If your 401(k) provider is an insurance, mutual fund, or payroll company, there is a good chance your 401(k) fees are too high. If you’re a business owner, you have the power to lower them, but you may need to switch 401(k) providers to do it. This move can seem daunting if you have never done it before.

In truth, an experienced new 401(k) provider will lead the process and do most of the heavy lifting. Your role should take no more than a few hours. Here’s what to expect and pitfalls to avoid.

The Process

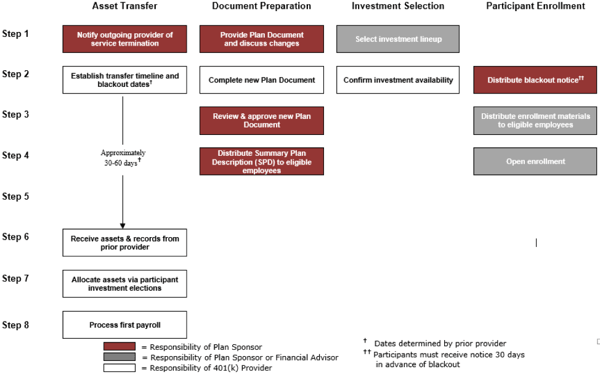

A common misconception about switching 401(k) providers is that the process involves terminating your current plan and then starting a new one. That’s not possible due to IRS “successor plan” rules. Instead, your new provider will take over administration of your current plan. In the 401(k) industry, this process is commonly called a “conversion.” During a plan conversion, four major tasks will be completed:

- Asset transfer – Transfer plan assets from the outgoing provider to the new provider

- Document preparation – Draft a new plan document to govern the operation of the plan. Generally, the terms of the new document will mirror the terms of the current document unless you want to make changes.

- Investment selection – Select plan investments for plan participants to choose from.

- Participant enrollment – Permit plan participants to make new salary deferral and investment elections.

These tasks usually take about 60-90 days to complete, but this timing can vary depending on the lead time required by your outgoing provider. Your role during the entire process should take no more than a few hours. You’ll spend most of your time early on, rounding up the information your new provider needs to take the lead.

Below is a summary of the plan conversion process. It’s usually kicked off by signing a services agreement with your new provider.

Transitioning annual ERISA compliance

When switching 401(k) providers, it’s usually best practice to send all plan contributions to your outgoing 401(k) provider until your plan’s “blackout” period starts. This timing offers the cleanest breakpoint for transitioning annual ERISA compliance – basically, nondiscrimination testing and Form 5500 preparation - to your new provider. Usually, the provider holding your plan assets at year-end will be responsible for completing that year’s ERISA compliance.

When a switch happens mid-year, your new provider will need certain information from your outgoing provider to complete annual ERISA compliance following the close of the year. They will tell you what they need, but it might be up to you to obtain it because some outgoing providers won’t speak to new providers directly.

Applicable Fees

You should expect to pay one-time fees for a 401(k) provider switch. Specifically, a termination fee charged by your outgoing provider and an establishment fee charged by your new provider. Providers will sometimes waive their establishment fee, but you should ask yourself why. Most likely than not, they charge high annual administration fees that will quickly offset your one-time savings.

Most – if not all – 401(k) providers require you to give advanced notice before you can terminate their services. In my experience, 90 days is most common. During the notice period, you’ll be on the hook to pay their administration fees. To keep final fees to a minimum, I recommend you send written termination notice to your outgoing provider as soon as you hire a new provider. Your new provider will likely have a template you can use for this notice.

All applicable fees should be described in each provider’s services agreement. Generally, these fees can be paid from plan assets.

Avoiding Pitfalls

Pitfalls can easily happen during a 401(k) provider switch when you don’t know what to look out for. Below are some common pitfalls and how to avoid them:

- Depositing contributions – Don’t stop sending plan contributions to your outgoing provider until you are told to do so. Employee salary deferrals and loan repayments are always subject to deposit deadlines. When a deadline is not met, you must fund lost earnings to participant accounts and report the issue to the government on your Form 5500.

- Annual ERISA compliance – Confirm it’s covered for both the prior and current plan year. If nondiscrimination testing and/or Form 5500 has not yet been completed for the prior year, confirm which 401(k) provider will complete it. You should also confirm that your new provider has all the outgoing provider information they will need to complete nondiscrimination testing and Form 5500 for the current year.

- Fees – Before you hire a new 401(k) provider, be sure to understand all the fees applicable to the switch. Some providers – particularly insurance companies – can charge punitive service termination fees. To protect the interests of plan participants, you want to keep these fees to a minimum.

Don’t be scared, lower your 401(k) fees!

Cost matters when you and employees save for retirement. That said, you should replace your 401(k) provider when their fees drag down the investment returns of plan participants needlessly.

Fortunately, making a 401(k) provider switch is typically a straightforward process. Your new provider should guide you and do the heavy lifting. In general, you’ll just need to get them the information they need to do that. This role should only take a few hours – a small price to pay for making retirement more affordable for yourself and your employees.