The Frugal Fiduciary Small Business 401(k) Blog

The Basics of 401(k) Nondiscrimination Testing

By: Eric Droblyen

July 31st 2021

401(k) Annual Administration - A Checklist for Business Owners (2022)

By: Eric Droblyen

July 31st 2021

401(k) Retirement Planning – 4 Steps to Retire Faster

By: Eric Droblyen

July 31st 2021

The Basics of 401(k) Fiduciary Responsibilities

By: Eric Droblyen

July 31st 2021

401(k) Withdrawal Rules – Frequently Asked Questions

By: Eric Droblyen

July 31st 2021

401(k) Investment Basics for Employers

By: Eric Droblyen

July 31st 2021

The Benefits of a 401(k) Plan for Employers and Employees

By: Eric Droblyen

July 31st 2021

Plan Compensation - The Basis For All 401(k) Contributions

By: Eric Droblyen

July 31st 2021

401(k) Plan Design – An Overview

By: Eric Droblyen

July 31st 2021

Shopping For a 401(k) Plan Doesn’t Need To Be Overwhelming For Small Businesses; A Checklist Can Help

By: Eric Droblyen

July 31st 2021

401(k) Fee Study - 75% of Small Business Plans Pay Hidden Fees

By: Eric Droblyen

July 31st 2021

Deadlines for 401(k) Nondiscrimination Testing

By: Eric Droblyen

July 30th 2021

Want to Retire Early? Three 401(k) Features That Can Help

By: Eric Droblyen

July 30th 2021

401(k) Contribution Deadlines – You Don’t Want to Miss Them!

By: Eric Droblyen

July 30th 2021

Is Your Company Part of a Controlled Group? You Need to Know or Risk 401(k) Plan Disqualification

By: Eric Droblyen

July 30th 2021

Small Business 401(k) Plan Design Study - What 4,330 401(k) Plans Are Doing

By: Eric Droblyen

July 30th 2021

Switching 401(k) Providers – What to Expect

By: Eric Droblyen

July 30th 2021

Understanding a 401(k) Plan's Fiduciary Hierarchy

By: Eric Droblyen

July 30th 2021

401(k) Loan Rules – What Plan Participants Need to Know

By: Eric Droblyen

July 30th 2021

Small Business 401(k) Tax Credits – Including SECURE Act Enhancements

By: Eric Droblyen

July 30th 2021

Options for Picking a 401(k) Investment Menu

By: Eric Droblyen

July 30th 2021

401(k) Fees - What You Need to Know About The 3 Major Categories

By: Eric Droblyen

July 30th 2021

Best Practices for Avoiding 401(k) Fiduciary Liability

By: Eric Droblyen

July 29th 2021

How Much Time Does Annual 401(k) Administration Take?

By: Eric Droblyen

July 29th 2021

Roth vs. Pre-Tax 401(k) Deferrals – How to Choose

By: Eric Droblyen

July 29th 2021

Deadlines for 401(k) Adoption – Including SECURE Act Changes

By: Eric Droblyen

July 29th 2021

The Coverage Test - What You Need to Know

By: Eric Droblyen

July 29th 2021

Hardship Distributions – Frequently Asked Questions

By: Eric Droblyen

July 29th 2021

Roth 401(k) Deferrals — Answers to Common Questions

By: Eric Droblyen

July 29th 2021

Safe Harbor 401(k) Plans - Frequently Asked Questions

By: Eric Droblyen

July 29th 2021

4 Traits of the Best Small Business 401(k) Providers

By: Eric Droblyen

July 29th 2021

How Compound Interest and Dollar Cost Averaging Grow Savings Over Time

By: Eric Droblyen

July 29th 2021

'Hidden' 401(k) Fees – What Business Owners Need to Know

By: Eric Droblyen

July 28th 2021

401(k) vs SIMPLE IRA: Which is Right for Your Business?

By: Eric Droblyen

July 28th 2021

401(k) Required Minimum Distributions (RMDs) – What You Need to Know

By: Eric Droblyen

July 28th 2021

401(k) Matching Contributions – Are They Right For Your Plan?

By: Eric Droblyen

July 28th 2021

Safe Harbor or Traditional 401(k) Plan – How to Decide

By: Eric Droblyen

July 28th 2021

401(k) Eligibility - When to Let Employees Join Your Plan

By: Eric Droblyen

July 28th 2021

Don’t Let Your 401(k) Provider Hide the Cost of Your Plan

By: Eric Droblyen

July 28th 2021

Apathy is the #1 Source of 401(k) Liability – It’s Easy to Avoid

By: Eric Droblyen

July 28th 2021

401(k) Investment Advice - Pros and Cons of the 3 Major Forms

By: Eric Droblyen

July 28th 2021

Cost Matters - How Much Lower 401(k) Fees Can Increase Savings

By: Eric Droblyen

July 27th 2021

401(k) Vesting Schedules – What They Are and How They Work

By: Eric Droblyen

July 27th 2021

Pooled vs. Single-Employer 401(k) Plans - Are PEPs for You?

By: Eric Droblyen

July 27th 2021

The ADP and ACP Tests - What You Need to Know

By: Eric Droblyen

July 27th 2021

Form 5500 - Answers to Frequently Asked Questions

By: Eric Droblyen

July 27th 2021

Profit Sharing Contributions – Are They Right For Your 401(k) Plan?

By: Eric Droblyen

July 27th 2021

Safe Harbor vs. QACA 401(k) Plan – How to Decide

By: Eric Droblyen

July 27th 2021

401(k) Fees - Administrative vs. Settlor Plan Expenses

By: Eric Droblyen

July 27th 2021

3 Warning Signs Your 401(k) Provider is Ripping You Off

By: Eric Droblyen

July 27th 2021

401(k) Fiduciary Outsourcing – The Roles Most Prone to Abuse

By: Eric Droblyen

July 27th 2021

How to Allocate 401(k) Fees Among Plan Participants

By: Eric Droblyen

July 27th 2021

How to Lobby Your Employer for a Better 401(k) Plan

By: Eric Droblyen

July 26th 2021

Solo 401(k) Plans – Their Benefits to Self-Employed Workers

By: Eric Droblyen

July 26th 2021

401(k) Fidelity Bonds – Frequently Asked Questions

By: Eric Droblyen

July 26th 2021

The Top Heavy Test - What You Need to Know

By: Eric Droblyen

July 26th 2021

Contribution Limits - What You Need to Know

By: Eric Droblyen

July 26th 2021

401(k) Participant Disclosure - What Employers Need to Know

By: Eric Droblyen

July 26th 2021

New Comparability 401(k) Plans - Are They Right for Your Small Business?

By: Eric Droblyen

July 26th 2021

Automatic Enrollment – Is It Right for Your 401(k) Plan?

By: Eric Droblyen

July 26th 2021

Employers Should Avoid Providers That Treat 401(k) Plans Like a Product, Not a Service

By: Eric Droblyen

July 26th 2021

Reasons to Pay 401(k) Fees from Corporate Bank Account

By: Eric Droblyen

July 26th 2021

Revenue Sharing - 5 Reasons for 401(k) Fiduciaries to Avoid it

By: Eric Droblyen

July 25th 2021

401(k) Earned Income – What You Need to Know

By: Eric Droblyen

July 25th 2021

403(b) vs. 401(k) Plans for Non-Financial People

July 25th 2021

401(k) Distributions - What You Need to Know

By: Eric Droblyen

July 25th 2021

Preventing Identity Theft in a Retirement Program as an Employer

By: Eric Droblyen

July 25th 2021

Design a 401(k) Plan Like a Pro in 6 Steps

By: Eric Droblyen

July 25th 2021

401(k) Rollovers – What Employers Need to Know

By: Eric Droblyen

July 25th 2021

The Top 4 Lies Told by 401(k) Providers

By: Eric Droblyen

July 25th 2021

Ownership Attribution Rules that Apply when 401(k) Testing

By: Eric Droblyen

July 24th 2021

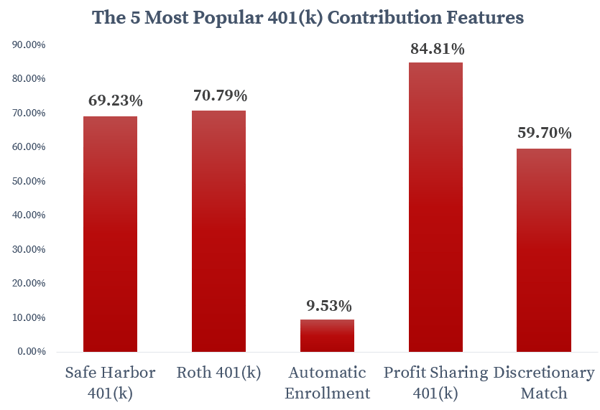

The 5 Most Popular Small Business 401(k) Plan Features

By: Eric Droblyen

July 24th 2021

Replacing SIMPLE IRAs with a 401(k) – Frequently Asked Questions

By: Eric Droblyen

July 24th 2021

Asset-Based 401(k) Admin Fees - Keep Them to a Minimum!

By: Eric Droblyen

July 24th 2021

Lost Participants – What Employers Need to Know

By: Eric Droblyen

July 24th 2021

Voluntary Contributions - Probably Not a Fit for Your 401(k) Plan

By: Eric Droblyen

July 24th 2021

401(k) Rollovers – Frequently Asked Questions

By: Eric Droblyen

July 24th 2021

401(k) Amendment Rules – Strict, but (Mostly) Straightforward

By: Eric Droblyen

July 23rd 2021

401(k) Rollovers - How to Evaluate Your Options

By: Eric Droblyen

July 23rd 2021

Starting a 401(k)? A Short Initial Plan Year is Probably a Bad Idea

By: Eric Droblyen

July 23rd 2021

Terminating Your Plan? Here’s What You Need to Know

By: Eric Droblyen

July 22nd 2021

Vesting Schedules – Everything You Need to Know

By: Eric Droblyen

July 22nd 2021

Top 10 401(k) Mistakes Found in the IRS Voluntary Compliance Program

By: Eric Droblyen

July 21st 2021

Acquisition or Merger? Don’t Overlook the Seller’s 401(k) Plan!

By: Eric Droblyen

July 21st 2021

Preventing Identify Theft in Your Retirement Plan

By: Eric Droblyen

July 21st 2021

What to Do When Your Retirement Plan Terminates

By: Eric Droblyen

July 20th 2021

How to Select an Auditor for the Form 5500

By: Eric Droblyen

July 20th 2021

How to Reclaim Your Retirement Plan with a Previous Employer

By: Eric Droblyen

July 19th 2021

Why Fee Levelization Does Not Make Revenue Sharing Okay

By: Eric Droblyen

July 5th 2021

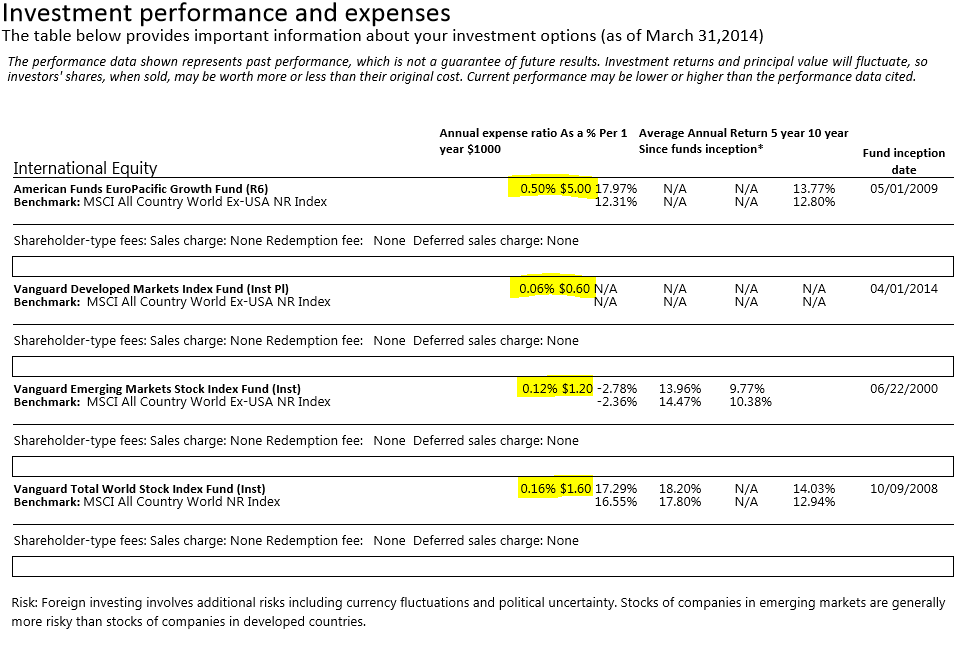

401(k) Mutual Funds - Pay Attention to Share Class!

By: Eric Droblyen

July 4th 2021

ERISA 404(c) - DOL Fee Disclosure Rules Makes Compliance Easy

By: Eric Droblyen

July 3rd 2021

How to Calculate Your All-In 401(k) Fee

By: Eric Droblyen

July 3rd 2021

The SPIVA Scorecard – A Must-Read for 401(k) Fiduciaries

By: Eric Droblyen

July 2nd 2021

How to Benchmark Your 401(k) Fees

By: Eric Droblyen

July 2nd 2021

How to Lower Your 401(k) Fees

By: Eric Droblyen

July 1st 2021

How to Pick a Lineup of "Prudent" Index Funds

By: Eric Droblyen

July 1st 2021

Thrift Savings Plan - What is it?

By: Eric Droblyen

April 3rd 2020

401(k) Document Retention Rules

By: Eric Droblyen

April 3rd 2020

Mega Back Door Roth IRA Contributions

By: Eric Droblyen

March 24th 2020