If you have questions about Principal's 401(k) fees – how they work, how much they cost on average, or how you can find & calculate them for your plan – you’ve come to the right place. In this guide, we’ll show you how to calculate the full cost of a Principal 401(k) plan using their DOL-mandated fee disclosure.

By the end of this guide, our aim is for you to have a complete understanding of how Principal’s pricing works, how much you’re paying, and how your fees stack up.

Let’s dive in.

What are Average Principal 401(k) Fees?

In our most recent Small Business 401(k) Fee Study, we found that Principal plans cost small businesses an average of 1.23% of plan assets each year, with their admin fees totaling about $455.94 per participant.

|

Average Principal 401(k) Fees |

|

|

Avg. Plan Assets |

$2,194,007.59 |

|

Avg. Plan Participants |

36 |

|

Per-Capita Admin Fees |

$455.94 |

|

All-In Fees |

1.23% |

While their per-capita admin fee is already above the $422.30 study average, that number can grow much higher due to the way these fees are charged.

In our experience, about 85% of admin fees charged by Principal are paid by revenue sharing or variable annuity wraps – “hidden” 401(k) fees that lower the investment returns of plan participants. Not only are plan sponsors or participants often unaware that they’re paying them, but they’re always charged as a percentage of plan assets. That means plan participants will automatically pay Principal higher and higher administration fees for the same level of service as their account grows. That’s not fair!

When you factor in compound interest, these growing fees can make a huge dent in your retirement savings. As such, you want to do everything in your power to avoid paying them.

If you’re using currently using Principal for your 401(k), your first step to avoiding these fees is to find out whether or not you’re paying them. We’ll show you how to do that next.

How to Find & Calculate Principal 401(k) Fees

To understand how much you’re paying for your Principal plan, I recommend you sum their administration and investment fees into a single “all-in” fee. Expressing this as both a percentage of plan assets, as well as hard dollars per-participant, will ultimately make it easier for you to compare the cost of your Principal plan to competing 401(k) providers and/or industry averages.

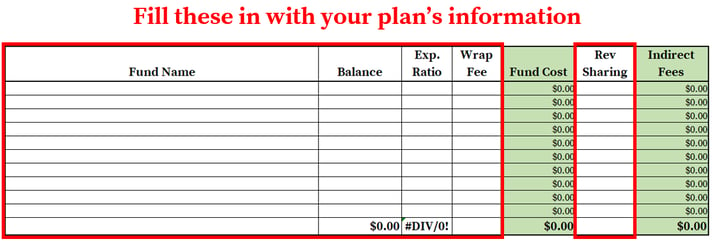

To make this easy on you, we’ve created a spreadsheet you can use with all the columns and formulas you’ll need. All you need to do is find the information for your plan, then copy it into the spreadsheet.

Doing this for Principal can be a bit of a pain, but not to worry – we’ll show you everything you need to do in 4 simple steps.

Doing this for Principal can be a bit of a pain, but not to worry – we’ll show you everything you need to do in 4 simple steps.

Step 1 – Gather All the Necessary Documents

To calculate your Principal 401(k) fees, you only need 1 document:

- Retirement Plan Fee Summary: Principal is obligated by Department of Labor regulations to provide employers with a 408(b)(2) fee disclosure. This document contains Principal’s pricing model, as well as plan-level information on the direct and asset-based fees they’re charging. This information is intended to help employers evaluate the “reasonableness” of 401(k) fees. This document can be found on the Principal employer website.

Once you’ve gathered your 408(b)(2), you’re ready to move on to step 2.

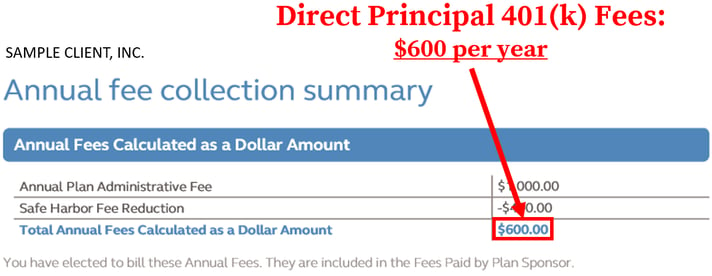

Step 2 – Locate Principal’s Direct 401(k) Fees

401(k) administration fees can be “direct” or “indirect” in nature. “Direct” fees can be deducted from participant accounts or paid from a corporate bank account, while indirect fees are paid from investment fund expenses, reducing their annual returns.

Direct fees are the most transparent and are probably the ones you’re most familiar with.

Principal's direct fees are displayed as hard dollar amount on the page 3 of their “Retirement Plan Fee Summary” document:

Most often, direct fees are only a small portion of the 401(k) administration fees charged by Principal. The company makes most of their money via “indirect fees." We’ll show you how to uncover those next.

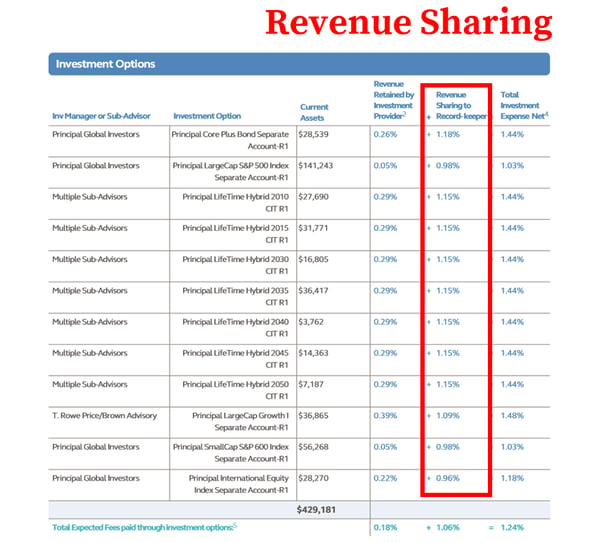

Step 3 – Uncover Principal’s Hidden 401(k) Fees

In the plans we studied, Principal charged the vast majority of their fees (85%) through indirect fees hidden in fund expenses. They do this with 2 types of indirect fees:

- Revenue Sharing Fees: Revenue sharing is the practice of adding non-investment related fees to the operating expenses of a mutual fund – which reduce the investment returns of plan participants. These additional fees then compensate plan service providers. There are two general forms:

- 12b-1 fees – usually compensate a broker or insurance agent.

- Sub-Transfer Agency (sub-TA) fees – usually compensate a recordkeeper.

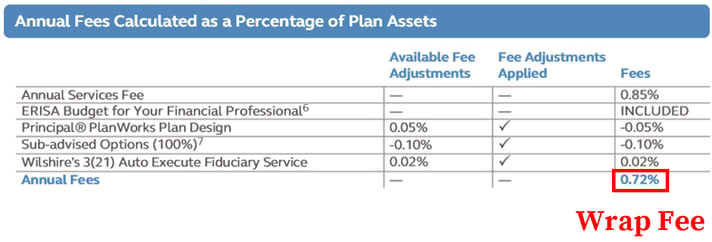

- Wrap Fees: Insurance companies often use variable annuities instead of mutual funds as 401(k) investments. A variable annuity is basically a mutual fund wrapped in a thin layer of insurance with additional fees and redemption restrictions. The additional fees usually include a “wrap” fee that can increase the expense ratio of the underlying mutual fund dramatically. Sometimes by more than 1%!

Neither revenue sharing nor wrap fees are disclosed as hard dollar amounts on the Principal fee disclosure, which makes them really easy to overlook. Instead, each are disclosed in different sections of the “Retirement Plan Fee Summary” 408(b)(2) document.

Principal’s revenue sharing fees are located in the “Investment Options” section of your 408(b)(2):

Principal’s wrap fees are located in the “Annual Fees Calculated as a Percentage of Plan Assets” section of your 408(b)(2):

In step 4, you’ll multiply the revenue sharing and wrap fee percentages by the applicable fund balance to calculate the indirect fees charged by Principal.

Step 4 – Calculate Your All-In 401(k) Fee

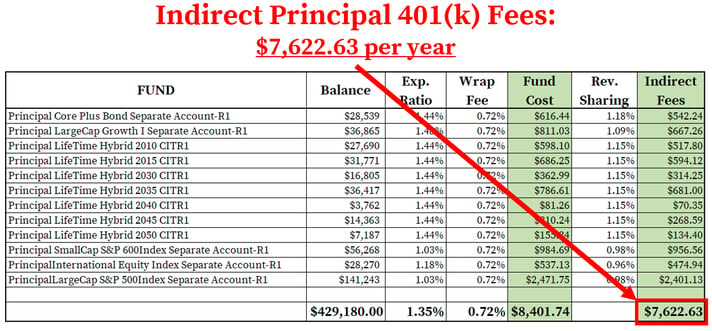

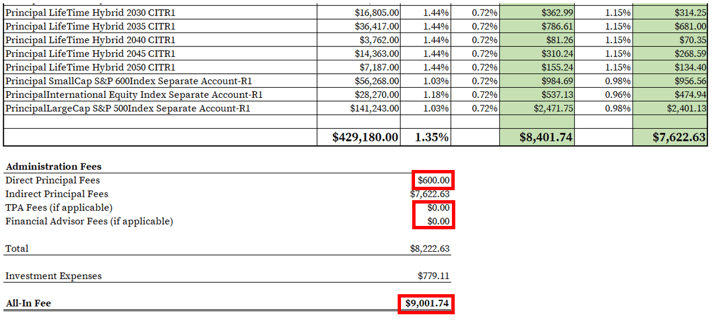

In this step, we’ll enter the information we found into our spreadsheet to calculate your plan’s total cost – or “all-in” fee (administration fees + investment expenses).

First, enter the fund information from your Principal 408(b)(2) document into the spreadsheet. The formulas will automatically calculate your indirect fees.

Next, we need to add your direct fees.

Simply enter Principal’s direct fee into the “Direct Fees” line item towards the bottom of your spreadsheet.

At this point, all of your administration fees and investment expenses (net of indirect fees) should be broken out and totaled, giving you the all-in fee of your Principal plan. $9,001.74 for our example.

To make it easier for you to benchmark your fees against other plans, we recommend expressing this number as a % of plan assets. In our example, this number is 1.35% ($9,001.74/$429,180.00).

Evaluate Your Admin Fees on a Per-Capita Basis

After you have calculated your all-in fee, we recommend you take a quick look at your Principal administration fees on a per-capita (i.e., headcount) basis.

The reason?

Excess administration fees – basically, fees that outstretch your 401(k) provider’s level of service – might not be readily apparent if they’re solely evaluated on an all-in basis with investment expenses. This is especially true if your plan has lots of assets.

To demonstrate the value of this evaluation, consider a $1,625,825.48 401(k) plan with only 7 participants from our 2018 small business 401(k) fee study. While its $25,611.64 all-in fee (1.58% of plan assets) was only a bit above the study’s 1.40% average, its $2,521.81 per capita administration fee ($17,652.64/7 participants) was about six times average!

To calculate your per-capita administration fees, divide your administration fee total by the number of participants in your plan. For our 18-participant example, this number is $456.81 – quite a bit higher than participants could be paying with a low-cost 401(k) provider.

Don’t Let Your Principal 401(k) Fees Get Out of Hand

By now, you should have a complete breakdown of your Principal 401(k) fees and how they’re being charged.

Even if yours are below average now, Principal’s revenue sharing and wrap fees can cause them to very quickly become excessive as assets grow. For this reason, it’s crucial that you compare your plan’s fees on a regular basis.

Too much trouble? We’ve got a solution.

Simply switch to a 401(k) provider that charges fees based on headcount – not assets - to the extent possible. Such a fee structure will make it easier for you to keep your 401(k) fees in check as your plan grows. You just might save some money while you’re at it.