Have you ever been to a wedding or club where the DJ keeps trying different songs hoping to fill up the dance floor? Similar to DJs who want full dance floors, the federal government really wants small businesses to have retirement plans. Instead of songs, the government tries tax incentives. A newer incentive strategy is to offer tax credits to small businesses for costs associated with starting a plan and providing employer contributions. These tax credits initially started through a law change in 2019 and a recent law change in 2022 enhanced the tax credits even more – conveniently labeled SECURE and SECURE 2.0.

There are now three distinct tax credits for plan fees or contributions paid by small businesses. Below is a summary of each tax credit to assist you in determining whether your business is eligible and the potential amount of the tax credit. To estimate the amount, use our online calculator.

Startup Tax Credit

Created in SECURE and enhanced in SECURE 2.0, an eligible employer may claim up to 100% of its qualified startup costs for adopting and maintaining a new 401(k) plan.

Who is an eligible employer?

To be eligible, you must meet 3 requirements:

-

- Have 100 or fewer employees who were paid at least $5,000 in compensation by you in the preceding year;

- Cover at least one non-HCE with your retirement plan; and

- In the 3 tax years before the first year you’re eligible for the credit, your employees weren’t substantially the same employees who received contributions or accrued benefits in another retirement plan sponsored by you, a member of a controlled group that includes you, or a predecessor of either.

A non-Highly Compensated Employee (non-HCE) is an employee who is not considered a Highly Compensated Employee (HCE). An HCE is an individual who:

-

- Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much compensation that person earned or received, or

- For the preceding year, received compensation from the business of more than $150,000 (if the preceding year is 2023 and $155,000 if the preceding year is 2024), and, if the employer so chooses, was in the top 20% of employees when ranked by compensation.

Due to the one non-HCE requirement, an owner-only business is unable to take advantage of the startup tax credit by adopting a solo 401(k) plan.

Further, due to the substantially same employees requirement, a business cannot take advantage of this tax credit by adding a 401(k) feature to an existing profit sharing plan. A business would also not be able to terminate an existing 401(k) plan and adopt a new 401(k) to receive this tax credit.

What are qualified startup costs?

Qualified startup costs include the ordinary and necessary expenses incurred by a small business to:

-

- Establish or administer a qualifying retirement plan, or

- Educate employees about the plan.

An eligible employer with 50 or fewer employees may claim a tax credit for 100% of its qualified startup costs.

An eligible employer with 51 to 100 employees may only claim a tax credit for 50% of its qualified startup costs.

Eligible startup costs with Employee Fiduciary include our one-time setup fee of $500 and our annual administration fee of $1,500 (up to 30 employees, each employee over 30 is $30 annually). If you choose to start a 401(k) plan with Employee Fiduciary, that will mean your first-year startup tax credit would equal $2,000 and $1,500 for the next two years.

Is there a maximum limit to the tax credit?

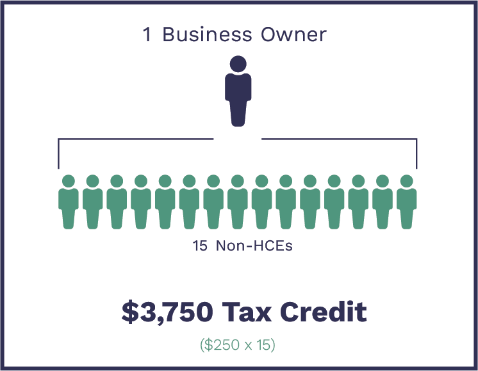

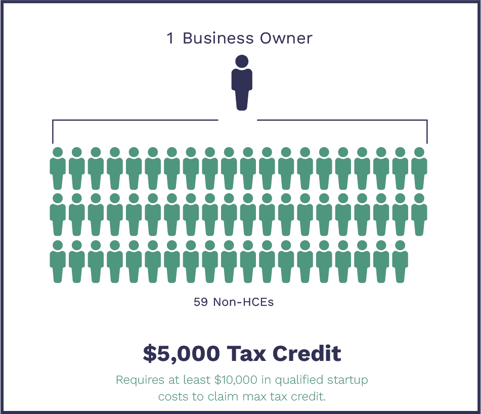

The maximum tax credit is $5,000 each year. The maximum tax credit is reduced for a business with less than 20 employees. The maximum for businesses with less than 20 employees cannot exceed $250 times the number of non-Highly Compensated Employees (non-HCEs) eligible for plan participation. An eligible employer can always claim a tax credit of at least $500 each year.

For example, a business with one owner and 15 non-HCEs may receive a tax credit up to $3,750 (250 x 15).

A business with an owner, three managers, and 59 non-HCEs may receive a tax credit up to the $5,000 limit. Remember that a business with over 50 employees can only claim 50% of its qualified startup costs. Therefore, expenses incurred by this business to establish and administer the plan would have to exceed $10,000 a year to reach the $5,000 tax credit.

How long can an eligible employer claim the tax credit?

The tax credit is available for the first three years starting when the plan is effective or, if elected by the business, the preceding year.

How do I apply for the tax credit?

You must file IRS Form 8881 (Credit for Small Employer Pension Plan Startup Costs) with your tax return to claim the startup tax credit. This form has not yet been amended to accommodate the SECURE 2.0 change allowing businesses with 50 or fewer employees to claim 100% of its qualified startup costs.

Employer Contribution Tax Credit

But wait, there’s more! SECURE 2.0 created a tax credit for employer contributions provided by small businesses over the first few years of the 401(k) plan. To receive this credit, a business must still meet the eligible employer requirements described under the startup tax credit section.

The maximum limit is $1,000 per eligible employee per year. An eligible employee is paid no more than $100,000 a year (adjusted for inflation). The exact tax credit depends upon the number of employees and the number of years since plan startup.

Tax Credit For Businesses with 50 or Fewer Employees

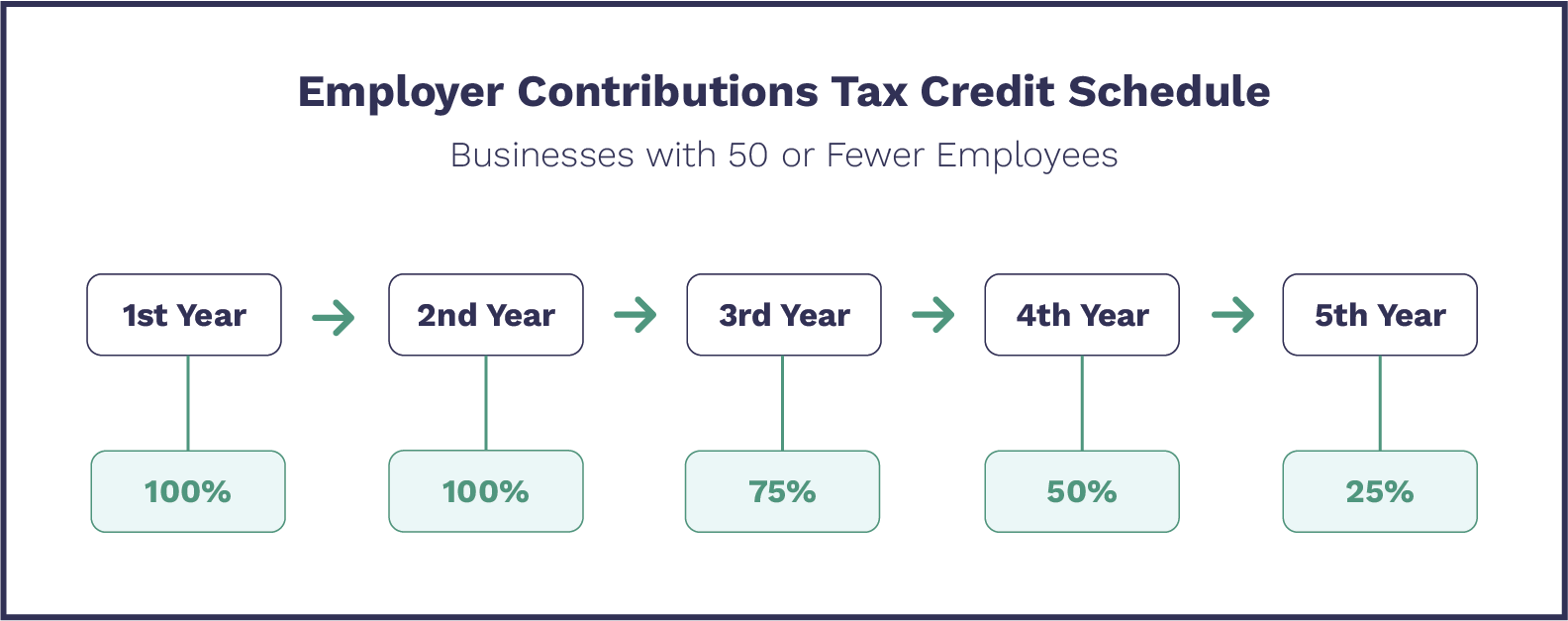

A business with 50 or fewer employees may receive a tax credit for 100% of employer contributions in the first two years (including the startup year), 75% of employer contributions in the third year, 50% in the fourth year, and 25% in the fifth year. There is no tax credit available for employer contributions after the fifth year of the plans’ startup.

To illustrate, a business with one owner (making over $100,000) and 15 eligible employees (making no more than $100,000) starts a 401(k) plan in 2023. Both the plan year and the business’ tax year are the calendar year. The plan allows salary deferrals and provides a match of 50% of deferrals, but is capped at $1,000. Assuming all 15 eligible employees (EEs) and the owner defer enough to take advantage of the match, the business would be receiving $52,500 in tax credits over five years.

| Employer Contribution Tax Credit For Businesses with 50 or Fewer Employees | ||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| Tax Credit | $15,000 | $15,000 | $11,250 |

$7,500 |

$3,750 |

$0 |

| Calculation | 15 EEs x $1,000 | 15 EEs x $1,000 | $15,000 x 75% | $15,000 x 50% | $15,000 x 25% | No more tax credit |

Employer contributions not eligible for the employer contributions tax credit may still be considered for tax deduction purposes.

Tax Credit For Businesses with 51 to 100 Employees

The tax credit for a business with 51 to 100 employees is based on a sliding scale. The percentage is reduced by 2 points for each employee over 50. To illustrate, the tax credit for a business with 80 employees would only be 40% (100% - (2% x 30)) of employer contributions for the first two years, 30% (75% x 40%) for the third year, 20% (50% x 40%) for the fourth year and 10% (25% x 40%) in the fifth year.

To illustrate, a business with 5 managers (each making over $100,000) and 75 eligible employees (making no more than $100,000) starts a 401(k) plan in 2023. Both the plan year and the business’ tax year are the calendar year. The plan allows salary deferrals and provides a match of 100% of deferrals capped at deferrals up to 3% of compensation. Assume total compensation for each year is $1,000,000 for managers and $5,500,000 for eligible employees and all employees defer enough to maximize the match contribution. As detailed below, the business would be receiving $105,000 in tax credits over five years.

| Employer Contribution Tax Credit For Businesses with 51 to 100 Employees | ||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| Tax Credit | $30,000 | $30,000 | $22,500 | $15,000 | $7,500 | $0 |

| Calculation | 75 EEs x $1,000 max x 40% | 75 EEs x $1,000 max x 40% | 75 EEs x $1,000 max x 30% | 75 EEs x $1,000 max x 20% | 75 EEs x $1,000 max x 10% | No more tax credit |

Employer contributions not eligible for the employer contributions tax credit may still be considered for tax deduction purposes.

Auto-Enrollment Tax Credit

Don’t forget SECURE created an auto-enrollment tax credit. Small businesses are eligible for a $500 tax credit by adding an automatic enrollment feature to a new or existing 401(k) plan. To be eligible for this tax credit, the auto-enrollment feature must meet Eligible Automatic Contribution Arrangement (EACA) requirements. A QACA safe harbor 401(k) plan will also meet EACA requirements. Unlike the startup tax credit, the only requirement to be an eligible employer is having 100 or fewer employees who were paid at least $5,000 in compensation in the preceding year.

Also different from the startup tax credit, the auto-enrollment tax credit is available to existing 401(k) plans and profit sharing plans adding a 401(k) feature. For example, you have sponsored a 401(k) plan over 20 years. If you are considered an eligible employer, you could add the automatic enrollment feature now and receive the tax credit. The credit is available for each of the first three years the feature is effective.

The auto-enrollment tax credit became much more relevant due to a law change in SECURE 2.0. Beginning in 2025, most 401(k) plans must have the auto-enrollment feature. Although businesses starting 401(k) plans now do not need to have the auto-enrollment feature, they will be required to adopt the feature by 2025. Small businesses may want to add the auto-enrollment feature now to minimize the potential disruption in 2025 as well as take advantage of this tax credit.

Cheaper Than Ever to Start a New 401(k) Plan!

Approximately 80% of our small business clients pay their 401(k) administration fees from a corporate bank account – not plan assets. This approach is usually a win-win for the business owner because they can deduct the fees as a business expense while keeping the portion that would have been paid from their personal 401(k) account earning compound interest until retirement.

The enhanced tax credits provided in both SECURE and SECURE 2.0 make this win-win scenario even more advantageous to business owners by making the out-of-pocket cost of a 401(k) plan even cheaper for up to the first five years. Is this the song to get your small business on the dance floor?