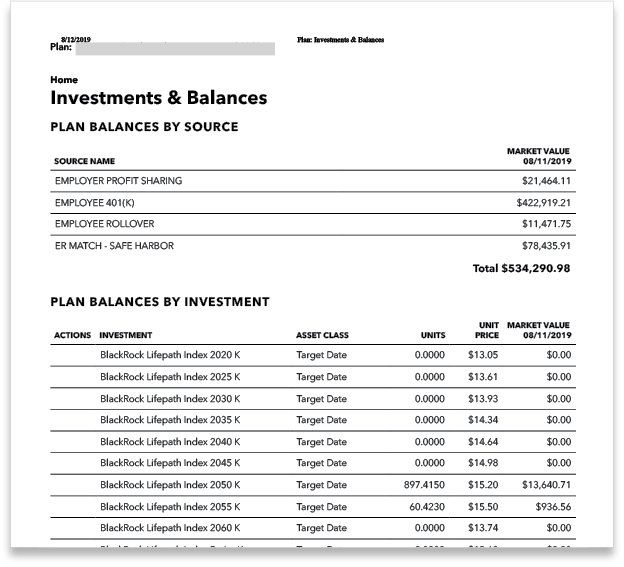

Statement of Assets

This is a spreadsheet or document that shows the total amount of money invested in each fund for your company’s entire plan. Since the 408(b)(2) only discloses fees as percentages, we’ll need this to calculate exactly how much you’re paying your provider.

This report can be found in Ascensus' employer website.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

Plan Fee Disclosure for Plan Fiduciaries

Also called a 408(b)(2) fee disclosure, Empower is obligated by Department of Labor regulations to provide this document. It contains plan-level information about the administration fees charged by Empower. This information is intended to help employers evaluate the “reasonableness” of their 401(k) fees. This document can be found on the Empower employer website.

TPA Services Agreement or Invoice

Empower does not deliver third-party administration (TPA) services – one of the three administration services every 401(k) plan requires - themselves. Instead, an unrelated (usually local) company delivers your TPA services. As such, you’ll need to factor the outside TPA’s pricing into your Empower fee calculation. The fees charged by your TPA can be disclosed in a services agreement or invoice.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

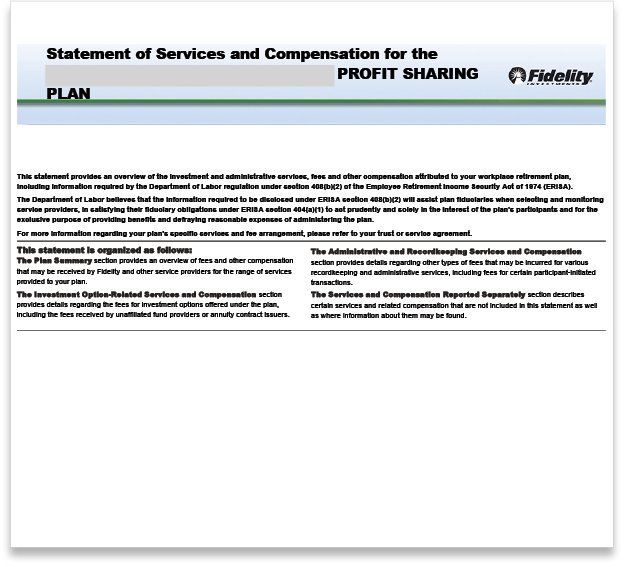

Statement of Services and Compensation

Also called a 408(b)(2) fee disclosure, Fidelity is obligated by Department of Labor regulations to provide this to employers. This document contains plan-level information about their administration fees. This information is intended to help employers evaluate the “reasonableness” of these fees. This document can be found on the Fidelity employer website.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

Updates to 408(b)(2) Disclosure Information

(2)%20Disclosure%20Information.jpg)

Also called a 408(b)(2) fee disclosure, John Hancock is obligated by Department of Labor regulations to provide this to employers. This document contains John Hancock’s pricing model, as well as plan-level information on the direct and asset-based fees they’re charging. This information is intended to help employers evaluate the “reasonableness” of their 401(k) fees. This document can be found on the John Hancock employer website.

(2)%20Disclosure%20Information.jpg)

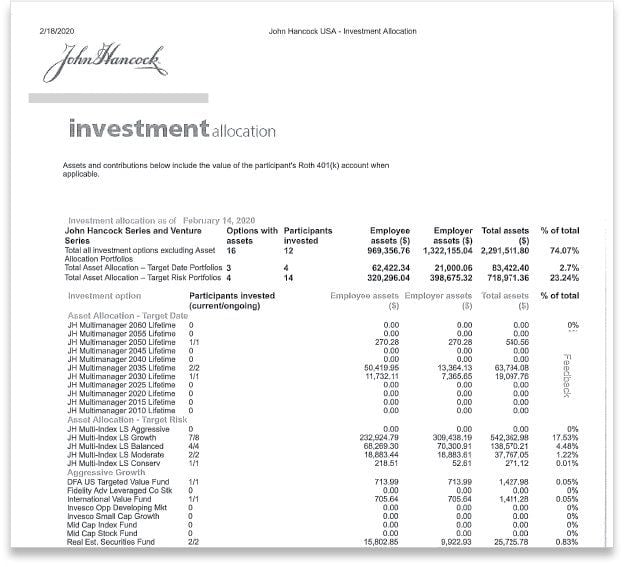

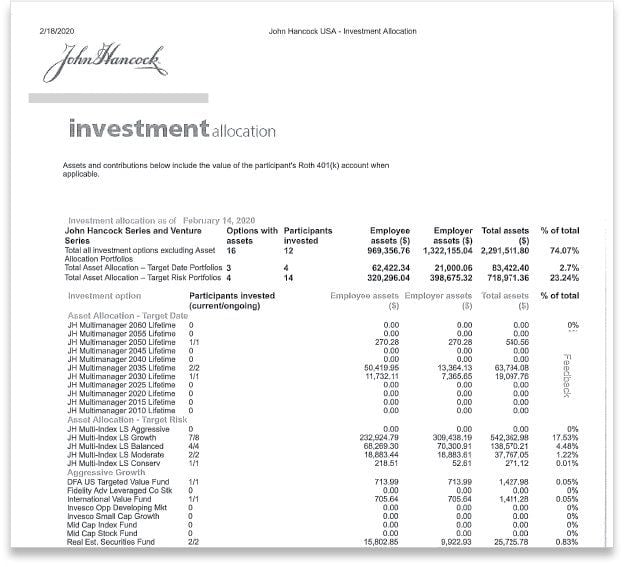

Investment Allocation

This is a spreadsheet or document that shows the total amount of money invested in each fund for your company’s entire plan. Since the 408(b)(2) only discloses fees as percentages, we’ll need this to calculate exactly how much you’re paying your provider.

This report can be found in John Hancock's employer website.

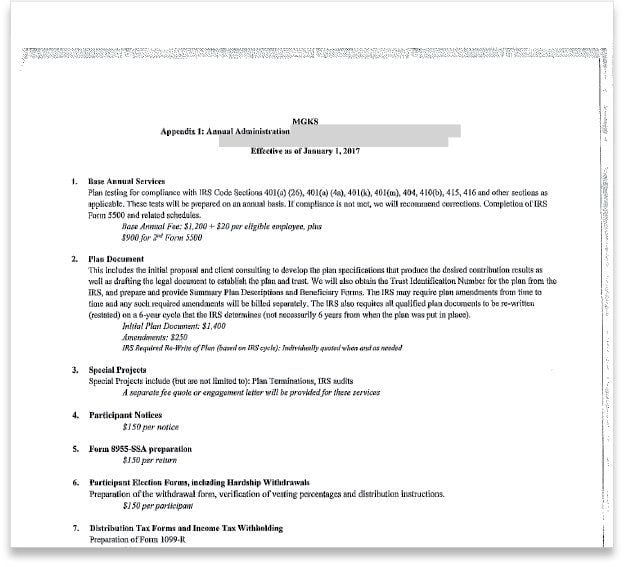

TPA Services Agreement or Invoice

John Hancock does not deliver third-party administration (TPA) services – one of the three administration services every 401(k) plan requires. Instead, an unrelated (usually local) TPA delivers them. As such, you’ll need to factor the TPA’s pricing into your John Hancock fee calculation. The fees charged by your TPA can be disclosed in a services agreement or invoice.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

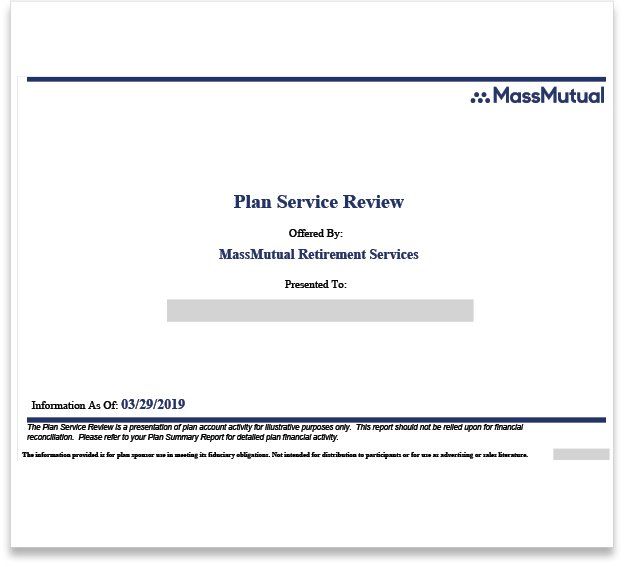

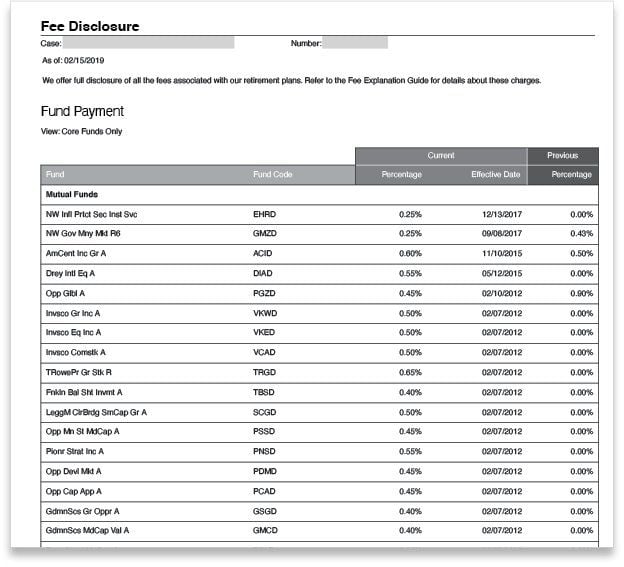

MassMutual Disclosure Statement

Also called a 408(b)(2) fee disclosure, this document contains plan-level information on the direct fees MassMutual is charging, as well as countless pages on all the indirect fees they may or may not be charging. The Department of Labor (DOL) requires this document to be provided to the employer sponsoring the 401(k) plan. A copy can be found on the MassMutual employer website.

Plan Service Review

This document provides a breakdown of the fees, performance, and balance for each fund in your 401(k) plan. These are also sent each year, and can be found on the employer website.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

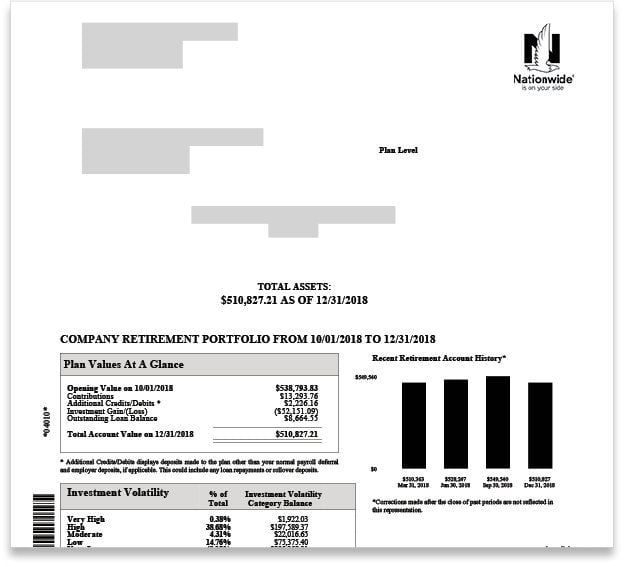

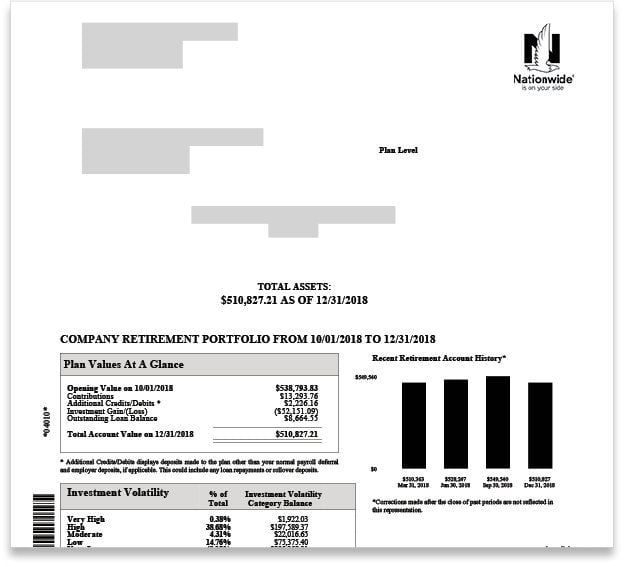

Nationwide Fee Disclosure

Also called a 408(b)(2) fee disclosure, Nationwide is obligated by Department of Labor regulations to provide this to employers. This document contains plan-level information about the direct fees they’re charging, as well as any revenue sharing payments they receive from the funds. This information is intended to help employers evaluate the “reasonableness” of these fees. This document can be found on the Nationwide employer website.

Statement of Assets

This is a spreadsheet or document that shows the total amount of money invested in each fund for your company’s entire plan. Since the 408(b)(2) only discloses fees as percentages, we’ll need this to calculate exactly how much you’re paying your provider.

This report can be found in Nationwide's employer website.

Fee Disclosure 404(a)(5) Statement

(5)%20Statement.jpg)

Plan sponsors are obligated by Department of Labor to provide participants with a 404a-5 fee disclosure each year. This document will help us uncover Nationwide's wrap fees, as well as the fund expense ratios.

(5)%20Statement.jpg)

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

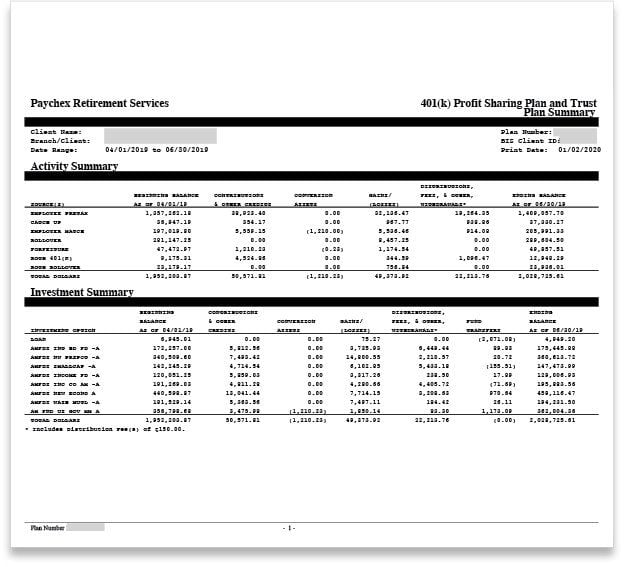

Retirement Plan Fee Disclosure Statement

Also called a 408(b)(2) fee disclosure, Paychex is obligated by Department of Labor regulations to provide this to employers. This document contains plan-level information about the administration fees charged by Paychex. This information is intended to help employers evaluate the “reasonableness” of these fees. This document can be found on the Paychex employer website.

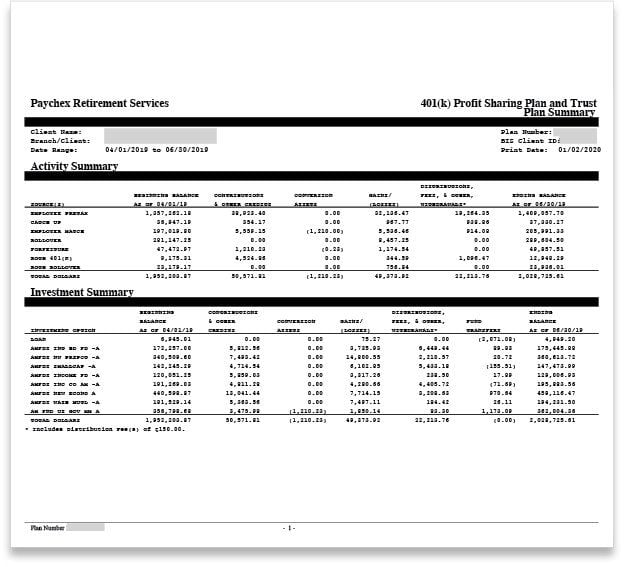

Statement of Assets

This is a spreadsheet or document that shows the total amount of money invested in each fund for your company’s entire plan. Since the 408(b)(2) only discloses fees as percentages, we’ll need this to calculate exactly how much you’re paying your provider.

This report can be found on Paychex's employer website.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

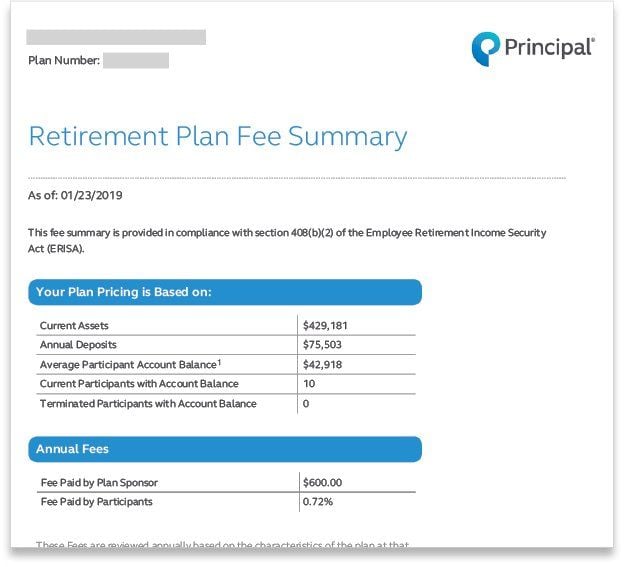

Step Two: Locate the Documents Below

Retirement Plan Fee Summary

Also known as a 408(b)(2) fee disclosure, Principal is obligated by Department of Labor regulations to provide this to employers. This document contains Principal’s pricing model, as well as plan-level information on the direct and asset-based fees they’re charging. This information is intended to help employers evaluate the “reasonableness” of 401(k) fees. This document can be found on the Principal employer website.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

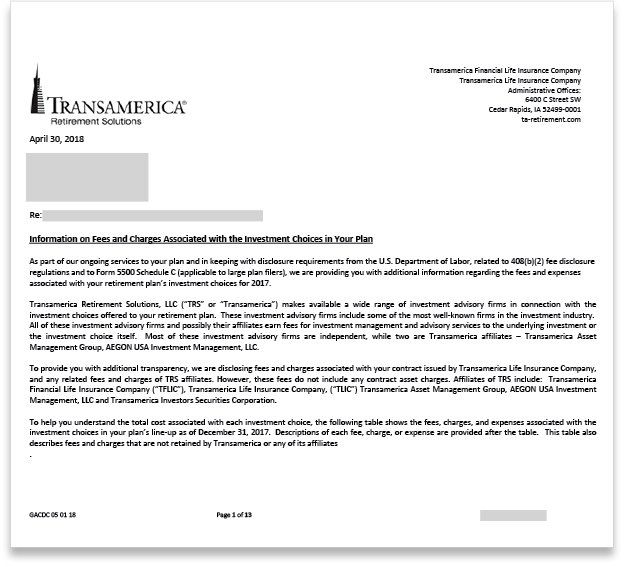

Step Two: Locate the Documents Below

Information on Fees and Charges Associated with the Investment Choices in Your Plan

Also known as a 408(b)(2) fee disclosure, Transamerica is obligated by Department of Labor regulations to provide employers with this document. It contains plan-level information about the administration fees charged by Transamerica. This information is intended to help employers evaluate the “reasonableness” of these fees. This document can be found on the Transamerica employer website.

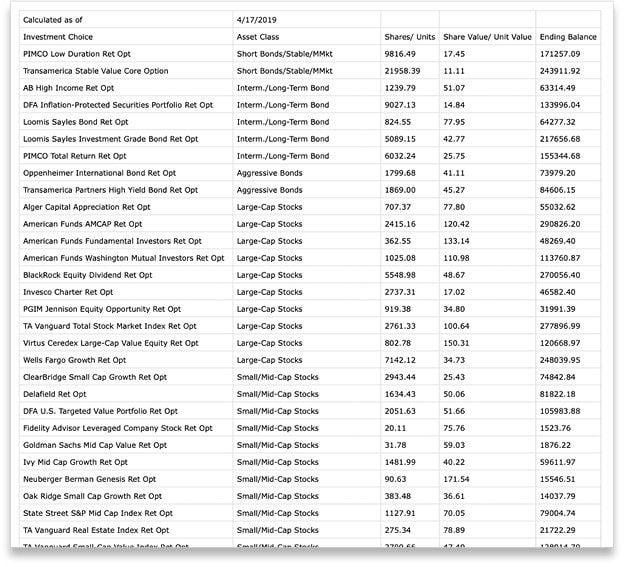

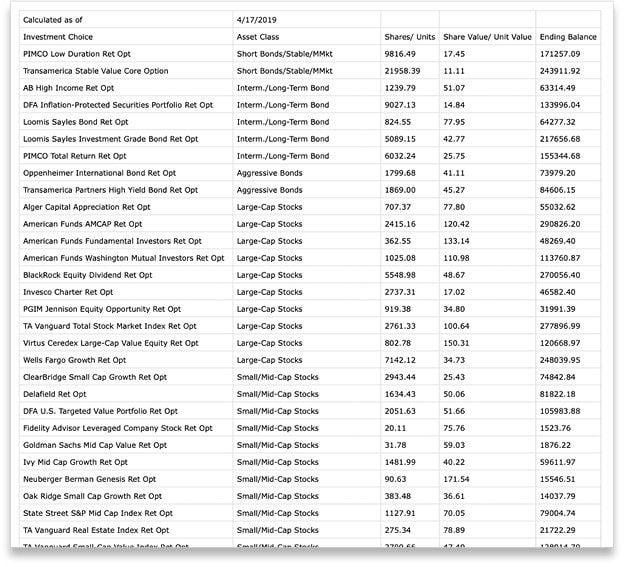

Statement of Assets

This is a spreadsheet you can download from the employer website. It provides a breakdown of how much money is invested in each fund in your 401(k) plan. Since the 408(b)(2) only discloses fees as percentages, we’ll need this to calculate exactly how much you’re paying your provider.

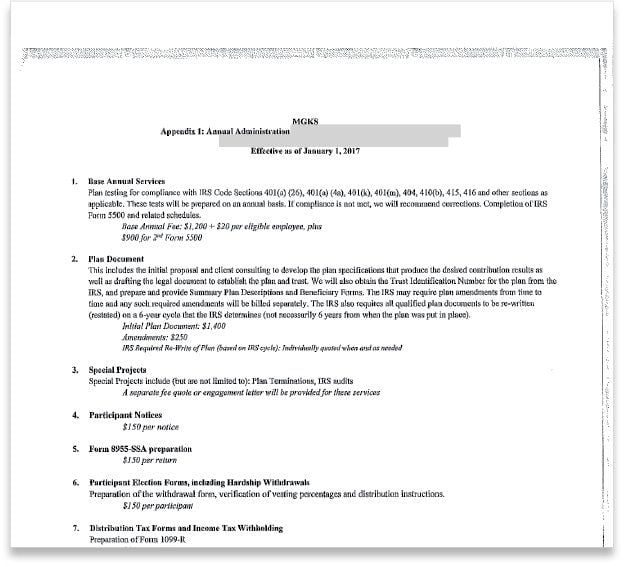

TPA Services Agreement or Invoice

Transamerica does not deliver third-party administration (TPA) services – one of the three administration services every 401(k) plan requires - for all of their plans. In these cases, an unrelated (usually local) TPA delivers these services. If you’re using an outside TPA who is billing you directly, you’ll need to factor their pricing into your Transamerica fee calculation. The fees charged by your TPA can be disclosed in a services agreement or invoice.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

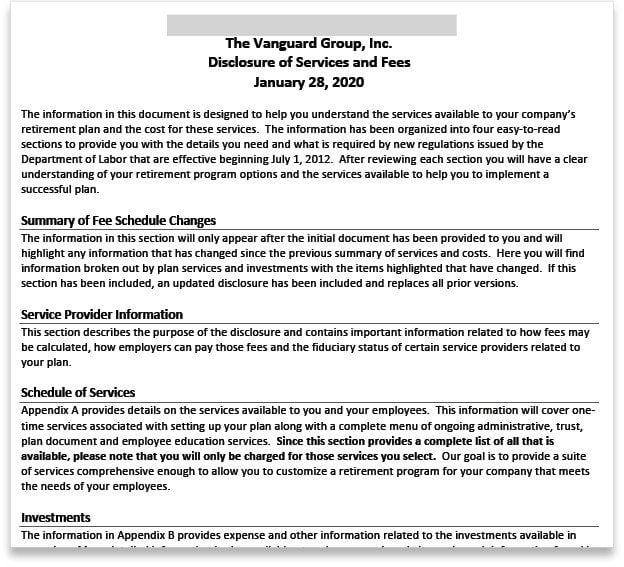

Disclosure of Services and Fees

Also known as a 408(b)(2) fee disclosure, Vanguard is obligated by Department of Labor regulations to provide this to employers. This document contains plan-level information on the direct fees they’re charging, as well as any revenue sharing payments they receive from the funds. This information is intended to help employers evaluate the “reasonableness” of their 401(k) fees. This document can be found on the Vanguard employer website.

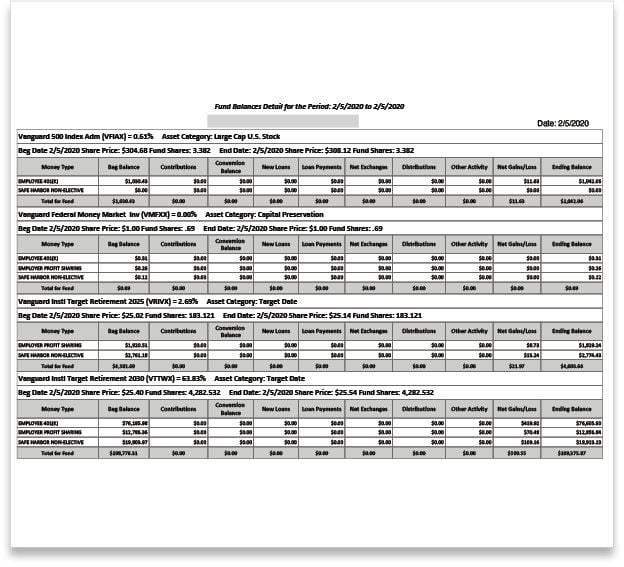

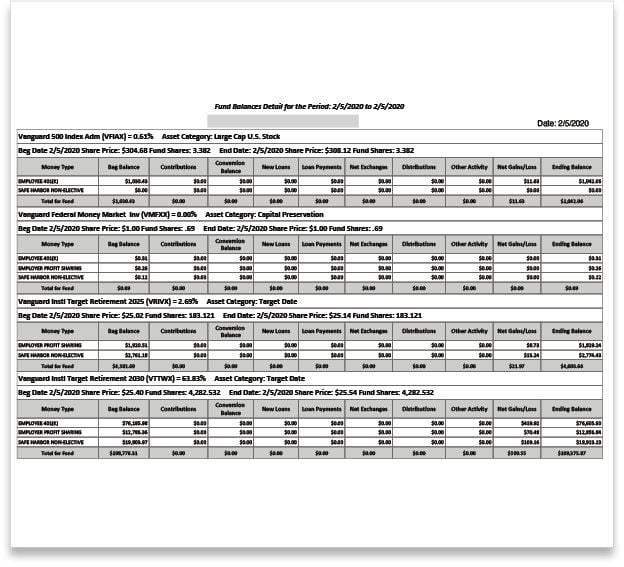

Fund Detail

This is a spreadsheet or document that shows the total amount of money invested in each fund for your company’s entire plan. We'll use the fund balances and expense ratios to calculate your investment fees.

This document can be found on Vanguard's employer website.

Step Three: Submit Your Documents and Get Your Free Fee Comparison

Step Two: Locate the Documents Below

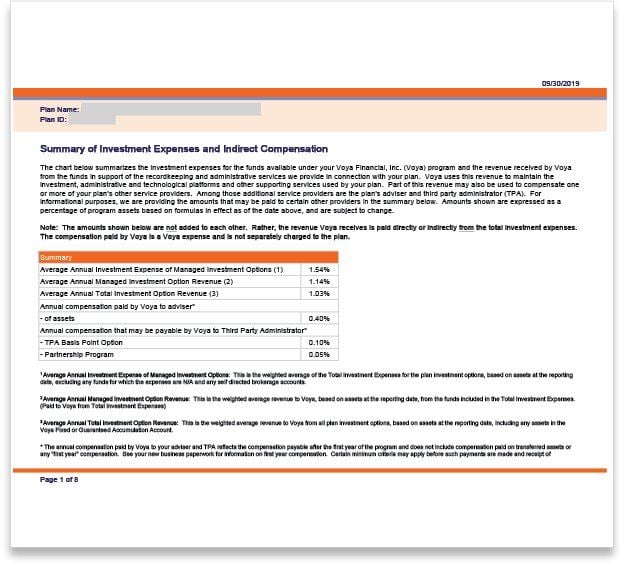

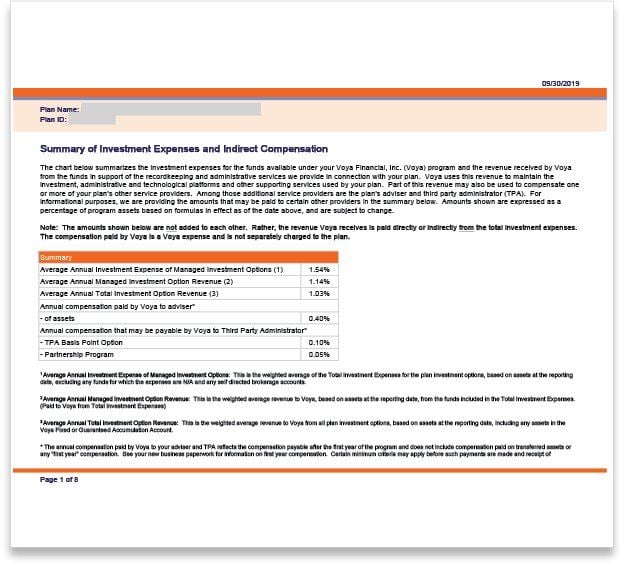

Summary of Investment Expenses and Indirect Compensation

Also known as a 408(b)(2) fee disclosure, VOYA is obligated by Department of Labor regulations to provide this to employers. This document contains plan-level information about the administration fees charged by VOYA. This information is intended to help employers evaluate the “reasonableness” of these fees. This document can be found on the VOYA employer website.

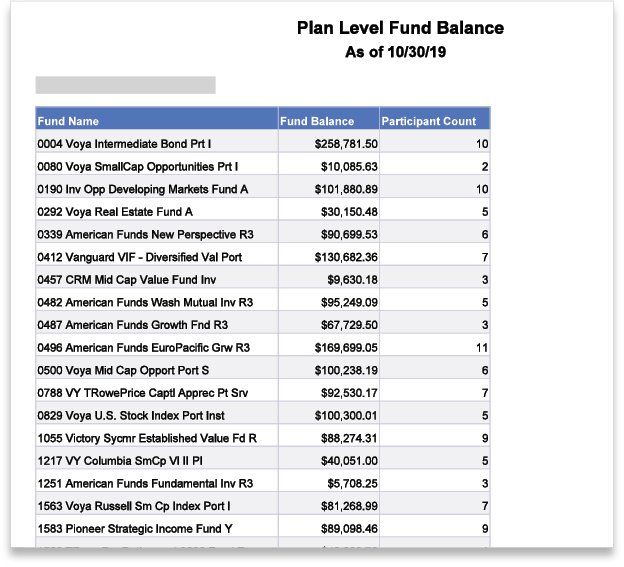

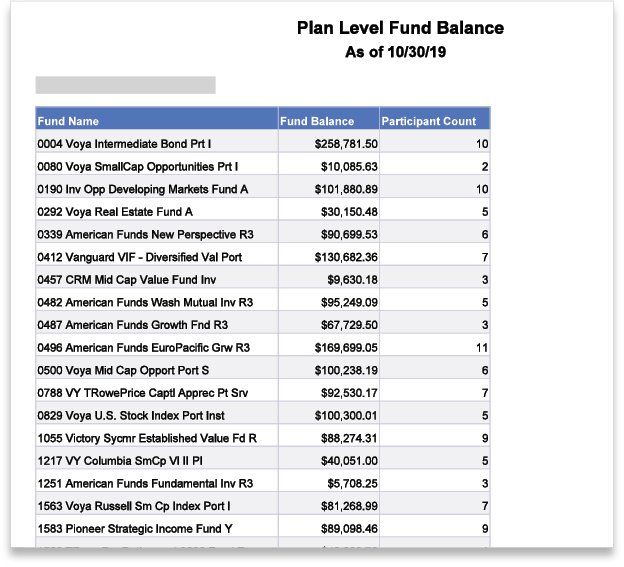

Plan Level Fund Balance

This is a spreadsheet or document that shows the total amount of money invested in each fund for your company’s entire plan. Since the 408(b)(2) only discloses fees as percentages, we’ll need this to calculate exactly how much you’re paying your provider.

This report can be found on VOYA's employer website.

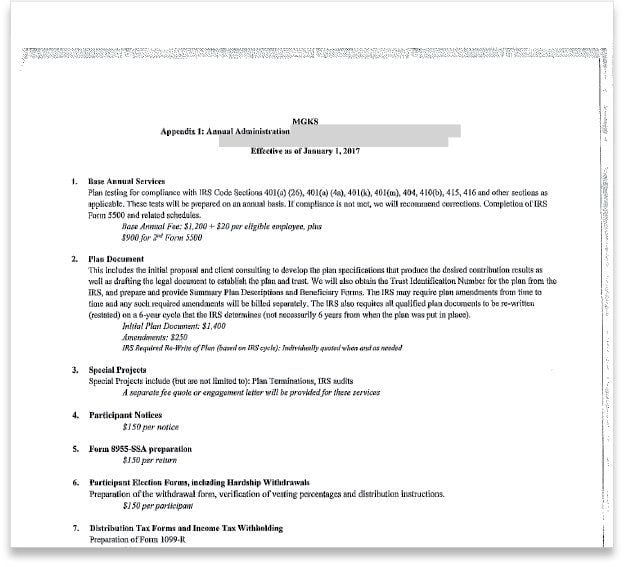

TPA Services Agreement or Invoice

VOYA does not deliver third-party administration (TPA) services – one of the three administration services every 401(k) plan requires. Instead, an unrelated (usually local) TPA delivers these services. As such, you’ll need to factor your TPA’s pricing into your VOYA fee calculation. The fees charged by your TPA can be disclosed in a services agreement or invoice.