The Frugal Fiduciary Small Business 401(k) Blog

Get the latest industry news, deadlines and tips you need to know to help tackle your fiduciary responsibility needs.

Reforming Roth provisions may be key to improving savings rates for Millennials. My proposal.

By: Greg Carpenter

November 20th 2014

Millennials are not saving enough for retirement. The Roth 401k concept is outstanding and provides an excellent way to build long-term wealth with tax benefits

Read More

Let’s put “Income” back in ERISA

By: Greg Carpenter

November 13th 2014

We recommend the government and industry nudge plan participants toward better retirement income results. Tweak ERISA by allowing more competition.

Read More

MassMutual settled its “functional fiduciary” lawsuit – a cause for hope for greater fee transparency.

By: Greg Carpenter

November 10th 2014

MassMutual Life Insurance Company settled its functional fiduciary lawsuit. Revenue sharing payments were not disclosed to the plan sponsor.

Read More

Small business owners are redefining the market for 401(k) plans. Result: Mass market “products” are about to go extinct.

By: Greg Carpenter

October 29th 2014

Small business retirement 401k plans value choice over all other buying factors. That’s a common observation across all markets and professions.

Read More

Edison International case highlights a needed reform: Share class restrictions in 401(k) plans.

By: Greg Carpenter

October 23rd 2014

The time has come for share class reform in 401(k) plans. The use of multiple share classes for mutual funds in 401k plans is confusing small business retirement plan sponsors.

Read More

Hiring an ERISA 3(38) Investment Manager can be the simplest way to limit 401(k) investment liability.

By: Greg Carpenter

October 15th 2014

The need for a professional investment manager for small business retirement plans should not be overlooked. It limits 401(k) investment liability

Read More

Financial wellness is impossible to achieve without plan participation. Here’s how to address the issue with your employees.

By: Greg Carpenter

October 8th 2014

Financial wellness is difficult to achieve without 401k plan participation. The primary reason employees do not participate in 401k plans is their personal budget.

Read More

Why small business retirement plans with high asset balances actually pay more for their plan services.

By: Greg Carpenter

October 2nd 2014

Benchmarking fees of small business retirement plans or small business 401k recordkeeping is way more difficult than it needs to be.

Read More

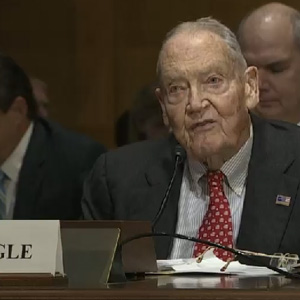

Vanguard’s John Bogle makes his case for improving 401(k) plans. Here’s why his Senate testimony rocks.

By: Greg Carpenter

September 24th 2014

John Bogle details the flaws in the current regulations governing 401(k) plans and the mutual fund industry putting profits above fiduciary duty.

Read More

Senate Finance Committee holds a hearing today on “Retirement Savings 2.0.” Here is what they should address to help small business retirement plans.

By: Greg Carpenter

September 16th 2014

Congress should provide greater incentives, 401k participation should become a serious commitment by the employee for their small business retirement plans

Read More