The Frugal Fiduciary Small Business 401(k) Blog

Get the latest industry news, deadlines and tips you need to know to help tackle your fiduciary responsibility needs.

401(k) Distribution Rules: Frequently Asked Questions for Employers and Employees

By: Eric Droblyen

May 6th 2025

Understand 401(k) distribution rules, taxes, and rollover options with this updated FAQ for employers and employees, including SECURE Act changes.

Read More

Classic vs. QACA Safe Harbor 401(k) Plans: How to Choose the Best Option for Your Business

By: Eric Droblyen

April 22nd 2025

Compare classic vs. QACA Safe Harbor 401(k) plans. Learn key differences, SECURE Act updates, and how to choose the best plan for your business.

Read More

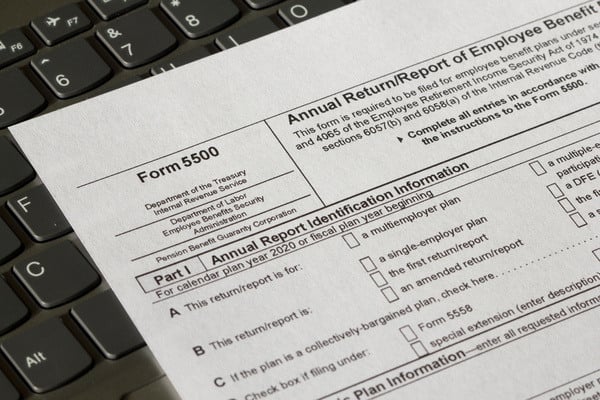

The 401(k) Form 5500: Your Questions Answered

By: Eric Droblyen

April 8th 2025

Form 5500 reports information about a 401(k) plan to government agencies and employees. In this guide, we'll break down frequently asked questions.

Read More

Why Asset-Based 401(k) Admin Fees Are a Problem – And What You Can Do About It

By: Eric Droblyen

March 25th 2025

Asset-based 401(k) admin fees can quietly drain thousands from retirement savings. Discover why fiduciaries should switch to transparent fee structures.

Read More

Boost Retirement Savings and Reduce Taxes by Paying Your 401(k) Fees from a Business Account

By: Eric Droblyen

March 11th 2025

Paying your 401(k) provider’s administration fees from your business account – not plan assets – can directly benefit you, your employees, and your business.

Read More

SECURE Act 2.0: 2025 Changes for Small Business 401(k) Plans

By: Eric Droblyen

February 25th 2025

SECURE Act 2.0 made significant changes to 401(k) plans for 2025. It’s crucial for business owners to understand them and prepare their plan for compliance.

Read More

The DOL’s Voluntary Fiduciary Correction Program: What Business Owners Need to Know

By: Eric Droblyen

February 11th 2025

Learn how DOL’s Voluntary Fiduciary Correction Program (VFCP) helps businesses fix 401(k) plan errors, avoid penalties, and stay ERISA compliant.

Read More

Lost a 401(k)? Here's How to Reclaim Your Retirement Savings

By: Eric Droblyen

January 14th 2025

Learn how to reclaim lost or forgotten 401(k) and pension accounts with the DOL's Retirement Savings Lost and Found Database. Follow our easy steps to secure your retirement savings today.

Read More

The Top Ten Frugal Fiduciary 401(k) Blogs of 2024

By: Eric Droblyen

December 31st 2024

Our top 10 blogs for 2024 are must-reads for small business 401(k) sponsors and participants. They cover SECURE 2.0, plan administration, and investment fees.

Read More

401(k) Variable Annuities - 5 Reasons to Avoid Them

By: Eric Droblyen

December 17th 2024

Over time, the cumulative effect of variable annuity wrap fees can cost a 401(k) participant hundreds of thousands of dollars in retirement. Here’s what you need to know.

Read More