Last week, the Investment Company Institute (ICI), a financial industry association representing mutual fund managers, published a “research” paper about the TSP, titled The Federal Thrift Savings Plan: Can It Be Duplicated? In it, the ICI says the TSP “is often portrayed as a standard for all participant-directed retirement plans…the TSP is a unique arrangement that cannot be compared with or duplicated by 401(k) plans.” This is empty rhetoric from a group representing companies that would lose revenue if more 401k plans adopted a TSP-like investing approach. Small businesses can absolutely have a 401(k) plan similar to the TSP. And I’m happy to explain how.

The Thrift Savings Plan (TSP) is a retirement plan for Federal employees. It was established by Congress in the Federal Employees' Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans.

With 4.7 million participants and $440 billion in assets, the TSP is the largest defined contribution retirement plan in the United States. It’s also the most efficient. TSP participants pay less than 0.03% of assets each year in plan administration and investment expenses. These low fees mean minimal drag on participant account returns. These savings can really add up over the course of a career, making it easier for TSP participants to save enough to retire comfortably.

TSP investments – generally available to any 401(k) plan

The TSP offers ten investment options - four index funds (F, C, S, and I Funds), a short-term U.S. Treasury securities fund (G Fund), and five Target Date Funds (TDFs) that invest in a mix of the G, F, C, S, and I Funds (L Funds). The investment objective of the TSP investment menu is simple - achieve diversified market returns with the least amount of drag from expenses.

With the exception of the G fund, 401(k) fiduciaries can choose comparable funds. The G Fund is a capital preservation option that guarantees investors no loss of principal. Nothing like it is available outside the TSP. That said, 401(k) fiduciaries can choose other capital preservation options, including money market and stable value funds.

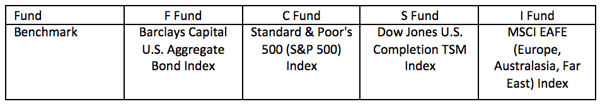

Benchmarks for the TSP’s 4 index funds are:

To build an investment menu that’s comparable to the TSP, 401k fiduciaries would select passively-managed index funds that track the TSP benchmarks. Alternatively, they could also select actively-managed funds intended to beat the benchmarks. If the latter approach is taken, 401(k) fiduciaries should be sure the funds they select do not underperform their passively-managed counterparts over time (after all fund expenses are considered).

What about participant investment advice?

An Aon Hewitt study found that median investment returns for retirement plan participants using TDFs, managed accounts and personal investment advice were 3.32% greater than returns earned by participants that picked an investment portfolio themselves. In short, professional advice is proven to help participant investing success.

The TSP uses TDFs (its L Funds) to offer its participants access to professionally-managed investment portfolios. 401(k) fiduciaries can do the same or hire a financial advisor to provide professional investment advice.

TSP efficiency should be an example for 401(k) plans

The TSP’s efficiency is the key to its greatness. Its low fees mean minimal drag on participant account returns. Any small business in the country can have a 401(k) that’s comparable to the TSP. Will these plans pay the same low expenses as the TSP? No way, but they can offer similar investments and pay low fees.

I hope small business 401(k) fiduciaries do not believe the ICI’s rhetoric that “it is impossible for private-sector participant-directed plans to achieve TSP-like results.” It’s simply not true.