If you have questions about Fidelity 401(k) fees – how they work, how much they cost on average, or how you can find & calculate them for your plan – you’ve come to the right place. In this guide, we’ll show you how to calculate the full cost of a Fidelity 401(k) plan using their DOL-mandated fee disclosure.

By the end of this guide, our aim is for you to have a complete understanding of how Fidelity’s pricing works, how much you’re paying, and how your fees stack up.

Let's dive in.

What are Average Fidelity 401(k) Fees?

We have evaluated the fees of a few Fidelity plans over the years as part of our 401(k) fee comparison service. Below are the averages we found for these plans.

|

Average Fidelity 401(k) Fees |

|

|

Avg. Plan Assets |

$4,007,011.94 |

|

Avg. Plan Participants |

46 |

|

Per-Capita Admin Fees |

$309.63 |

|

All-In Fees |

0.71% |

While their per-capita admin fee was below the $422.30 average in our 2018 401(k) fee study, that number can easily grow much higher due to the way these fees are charged.

In our experience, about 70% of admin fees charged by Fidelity are paid by revenue sharing – “hidden” 401(k) fees that lower the investment returns of plan participants. Not only are plan sponsors or participants often unaware that they’re paying them, but they’re always charged as a percentage of plan assets. That means plan participants will automatically pay Fidelity higher and higher administration fees for the same level of service as their account grows. That’s not fair!

When you factor in compound interest, these growing fees can make a huge dent in your retirement savings. As such, you want to do everything in your power to avoid paying them.

If you’re currently using Fidelity for your 401(k), your first step to avoiding these fees is to find out whether or not you’re paying them. We’ll show you how to do that next.

How to Find & Calculate Fidelity 401(k) Fees

To understand how much you’re paying for your Fidelity plan, I recommend you sum their administration and investment expenses into a single “all-in” fee. Expressing this as both a percentage of plan assets, as well as hard dollars per-participant, will ultimately make it easier for you to compare the cost of your Fidelity plan to competing 401(k) providers and/or industry averages.

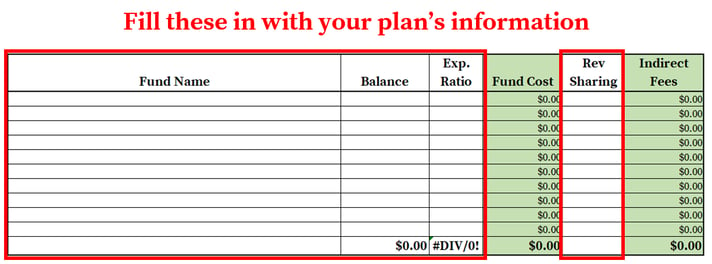

To make this easy on you, we’ve created a spreadsheet you can use with all the columns and formulas you’ll need. All you need to do is find the information for your plan, then copy it into the spreadsheet.

Doing this for Fidelity can be a bit of a pain, but not to worry – we’ll show you everything you need to do in 4 simple steps.

Step 1 – Gather All the Necessary Documents

To calculate your Fidelity 401(k) fees, the only document you’ll need is their 408(b)(2) fee disclosure - what Fidelity has named a “Statement of Services and Compensation”.

Fidelity is obligated by Department of Labor regulations to provide employers with a 408(b)(2). This document contains plan-level information about their administration fees. This information is intended to help employers evaluate the “reasonableness” of these fees. This document can be found on the Fidelity employer website.

If you hired an outside financial advisor for your plan, you’ll need to factor their pricing into your Fidelity fee calculation. This information can usually be found in a services agreement or invoice.

Once you’ve gathered your 408(b)(2), you’re ready to move on to step 2.

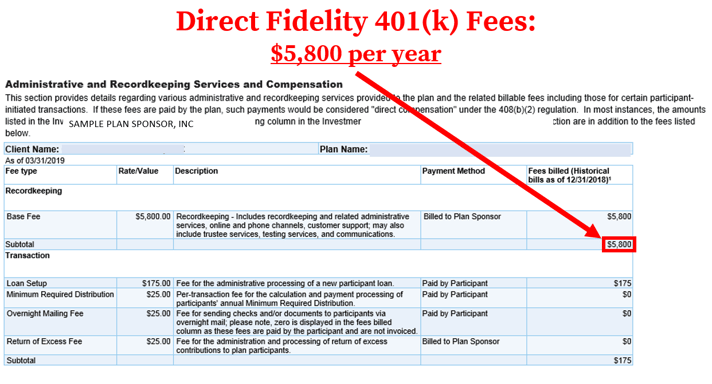

Step 2 – Locate Fidelity’s Direct 401(k) Fees

401(k) administration fees can be “direct” or “indirect” in nature. Direct fees can be deducted from participant accounts or paid from a corporate bank account, while indirect fees are paid from investment fund expenses - reducing their annual returns. Direct fees are the most transparent and are probably the ones you’re most familiar with.

Fidelity’s direct fees can be found on the “Administrative and Recordkeeping Services and Compensation” page of their 408(b)(2) fee disclosure:

Next, we’ll see if Fidelity charges your plan any hidden administration fees.

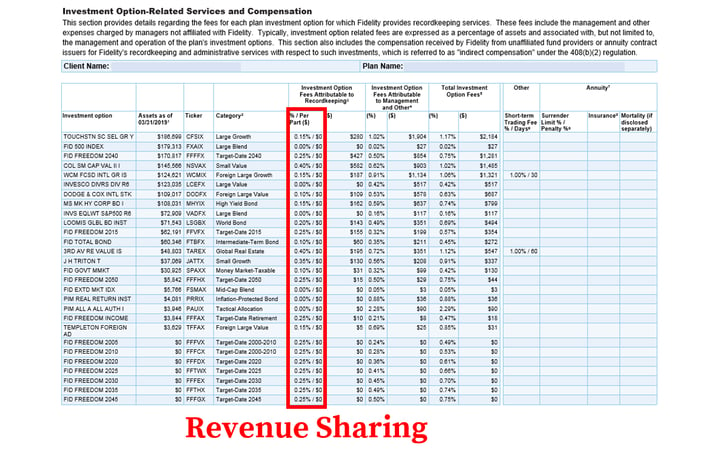

Step 3 – Uncover Fidelity Hidden 401(k) Fees

In our experience, roughly 70% of the administration fees charged by Fidelity are paid by revenue sharing – a form of “indirect” fee paid from the operating expenses of some mutual funds. Revenue sharing increases the cost of a mutual fund, thereby lowering its annual returns. There are two basic forms:

- 12b-1 fees – these payments usually compensate a financial advisor.

- Sub-Transfer Agency (sub-TA) fees – these payments usually compensate a recordkeeper.

Revenue sharing is not disclosed as a hard dollar amount on the Fidelity fee disclosure. Instead, its buried in the expense ratio of plan funds, making them really easy to overlook. You can find these “hidden” administration fees disclosed as a percentage of assets in the “Appendix B - Investment” section of the “Disclosure of Services and Fees” document:

In step 4, you’ll multiply the revenue sharing and wrap fee percentages by the applicable fund balance to calculate the indirect fees charged by Fidelity.

Step 4 – Calculate Your All-In 401(k) Fee

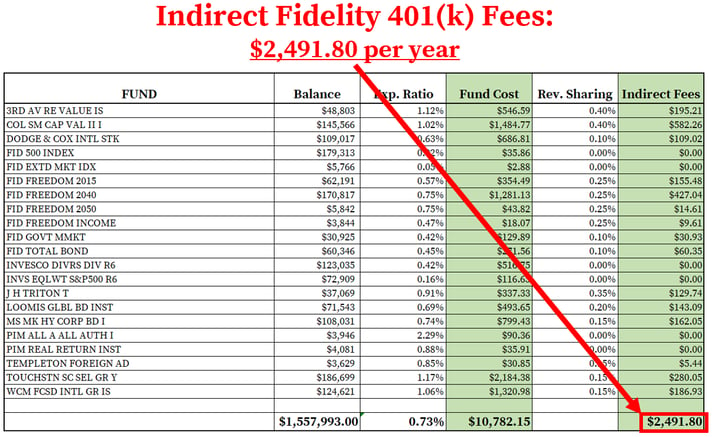

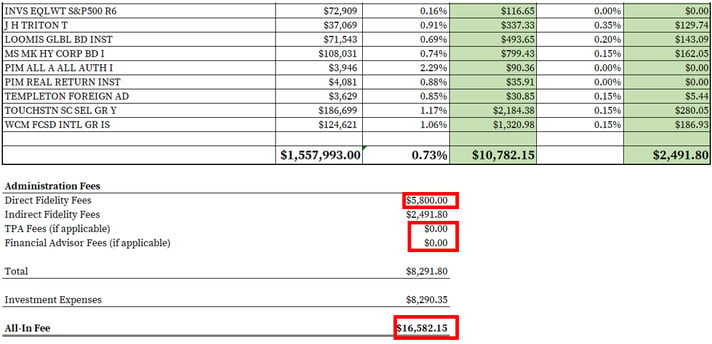

In this step, we’ll enter the information we found into our spreadsheet to calculate your plan’s total cost – or “all-in” fee (administration fees + investment expenses).

First, enter the fund information from your Fidelity 408(b)(2) document into the spreadsheet. The formulas will automatically calculate your indirect fees.

Next, we need to calculate your direct fees.

Enter Fidelity’s direct fee into the appropriate line item towards the bottom of your spreadsheet.

If an outside financial advisor charges additional fees, enter the amount into your spreadsheet.

At this point, all of your administration fees and investment expenses (net of indirect fees) should be broken out and totaled, giving you the all-in fee of your Fidelity plan. $16,582.15 for our example.

To make it easier for you to benchmark your fees against other plans, we recommend expressing this number as a % of plan assets. In our example, this number is 1.06% ($$16,582.15/ $1,557,993.00).

Evaluate Your Admin Fees on a Per-Capita Basis

After you have calculated your all-in fee, we recommend you take a quick look at your Fidelity administration fees on a per-capita (i.e., headcount) basis.

The reason?

Excess administration fees – basically, fees that outstretch your 401(k) provider’s level of service – might not be readily apparent if they’re solely evaluated on an all-in basis with investment expenses. This is especially true if your plan has lots of assets.

To demonstrate the value of this evaluation, consider a $1,625,825.48 401(k) plan with only 7 participants from our 2018 small business 401(k) fee study. While its $25,611.64 all-in fee (1.58% of plan assets) was only a bit above the study’s 1.40% average, its $2,521.81 per capita administration fee ($17,652.64/7 participants) was about six times average!

To calculate your per-capita administration fees, simply divide the administration fee total from your spreadsheet by the number of participants in your plan. For our 13-participant example, this number is $637.83 – quite a bit higher than what participants could be paying with a low-cost 401(k) provider.

Don’t Let Your Fidelity 401(k) Fees Get Out of Hand

By now, you should have a complete breakdown of your Fidelity 401(k) fees and how they’re being charged.

Even if yours are below average now, Fidelity’s revenue sharing can cause them to very quickly become excessive as assets grow. For this reason, it’s crucial that you compare your plan’s fees on a regular basis.

Too much trouble? We’ve got a solution.

Simply switch to a 401(k) provider that charges fees based on headcount – not assets - to the extent possible. Such a fee structure will make it easier for you to keep your 401(k) fees in check as your plan grows. You just might save some money while you’re at it.