The Frugal Fiduciary Small Business 401(k) Blog

Get the latest industry news, deadlines and tips you need to know to help tackle your fiduciary responsibility needs.

Why small business retirement plans with high asset balances actually pay more for their plan services.

By: Greg Carpenter

October 2nd 2014

Benchmarking fees of small business retirement plans or small business 401k recordkeeping is way more difficult than it needs to be.

Read More

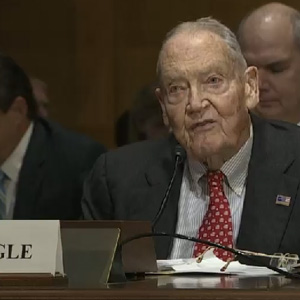

Vanguard’s John Bogle makes his case for improving 401(k) plans. Here’s why his Senate testimony rocks.

By: Greg Carpenter

September 24th 2014

John Bogle details the flaws in the current regulations governing 401(k) plans and the mutual fund industry putting profits above fiduciary duty.

Read More

Senate Finance Committee holds a hearing today on “Retirement Savings 2.0.” Here is what they should address to help small business retirement plans.

By: Greg Carpenter

September 16th 2014

Congress should provide greater incentives, 401k participation should become a serious commitment by the employee for their small business retirement plans

Read More

Brokerage Windows in 401(k) Plans: Nope. Not even if they say “pretty please.”

By: Greg Carpenter

September 10th 2014

Brokerage windows are risky, potentially very expensive and appropriate for only a very small fraction of 401(k) investors. Use the fiduciary responsibility model

Read More

Former DOL Deputy Director declares scandal in IRA rollovers. It’s a scandal, just not the one he thinks it is.

By: Greg Carpenter

August 20th 2014

The scandal is that we do not have fiduciary standards in place that require brokers and other advisors to act in the clients’ IRA best interests.

Read More

New companies are trying to fill the gaps in 401(k) fee disclosure regulations. Here’s why they all fall short.

By: Greg Carpenter

August 15th 2014

New companies are springing up to fill gaps in 401(k) fee disclosure regulations. Here is what small business retirement plan sponsors need to know.

Read More

Plan re-enrollment: The “Wonder Drug” for your company’s retirement plan. It’s cheap, simple and benefits sponsors and employees.

By: Greg Carpenter

August 7th 2014

Plan re-enrollment can be effective putting your small business retirement plan back on track to success. cheap and simple to implement.

Read More

Former Obama administration official offers a plan to “fix” the tax incentives for retirement plans. Here is why it is dead wrong.

By: Greg Carpenter

July 30th 2014

Prominent politico offers a plan for getting more people to save for retirement. Here’s why I disagree. Change tax laws, not 401k rules for retirement plans

Read More

In small business retirement plans, the employees with the smallest balances need the most help. Here’s my frugal guide to making the plan work for everyone in your organization.

By: Greg Carpenter

July 24th 2014

Making small business retirement plans work for the employees on the shop floor.

Read More

Revenue sharing is on the decline in 401(k) plans. Three reasons why it will soon be gone altogether.

By: Greg Carpenter

July 16th 2014

Revenue sharing is the practice of adding additional non-investment related fees to the expense ratio of a mutual fund. The investors don’t see the fees being deducted.

Read More